We recently published a list of 15 AI Stocks That Are On Sale. In this article, we are going to take a look at where Veeco Instruments Inc. (NASDAQ:VECO) stands against the other AI stocks that are on sale.

Big Tech: The Best Performing Sector of Q2?

Big tech, specifically artificial intelligence, is the sector that many are starting to consider as the best-performing sector of the market in the second quarter of 2024. The concentration of the major players in this space has been in the large-cap companies since your ability to fully develop AI and benefit from its profitability really depends on the scale of your business. Basically, the bigger a company is, the better it will be positioned within the AI-led market this year. Because of this phenomenon, big tech companies, with all the money in the world to invest in AI development, are ensuring that this revolutionary tech drives the overall tech sector to record highs in 2024.

According to Alex Kantrowitz, Founder of Big Technology, these trends can be expected to lift up other sectors in the market that have a strong relationship with AI. One such sector is energy, which, according to Kantrowitz, is going to be seeing a lot more demand from customers that are developing AI and creating and training Large Language Models. While many players in the AI space today are also working on finding ways to use energy for AI development more efficiently, the general consensus seems to be that there’s a need to tap into more existing sources of energy until such methods are found. Because of this, the markets may see demand for nuclear energy rise to unprecedented levels as well.

AI in Digital Advertising

Another sector that might catch the AI draft and be propelled higher is digital advertising. With the rise of AI-powered marketing clouds, many advertisement-focused businesses are beginning to see immense increases in their return on investment. According to David Steinberg, the CEO of Zeta Global, AI is leading to immense growth within the advertising ecosystem, with Steinberg expecting growth in low double-digits this year. He noted that the launch of ChatGPT was the “big renaissance moment” for AI, which changed our perception of this technology from being a figment of science fiction to something serious enough to be discussed in company board rooms. Because of this, Steinberg believes that every company out there in advertisement and retail is pivoting its business to incorporate high-quality enterprise AI usages in its operations.

Part of the reason why AI is taking over the market in this manner is the promise it makes – efficiency coupled with revenue growth. By focusing on AI development and integration, businesses across the globe can increase their efficiency while also generating higher profits for themselves and their shareholders. Considering this, and the fact that AI stocks have been performing exceptionally well in the second quarter, we have compiled a list of some AI stocks on sale that investors may wish to consider for their portfolios this year.

Our Methodology

We first compiled a list of 40 AI stocks by sifting through ETFs and online rankings, including our own rankings. We then selected the 15 stocks with P/E ratios lower than the S&P 500’s P/E of 24.1 as of September 27 (according to data from WSJ) and with expected EPS growth for this year. The stocks are ranked based on their P/E ratios, from the highest to the lowest. We also mentioned the number of hedge funds holding stakes in each stock, as of the second quarter.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points. (see more details here).

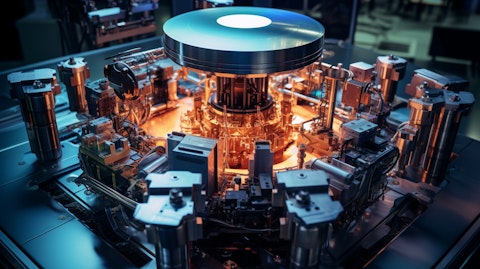

A one of a kind semiconductor process equipment machine with various parts and components.

Veeco Instruments Inc. (NASDAQ:VECO)

Number of Hedge Fund Holders: 24

Expected Earnings Growth: 4.7%

P/E Ratio: 18.8

Veeco Instruments Inc. (NASDAQ:VECO) is a semiconductor materials and equipment company based in Plainview, New York. It manufactures and supports semiconductor and thin film process equipment to make electronic devices globally.

In the second quarter, Veeco Instruments Inc. (NASDAQ:VECO) management noted that the company’s semiconductor business has remained strong so far this year, particularly because of record laser annealing revenue. Revenue for the quarter overall came in at $176 million, up 9% year-over-year, with non-GAAP operating income coming in at $28 million.

Veeco Instruments Inc. (NASDAQ:VECO) is currently investing in core technologies to expand its served available market. In laser annealing, the company has the opportunity to grow its SAM from $600 million to over a billion dollars. This represents significant growth potential for this lesser-known company in the semiconductor space.

Artificial intelligence is also expected to significantly improve Veeco Instruments Inc.’s (NASDAQ:VECO) profitability. The company’s systems used in transistor formation are currently used for GPU and CPU production, and its systems support advanced packaging for AI by enabling flux clean of micro bumps at leading foundry and memory customers. Veeco Instruments Inc. (NASDAQ:VECO) also has a significant international presence, with operations in the Asia Pacific and China alongside the US and Europe. All these factors combined are helping the company gain a unique position to benefit from the AI boom, and yet the stock is still trading at a relatively cheap valuation.

Veeco Instruments Inc. (NASDAQ:VECO) was seen in the 13F holdings of 24 hedge funds in the second quarter, with a total stake value of $220.3 million.

Wasatch Global Investors mentioned Veeco Instruments Inc. (NASDAQ:VECO) in its second-quarter 2024 investor letter:

“Veeco Instruments Inc. (NASDAQ:VECO) was the top contributor to strategy performance during the second quarter. The company is a global capital-equipment supplier that designs and builds processing systems used to manufacture high-tech microelectronic devices including semiconductors, photonics, display technologies and power supplies. These devices are integral to applications like advanced computing, machine learning and AI. Veeco has exhibited solid fundamentals and a reasonable valuation for a few years. Going forward, we think the bipartisan CHIPS and Science Act will create an additional tailwind for Veeco, which is one of relatively few U.S. micro-cap companies involved in semiconductor manufacturing and AI.”

Overall VECO ranks 11th on our list of AI stocks that are on sale. While VECO is an exceptional investment, we believe that AI stocks hold promise for delivering high returns and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than VECO and which trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: $30 Trillion Opportunity: 15 Best Humanoid Robot Stocks to Buy According to Morgan Stanley and Jim Cramer Says NVIDIA ‘Has Become A Wasteland’.

Disclosure: None. This article is originally published at Insider Monkey.