Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The one and a half month time period since the end of the third quarter is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Vectren Corporation (NYSE:VVC).

Hedge fund interest in Vectren Corporation (NYSE:VVC) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Haemonetics Corporation (NYSE:HAE), Commscope Holding Company Inc (NASDAQ:COMM), and PacWest Bancorp (NASDAQ:PACW) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a peek at the new hedge fund action surrounding Vectren Corporation (NYSE:VVC).

Hedge fund activity in Vectren Corporation (NYSE:VVC)

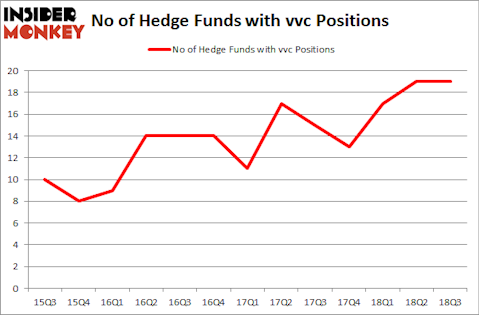

Heading into the fourth quarter of 2018, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, representing no change from the second quarter of 2018. By comparison, 13 hedge funds held shares or bullish call options in VVC heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Vectren Corporation (NYSE:VVC) was held by Magnetar Capital, which reported holding $191 million worth of stock at the end of September. It was followed by Alpine Associates with a $128.7 million position. Other investors bullish on the company included Renaissance Technologies, Water Island Capital, and Marshall Wace LLP.

Since Vectren Corporation (NYSE:VVC) has faced a decline in interest from hedge fund managers, logic holds that there was a specific group of fund managers that decided to sell off their full holdings by the end of the third quarter. Intriguingly, Nick Niell’s Arrowgrass Capital Partners sold off the largest investment of all the hedgies monitored by Insider Monkey, comprising about $40.6 million in stock. Peter Rathjens, Bruce Clarke and John Campbell’s fund, Arrowstreet Capital, also said goodbye to its stock, about $2.7 million worth. These bearish behaviors are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to Vectren Corporation (NYSE:VVC). These stocks are Haemonetics Corporation (NYSE:HAE), Commscope Holding Company Inc (NASDAQ:COMM), PacWest Bancorp (NASDAQ:PACW), and Healthequity Inc (NASDAQ:HQY). All of these stocks’ market caps resemble VVC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HAE | 22 | 573018 | -2 |

| COMM | 31 | 1229371 | 4 |

| PACW | 26 | 253555 | 3 |

| HQY | 15 | 63417 | -2 |

| Average | 23.5 | 529840 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $530 million. That figure was $554 million in VVC’s case. Commscope Holding Company Inc (NASDAQ:COMM) is the most popular stock in this table. On the other hand Healthequity Inc (NASDAQ:HQY) is the least popular one with only 15 bullish hedge fund positions. Vectren Corporation (NYSE:VVC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard COMM might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.