Varex Imaging Corporation (NASDAQ:VREX) Q4 2023 Earnings Call Transcript November 14, 2023

Varex Imaging Corporation beats earnings expectations. Reported EPS is $0.45, expectations were $0.33.

Operator: Greetings, and welcome to the Varex Fourth Quarter and Fiscal Year 2023 Earnings Call. At this time, all participants are in a listen-only mode. A question-and-answer session will follow the formal presentation. [Operator Instructions] As a reminder, this conference is being recorded. It is now my pleasure to introduce Christopher Belfiore, Director of Investor Relations. Thank you. You may begin.

Christopher Belfiore: Good afternoon, and welcome to Varex Imaging Corporation’s earnings conference call for the fourth quarter of fiscal year 2023. With me today are Sunny Sanyal, our President and CEO; and Sam Maheshwari, our CFO. Please note that the live webcast of this conference call includes a supplemental slide presentation that can be accessed at Varex’s website at vareximaging.com/news. The webcast and supplemental slide presentation will be archived on Varex’s website. To simplify our discussion, unless otherwise stated, all references to the quarter are for the fourth quarter of fiscal year 2023. In addition, unless otherwise stated, quarterly comparisons are made sequentially from the fourth quarter of fiscal year 2023 to the third quarter of fiscal year 2023 rather than to the same quarter of the prior year.

Finally, all references to the year are to the fiscal year and not calendar year unless otherwise stated. Please be advised that during this call, we will be making forward-looking statements, which are predictions or projections about future events. These statements are based on current expectations and assumptions that are subject to risks and uncertainties that could cause actual results to differ materially from those anticipated. Risks relating to our business are described in our quarterly earnings release and our filings with the SEC. Additional information concerning factors that could cause actual results to materially differ from those anticipated is contained in our SEC filings, including Item 1A, Risk Factors of our quarterly reports on Form 10-Q and our Annual Report on Form 10-K.

The information in this discussion speaks as of today’s date, and we assume no obligation to update or revise the forward-looking statements in this discussion. On today’s call, we will discuss certain non-GAAP financial measures. These non-GAAP measures are not presented in accordance with, nor are they a substitute for GAAP financial measures. We provided a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP financial measure in our earnings press release, which is posted on our website. I will now turn the call over to Sunny.

Sunny Sanyal: Thanks, Chris. Good afternoon, everyone, and thank you for joining us for our fourth quarter earnings call. I’m pleased to announce another solid quarter for Varex. Revenue of $227 million in the quarter was a result of strong performance in our Industrial segment offset by lower revenue in China in our Medical segment. Non-GAAP gross margin of 36% and non-GAAP earnings per share of $0.45 exceeded our expectations. Revenue in the fourth quarter decreased 2%, both sequentially and year-over-year. Revenue in the Medical segment decreased 7% sequentially and 10% year-over-year, while Industrial segment revenue increased 12% sequentially and 27% year-over-year. Non-GAAP gross margin of 36% was solid in the fourth quarter and above the high end of our expectations.

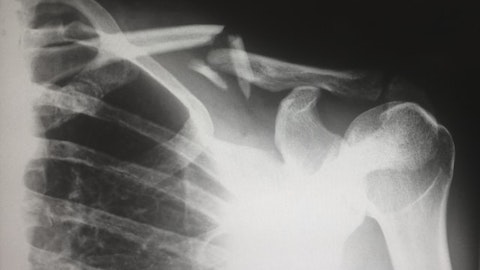

This is primarily due to a beneficial segment and product mix led by higher proportion of Industrial sales as well as further realization of results of our pricing initiatives. Adjusted EBITDA in the fourth quarter were $38 million and non-GAAP EPS was $0.45. We ended the fourth quarter in the fiscal year with $195 million of cash, cash equivalents and marketable securities on the balance sheet, which was $42 million higher sequentially and $82 million from the fiscal 2022 year-end. The increase was primarily due to higher profitability and the reduction of inventory in the quarter and year. Let me give you some insights into sales detail by modality in the quarter compared to a five quarter average, which we refer to as the sales trend. In our Medical segment, global sales of CT tubes remain flat compared to the trend in the quarter as the lower sales in China was offset by strength in the rest of the world.

Mammography remains strong with sales above the trend in the quarter. Oncology improved in the quarter was — and was above its sales trend. Fluoroscopy remained flat while radiographic sales were below the trend in the quarter. Dental remained soft and was also below the sales trend in the quarter. We saw strong performance in our Industrial segment with record revenue of $64 million in the quarter. Non-destructive inspection specifically cargo screening was a bright spot for the Industrial segment. Similar to last quarter, we also continued to see increased adoption of photon counting detectors across various industrial verticals including food, battery, and electronics inspection. Our Medical segment finished the fiscal year at $673 million in revenue, which was flat year-over-year and represented approximately 75% of total Varex revenues for the year.

The global CT market continues to be a significant driver of overall sales accounting for nearly 40% of Medical sales in fiscal 2023. We expect CT to continue to be a key driver of our Medical sales as developing countries expand their healthcare services. In addition to the new installations and upgrades, we expect replacement tubes sold into our extensive and growing installed base to provide solid baseline for future CT tube sales. Our photon counting technologies continues to gain OEM interest and we are working with several of our customers on a range of potential medical applications for photon counting, particularly where speed and high contrast imaging can make a difference. We expect photon counting technologies to once again be a main focal point at RSNA show in a couple of weeks and we believe our position at the table is very strong.

While there are many potential medical applications for photon counting technology, use of photon counting detectors in CT is a significant focus for our customers and we are actively engaged in their design discussions. We look forward to meeting with our customers and colleagues in Chicago at RSNA to discuss how we can enable their innovation and imaging. Moving to our software business. I’m happy to say that our majority owned subsidiary MeVis Medical Solutions recently received U.S. FDA 510(k) clearance for an innovative new software product named MeVis Liver Suite. This is an AI-based software application, which enables physicians and radiologists to create detailed visualizations and volumetric quantification for evaluation of liver surgery strategies, treatment planning, and for post-procedure follow-up assessment.

The innovative AI-based software technology and 3D medical visualization driven approach is applicable to both CT and MR imaging and can help daily workflow for liver surgery and post-procedure evaluation. Let me turn now to our Industrial segment. In the recent quarters, the strength of our Industrial segment has been a highlight for Varex. In fiscal 2023, our Industrial segment grew to $220 million in revenue, up 19% year-over-year and accounted for approximately 25% of total Varex revenue. This growth has been due to broad-based strength in various non-destructive inspection verticals, driven by our investment in X-ray tubes, linear accelerators, as well as photon counting detectors. In the past, we expressed intention to provide more integrated solutions including full systems to our customers across various industrial verticals.

One of the verticals we highlighted was irradiation of consumer based facing goods like packaged foods or plant products. Today, I’m excited to announce a new industrial irradiation system that we will offer directly to end customers that is a novel application of our X-ray technology. We expect system solutions to potentially add nearly $1 billion to our addressable market within five years. This new irradiation system XRpure offered by one of our subsidiaries can be used to reduce microbial loads in agricultural and other products. One of the applications of this system is for decontaminating cannabis, which is becoming a significant market in the U.S. Across the United States, where cannabis is legal, state regulators have established limits on various types of microbial contamination in the interest of public health and safety.

Cannabis growers are therefore required to submit a sample from each batch grown to be tested for microbial load before the product can be sold. This process is critical to growers as a failing cannabis lot can potentially lead to financial and reputational issues as well as patient’s health and safety concerns. There are many benefits of using X-ray irradiation to decontaminate an organic product. Traditional decontamination methods may use chemical or heat based technologies, which can degrade then product. In contrast, X-ray irradiation decontaminates the product by killing the microbes and pathogens without compromising the efficacy of the product. Cannabis cultivation for both medical and legal recreational uses has grown significantly in the United States over the last several years.

With an estimated 13,000 growers nationwide, we believe the addressable market for cannabis irradiation using X-ray technology is approximately $225 million per year and growing at double digits. With a subscription model for XRpure, we expect to be able to reach a run rate of $25 million to $50 million in annual revenues in the next five years. We believe our advanced X-ray technology can make XRpure a significant player in this space. In the coming weeks, our team will commercially launch the XRpure product at the 12th Annual MJBizCon Show, which is the largest cannabis conference and expo in the world. We are very excited at the potential of this new system and believe this is just one of the many applications where X-ray irradiation can be utilized.

If you’d like to learn more about XRpure, please visit the website at www.xrpure.com. In fiscal 2023, we made solid progress with innovation, strengthened our financial position and generated solid cash flow. As we look to fiscal 2024 and the future of Varex, we remain focused on executing on our existing and new initiatives to drive profitable growth and continued free cash flow generation. We are expanding investment in our Industrial segment, where new technology tends to be adopted at a much more rapid pace. Much like what we have done with our photon counting technologies, we believe we can leverage the more rapid adoption and feedback from industrial customers to accelerate development of new products in medical. As we highlighted earlier, there are many applications of our X-ray technologies across the industrial landscape from non-destructive inspection to decontamination of organic products.

Our intention is to invest in full systems in select industrial verticals that can create differentiated workflow solutions. In due course, we will share more with you as we continue to make progress on this initiative. We intend to continue to invest in photon counting technology, which is gaining solid traction across our non-destructive inspection applications in our Industrial segment and expand its use in medical applications. Photon counting CT detectors is an example of an application that can become a potentially meaningful growth driver for us in the future. Similarly, we’re taking a page from our playbook in China and investing in our future in India. We intend to leverage the local for local approach to engage emerging local OEMs and build our footprint in India.

We’re making progress with our efforts and expect to manufacture tubes and detectors in India in the next 18 months. India is a very large end user market for diagnostic imaging where modality penetration per million of population is very low. The Indian government has made a public commitment to expand healthcare services and gain independence in medical device technologies. We see new OEMs emerging in India, making it an attractive market for us to invest in a local presence to seek out new OEMs and to grow with them. We improved our gross margins in fiscal 2023 with our pricing initiatives. We expect to continue to see gross margins improve for the full fiscal 2024 as select pricing actions are implemented. Our freight related expenses as well as efficiencies across our manufacturing platform continue to be a tailwind to overall gross margins.

We are pleased with our inventory reduction efforts in fiscal 2023 and we remain focused on further reducing inventory levels in fiscal 2024. Ultimately, our goal is to maintain efficient inventory levels associated with demand and new product introductions. Finally, fiscal 2023 was a record year for Varex in terms of cash generation. With initiatives around margin expansion and inventory management, we expect to see continued cash generation going forward into fiscal 2024. While there are some challenges to growth in China in fiscal 2024, which we will touch on in a bit, we are well positioned to navigate these uncertainties while continuing to support our customers. With that, let me hand over the call to our CFO, Sam.

Sam Maheshwari: Thanks, Sunny, and hello, everyone. As a reminder, unless otherwise indicated, I’ll provide sequential comparison of our results for the fourth quarter of fiscal year 2023 with those of our third quarter of fiscal 2023. The fourth quarter was another solid quarter for us, while revenue was below the guidance midpoint, gross margin and non-GAAP EPS were above the high end of our guidance. Continued strength in our Industrial segment was the primary driver of strength in the quarter. As a result, we reported sales of $227 million, non-GAAP gross margin of 36% and non-GAAP EPS of $0.45, which was also helped by an unusually low tax rate in the quarter. Cash generation remains strong with $47 million of operating cash flow in the quarter.

Fourth quarter revenues decreased 2% compared to the third quarter. Medical revenues were $164 million, and industrial revenues were $64 million. Sequentially. medical sales decreased 7% and industrial sales increased 12%. Medical revenues were 72% and industrial revenues were 28% of total revenues for the quarter. Looking at revenue by region. Americas increased 1% sequentially, while EMEA increased 1% and APAC declined 8%. The decline in APAC was primarily the result of lower sales in our China business due to the anti-corruption campaign there. China sales were 13% of fourth quarter revenues. For full fiscal year 2023, sales to China totaled $147 million, which is up 5% year-over-year and represents 16% of total Varex sales. Given the anti-corruption campaign, we expect China sales to be down in fiscal 2024 compared to fiscal 2023.

Visibility to the magnitude and duration of the impact from this campaign is unclear, but we expect this to be temporary and currently believe the market may improve in the second half of our fiscal year 2024. We remain focused on executing our long-term strategy in China and support its efforts to improve the overall healthcare infrastructure. Let me now cover our results on a GAAP basis. Fourth quarter gross margin was 34%, up 100 basis points from the previous quarter. Operating expenses increased $2 million sequentially to $54 million, and operating income was $24 million flat sequentially. Net earnings were $32 million, and GAAP EPS was $0.66 based on fully diluted 51 million shares. Moving on to non-GAAP results for the quarter. We are pleased with our gross margin of 36% in the quarter.

This was up 200 basis points from the previous quarter and above the high end of our guidance. The higher gross margin was primarily due to beneficial mix led by the higher proportion of industrial sales, as well as further realization of our pricing initiative. Our quarterly gross margin can fluctuate depending upon segment mix, product mix, customer concentration, and factory productivity. For fiscal 2023, our gross margin was 33%, slightly down compared to fiscal 2022. R&D spending in the fourth quarter was $22 million, up $2 million compared to the prior quarter and represented 10% of revenues. The higher R&D expense was due to higher spending on R&D materials in industrial systems as well as for the supplier diversification efforts. SG&A was $30 million, up approximately $1 million compared to the prior quarter and represented 13% of revenue.

As a result, operating expenses were $51 million, up $2 million from the prior quarter and represented 23% of revenue. For fiscal 2023, operating expenses were $199 million, up 11% compared to fiscal 2022 and represented 22% of revenues. Operating income was $30 million and operating margin was 13% of revenue similar to the previous quarter. Full year operating income was $99 million, and operating margin was 11% of revenue. Tax expense in the fourth quarter was low at $1 million or 6% of pre-tax income compared to $5 million or 21% in the previous quarter. The lower tax rate in the fourth quarter was primarily a result of favorable credits related to R&D and foreign taxes and favorable book to tax differences as a result of the Tax Reform Act.

For fiscal 2023, the tax expense of $12 million was 17% of pre-tax income. Net earnings were $21 million or $0.45 per diluted share up $0.08 from the third quarter. Average diluted shares for the quarter on a non-GAAP basis were 51 million. Now turning to the balance sheet. Accounts receivable increased $1 million and days sales outstanding increased by one day to 65 days in the quarter. Inventory decreased by $20 million in the fourth quarter and days of inventory decreased by five days to 169 days. We are happy with the result of our inventory reduction efforts in fiscal 2023 and expect to remain focused on maintaining efficient inventory management. Accounts payable decreased by $10 million and days payable decreased by five days to 39 days due to reduced incoming inventory receipts.

Now, moving to debt and cash flow information. Net cash flow from operations was a robust $47 million in the fourth quarter due primarily to profitability and a $20 million reduction in inventory. We ended the quarter with cash, cash equivalents and marketable securities of $195 million, an increase of $42 million from the prior quarter and $82 million from fiscal year end 2022. Please note the $195 million includes the $153 million of cash and cash equivalents shown on the balance sheet. $41 million of marketable securities and $1 million of certificates of deposit. Gross debt outstanding at the end of the quarter was $448 million, and debt net of $195 million of cash and securities was $253 million. Adjusted EBITDA for the quarter was $38 million, and adjusted EBITDA margin was 17% of sales.

Our fiscal 2023 adjusted EBITDA was $132 million, and our net debt leverage ratio was 1.9 times on a trailing 12-month basis. Now, moving on to outlook for the first quarter of fiscal year 2024 and the full fiscal year. Under the backdrop of the anti-corruption campaign in China, we expect the following: First, revenues for the first quarter of fiscal 2024 are expected to be down approximately 8% at the midpoint compared to the first quarter of fiscal 2023. This is largely the result of lower sales in our China medical business. We expect the second half of fiscal 2024 to improve over the first half of fiscal 2024 with full fiscal year revenues down approximately 3% to 5% compared to full fiscal 2023. This expectation assumes business in China improves in the second half of fiscal 2024.

Second, we made significant progress on improving our gross margin in fiscal 2023, and we expect this to continue in fiscal 2024. We expect to see gross margin improve in fiscal 2024, and we are targeting 35% in the second half of fiscal 2024. Third, we expect a tax rate of approximately 21% to 23% for full fiscal year. Lastly, we expect to continue to generate cash flow while investing in our future. For fiscal 2024, we expect CapEx of $25 million to $30 million and free cash flow generation above 90% of non-GAAP net income. Now moving on to guidance for the first quarter of fiscal 2024. As a reminder, in addition to lower sales in our China medical business, the first fiscal quarter is generally a seasonally low quarter for shipments for us.

With that in mind, our guidance for first quarter is as follows: Revenues are expected between $180 million and $200 million and non-GAAP earnings per diluted share is expected between $0:00 and $0.20. Our expectations are based on non-GAAP gross margin in the range of 33% to 34%. Non-GAAP operating expenses in a range of $49 million to $50 million. Tax rate of about 22% for the first quarter. Non-GAAP diluted share count of about 41 million shares. With that, we’ll now open the call for your questions.

See also George Soros Stock Portfolio and 10 Best Copper Stocks To Buy Now.

Q&A Session

Follow Varex Imaging Corp (NASDAQ:VREX)

Follow Varex Imaging Corp (NASDAQ:VREX)

Receive real-time insider trading and news alerts

Operator: Thank you. Ladies and gentlemen, at this time, we’ll be conducting a question-and-answer session. [Operator Instructions] Our first question comes from the line of James Sidoti with Sidoti & Company. Please proceed with your question.

James Sidoti: Hi, good afternoon. Can you hear me?

Sunny Sanyal: Yes. Hello, Jim.

Sam Maheshwari: Hi, Jim.

James Sidoti: Hi. Thanks for taking the questions. Well, let’s start out with China because I think that’s the thing people are going to focus on most. It sounds like revenue at 16% [ph] of sales was around $36 million in a quarter. Sorry if you said it, but what was it a year ago?

Sam Maheshwari: The revenue a year ago in China was just give me one second here, Jim. It was – a year ago, it was – Q4 2022 it was about $37 million, and in Q4 2023 not $36 million, $31 million.

James Sidoti: $31 million, okay.

Sam Maheshwari: Yes. Yes.

James Sidoti: And was the decline primarily related to the anti-corruption or can you break that out?

Sunny Sanyal: To what we see, Jim, it is mostly related to anti-corruption measure. But at the same time, we know the economy in China is also soft. But it is very difficult for us to parse out the two issues they might be connected. So – but mostly we would say it is anti-corruption measures based on what we are hearing through our sales channel who have been talking to customers over there.

James Sidoti: And in the past when China’s implemented these anti-corruption initiatives and sales have declined, have you seen a rebound relatively quickly in two or three quarters, or how long do you think it takes for the sales to come back based on historical?

Sunny Sanyal: So the last time we – I think last time we saw this was somewhere around 2014 timeframe. And as we look at our revenues from 2014 to 2015, it’s – it seemed to have bounced back. It felt fairly quickly bounced back. But at that time, we also had a very small amount of business in China, not nothing like what we have today.

James Sidoti: Okay. All right. And then if we move on to the AI, it sounds like you got an application approved for liver surgery. What about applications for things like breast cancer detection or prostate cancer detection? How far are you from some of those projects?

Sunny Sanyal: Yes. So our software business has two channels. One where we go through OEMs, so our breast, prostate, those are sold through OEMs. Our lung screening workstation is a standalone workstation full workflow solution that we go direct and that continues on and we’re bidding on tenders as we’ve described previously. And this is also another new standalone solution for, to support liver surgery transplants, et cetera. It’s a direct-to-market channel and that’s why we went for the full 510(k) for this.

James Sidoti: Okay. So for the other applications, the OEMs will do the FDA conditions?

Sunny Sanyal: Correct. Correct. We also sell lung screening modules and applications through the OEM channel, but we have a full standalone workstation. So our software business in summary has two parts. There’s acquisition and diagnostics. And the acquisition is our – what we call as our Nexus platform. It’s a combination of tube detectors, integration with generators. It’s a full blown acquisition system that we sell also through the OEM channel. Those are mostly through systems integrators. And then the pure AI software historically was sold through the OEMs. Over the last few years, we’ve started going directly to bidding directly on tenders and selling directly to hospitals.

James Sidoti: All right. And then on the industrial business, I mean, another very strong quarter. What’s driving that and are these growth rates sustainable?

Sunny Sanyal: So we had an exceptionally strong fourth quarter for industrial, which was more than actually what we had forecasted. The strength was broad based. We saw it in many of the non-destructive inspection verticals as well as cargo was as we said, it was a bright spot this quarter. We expect for the year, we expect industrial to still grow. So we’re going to have a growth year for industrial, but the first quarter will be down and it will be down because of actually a lot of strength in the fourth quarter. So there tends to be monthly puts and takes and we had some customers that were up against some deadlines and pushed us very hard to ship some additional products, which is what we did in the fourth quarter. And so we’re going to have a – we’re going to see a softer first quarter, but overall for the full fiscal year, we’re expecting a growth out of industrial year-over-year growth.

James Sidoti: Okay. All right. Well, yes, so it seems like big picture, the margins are getting better. The industrial business continues to grow and you have a short-term hiccup in China. But long term you still think China is going to be a growing market for you, is that correct?

Sunny Sanyal: Yes. Absolutely. We believe so. The Chinese government continues to assert their commitment to expansion of healthcare. We’re very well positioned there. Our installed base is large and keeps growing. We are making a lot of advances with products with our Chinese OEM customers in cardiovascular and some of the – some additional modalities like dental, et cetera. So China continues to be a good market for us. We’re well positioned for 2025. We just need to get past this current malaise. And so we’re anticipating that the second half of next year is when that’s what we’re hearing where the recovery will begin.

James Sidoti: And then the last question from me on the balance sheet. I know you have some debt paydowns coming up. What’s your plan for capital allocation? Are you going to continue to build up the cash balance so you can pay down some of that debt or do you think you’ll be more active on the acquisition front in the next four or five quarters?

Sunny Sanyal: Yes, Jim, so yes our overall cash balance at the end of Q4 was $195 million. And I just want to remind looking at the balance sheet, you may not be able to get to that because it’s distributed amongst couple of lines, but the total cash was $195 million and we clearly are in an excess cash situation. But as you rightly said, we are essentially preparing for upcoming refinancing because the debt is supposed to mature in June of 2025, but it would go current in June of 2024. So essentially, we are building up the cash balance to approach refinancing with strength and at the same time take care of some of the excess cash situation. At this time, priority is to – from a capital deployment perspective, the priority is to fully fund the operations and then followed by deleveraging. And lastly, and then beyond that would be an inorganic growth.

James Sidoti: Okay. All right. Well, thank you. Thank you for taking the questions.

Sunny Sanyal: Thank you, Jim.

Operator: Our next question comes from the line of Larry Solow with CJS. Please proceed with your question.

Sunny Sanyal: Go ahead, Larry.

Larry Solow: Thank you, and hey, good evening guys. I guess first question just on the medical weakness on revenue, is it sounds like you guys are feel like it’s mostly China, whether it’s economic-related or mostly the – just the increased scrutiny in this – in the anti-corruption environment, but anything on – just on the U.S. side of it. And I’ve seen a lot of hospital-based companies just having issues with hospital spending budgets. I know you being a little bit tight obviously hospitals aren’t doing well in a high interest rate environment either. And I know you guys in 2023, I think we started out good, then we got a little bit more – a little more conservative and then less in Q3 things were a lot better. So any – but it feels like you haven’t spoken too much about negatives there, but I’m just trying to connect those dots. Thanks.

Sunny Sanyal: Let me make a comment my last time to chime in. So there were many puts and takes Larry. First of all, first quarter is a seasonally lower quarter. And secondly, the situation in China put it – puts additional burden on the medical side. So that, that is what’s driving the – pressure on the medical in the first quarter. And then of course, then compounding the fact that industrial had a strong fourth quarter and we’re just seeing a month-to-month kind of a issue there. In terms of the U.S. and the hospital market, our general perception and what we’re hearing and seeing is that the hospital’s – health of the hospitals is improving. They’re reporting better operating expenses controls. So we think that they’re in a better position going forward into the next year to for capital deployment.

So no real concerns there. What we want to make – what we we’re trying to get our head around is how and when the Chinese situation will turn around.

Sam Maheshwari: Yes. Larry, I would add that if you look at our Q4 results, revenues in Americas improved sequentially over third quarter, and then EMEA also improved over the third quarter. The place where you typically would want to see a growth, but it declined in fourth quarter was APAC. And we talked about China driving that. So Americas and EMEA, they both grew and the impact was through China reflected in APAC. And from Q4 into Q1, there’s a seasonality that is coming in and we then expect to resume the growth from there in Americas, EMEA, et cetera. And then the China, as we’ve already talked about, it is somewhat of a situation dependent. And my – as and when this anti-corruption campaign gets over, we hope to begin to grow from there in that region.

Larry Solow: And specifically China, and I know you’re not guiding, as you look at the 2025, but it feels like the next few quarters, it’s hard to time exactly when the shakes out. But any concern, I mean, that when as we get back to normalization that we’re at a lower level, it feels like I know the – there’s been any change in sort of that mid to longer-term outlook for the build out of CT in China. Anything there of significance?

Sunny Sanyal: Larry, nothing particular. First of all, if you – if based on the anecdotal and customer feedback, we think what’s been happening over the last several months is a significant reduction in new system placements. So that means the volume of business that we’re getting from China has been primarily grew. China for us is mostly tubes and mostly CT tubes. So the business that – the volume of business that we’ve been seeing has been replacement tubes to keep their hospitals and healthcare systems running.

Larry Solow: Right, right, right.

Sunny Sanyal: So that we think is a good baseline for us. So from here on, as business comes back, there is going to be some amount of pent-up demand, which will adjust the levels back up, and then we expect it to grow back from there. Now we’ve grown – China business has grown at 20% plus per year. We don’t – and we’ve said before that that is not sustainable. We expect growth to come to what would be kind of secular levels for China, which is in the 8% to 10% type of a range. So that’s what we think will happen. It’ll bounce back, there’ll be a little bit of pent-up demand, which will raise the baseline and then go back to a little bit more traditional growth rates.

Sam Maheshwari: Larry…

Larry Solow: Right. Okay. I know you’re not guiding – yes, yes, I’m here. Yes, sorry.

Sam Maheshwari: No, go ahead, Larry. Go ahead, please.

Larry Solow: No. I was just going to say, I just I know you’re not guiding, sorry to interrupt. I know you’re not guiding on the revenue line specifically, but just from a high level, if you decline 4% at the mid-point, right? If I just – if the rest of your business is flat and China’s down 25%, you’d be, you’ll decline 4%. That’s just the way the math works out, like almost to a key [ph]. So my – again, it sounds like the rest of your business might actually be up. So it feels like China could actually be down more than 25% in front and bigger in the beginning of the year. Am I thinking about that kind of right?

Sam Maheshwari: Larry, we are not guiding by geography or anything, but in some ways you are thinking in a right way. We are expecting China full year to be a down year for 2024. In terms of percentages, et cetera, we are not guiding. But broadly, you are thinking about it right. Yes.

Larry Solow: Okay. Okay. And I interrupted you. I don’t know, were you trying to say something before that? I’m sorry about that.

Sam Maheshwari: I was trying to say something Larry, but now I forgot what your question was.

Larry Solow: That’s okay. All right. I’ll move on. I’ll let someone else get into the queue. Thank you, guys.

Sam Maheshwari: Sure. Yes.

Operator: Our next question comes from the line of Suraj Kalia with Oppenheimer. Please proceed with your question.

Suraj Kalia: Sam, Sunny, can you hear me all right?

Sunny Sanyal: Yes. Hello, Suraj.

Sam Maheshwari: Yes.

Suraj Kalia: Good afternoon, gentlemen. So Sunny, did I hear you all correctly that the expectation of the anti-corruption wave to abate is roughly around two quarters? Or did I get that wrong?

Sunny Sanyal: We’re expecting that we will start to see things pick up again in our beginning of our third quarter. So that’s again the situation is little fluid. We will know better in the upcoming months, but the current expectation is that mar – in Q3 – beginning of Q3 onwards, we would start to see it pick back up.

Suraj Kalia: Got it. Sam, I know there are a lot of moving parts, appreciate that. But to the extent that China contribution is soft, does it necessarily now should we start looking at gross margin? There should be an uptick.

Sam Maheshwari: Yes, so that’s right, Suraj. China, lack of China revenues or less proportion of China revenues is actually a tailwind for the gross margin. But we also need to keep in mind, the volume effect of it. So the two aspects intersect, but part of the reason Q4 gross margin were much higher than our expectation is because China mix went lower than what we were expecting at the beginning of the quarter. So your intuition is right there that less China revenue does help gross margin, but only to the extent that the volume is not – lack of volume is not becoming the driving factor.

Suraj Kalia: Got it. Sunny, in terms of tubes and detector manufacturing in India, is this strategy local for local or local for international?

Sunny Sanyal: No. India is going to be first local for global and then later also local for local. So the India strategy is an extent is slightly different from that of China, in this case, we’re setting India up as a full capability operating center. So full manufacturing for extending our capacity from Salt Lake to India and then also business functions, R&D, et cetera. So India’s going to become a full blown hub for us for South Asia.

Suraj Kalia: Got it. Got it. Final question, Sam, and I’ll hop back in queue. So Sam, since the time that I’ve picked up Varex, I think so almost three years ago to now just ballparking it. Okay. Industrials has gone from almost 20% contribution to, let’s say, around 30% contribution, right, to overall sales. Obviously, there are respective growth rates in these two buckets. As we look forward over, let’s say, the next four, eight quarters, is this a trajectory that we should continue to expect, i.e., increasing contribution of industrials and that’s really how we should start thinking about the overall business. Or do you think like to steal Sunny’s words that some temporary malaise, but then it should revert back to the 80/20? Gentlemen, thank you for taking my questions.

Sam Maheshwari: Yes. Suraj, very good question. In general, Industrial business growth rate for us is higher than the Medical business growth rate. So I expect the overall contribution of Industrial segment to our revenues to continue to climb. And in the next three to five years, it might cross 30%. So that is the right way to think about it. There are just a lot of applications that we are seeing that X-ray technology can be very successfully applied in for the Industrial business. So right now, we are thinking that eventually Industrial could go 30% or somewhat even higher than that in terms of the overall revenue proportion.

Suraj Kalia: Thank you.

Sam Maheshwari: Thanks, Suraj.

Operator: Our next question comes from the line of Anthony Petrone with Mizuho. Please proceed with your questions.

Anthony Petrone: Thanks and good afternoon. Maybe just to segue back to China, Sunny you mentioned, it’s – tubes are still sort of trending well here, but it’s been a slowdown on the capital front. But I just want to confirm, we’ve heard actually both headwinds throughout the quarter due to anti-corruption, meaning that procedures were down through the third quarter, but also that capital purchases slowed down. So I know you mentioned tubes were still trending well, has there been any slowdown in tubes? And do you expect actually tubes can also see a catch up once things normalize into next year? And I’ll have one follow-up.

Sunny Sanyal: Let me clarify. Tubes has been down. So that’s what’s led China to the decline in sales for us. However, when we ask our customers, where are these going? It’s – we are not sensing a strong placement of new systems. So our understanding is this is mostly going into replacement and wherever there might have been a smaller percentage of those than normal for new systems. So hard for us to tease this apart. But the general sense is that new business or new systems, placements is down and replacements have continued, but tubes overall have been down as a result.

Anthony Petrone: That’s helpful. And then maybe just when you think about the global manufacturing footprint, new disclosure tonight on India, how does that play with Wuxi is? Is Wuxi only going to exclusively supply to China? Will India supply to India? What happens to Salt Lake over time? Or will India and Wuxi become just larger global hubs? Thanks again.

Sunny Sanyal: Yes. So China and Wuxi was – our footprint in Wuxi was set up for China. So we optimized it for the specific products that are – were needed in China. And to the extent, particularly for detectors, the detectors that we make in China, we’ve also been shipping to other places where we needed lower cost detectors. So from that perspective, Wuxi is mainly for China. India, the capacity that we’re adding to India actually moves out some capacity from Salt Lake, frees up Salt Lake for some other products. Salt Lake is running the tubes. Production at Salt Lake is running at very high capacity levels. So this frees up space here. And then the production in India is initially intended, Phase 1 is intended for global sales.

And these will be at a lower cost with lower cost supply chain over the last three years during the COVID phase, and since then we have been diversifying our supplier base and one of the things we did was qualified a lot of suppliers in India. So this is – this gives us access to lower cost supply chain, lower manufacturing costs, and makes us more competitive. That’s the intention. And then for many of the newer tubes, the innovation and some of the high end tubes, we will use up the capacity freed up in Salt Lake for that.

Anthony Petrone: Thanks again.

Sunny Sanyal: Thanks, Anthony.

Operator: There are no further questions in the queue. I’d like to hand the call back to management for closing remarks.

Christopher Belfiore: Great. Thank you for your questions. Sunny, do you have any final comments?

Sunny Sanyal: Yes. It’s a short comment. Thanks, Chris. So in closing, we’re really pleased with the results we achieved in fiscal 2023. And as always, I’d really like to thank our employees all over the world for their efforts during this – during the year. Everyone worked really hard to contribute to our results. And thank you for taking the time to join us today and for your continued interest in Varex.

Christopher Belfiore: Thank you, Sunny, and thank you all for participating in our earnings conference call for the fourth quarter of fiscal year 2023. The webcast and supplemental slide presentation will be archived on our website. A replay of this quarterly conference call will be available through November 28 and can be accessed at vareximaging.com/investorrelations. Thank you and have a great evening.

Operator: Ladies and gentlemen, this does conclude today’s teleconference. Thank you for your participation. You may disconnect your lines at this time and have a wonderful day.

Follow Varex Imaging Corp (NASDAQ:VREX)

Follow Varex Imaging Corp (NASDAQ:VREX)

Receive real-time insider trading and news alerts