Varex Imaging Corporation (NASDAQ:VREX) Q1 2023 Earnings Call Transcript January 31, 2023

Operator: Greetings and welcome to the Varex First Quarter Fiscal Year 2023 Earnings Call. At this time, all participants are in listen-only mode. A brief question-and-answer session will follow the formal presentation. As a reminder, this conference is being recorded. It is now my pleasure to introduce your host Christopher Belfiore, Director of Investor Relations. Thank you, Christopher. You may begin.

Christopher Belfiore: Good afternoon and welcome to Varex Imaging Corporation’s earnings conference call for the first quarter of fiscal year 2023. With me today are Sunny Sanyal, our President and CEO; and Sam Maheshwari, our CFO. Please note that the live webcast of this conference call includes a supplemental slide presentation that can be accessed at Varex’s website at vareximaging.com/news. The webcast and supplemental slide presentations will be archived on Varex’s website. To simplify our discussion, unless otherwise stated, all references to the quarter are for the first quarter of fiscal year 2023. In addition, unless otherwise stated, quarterly comparisons are made sequentially from the first quarter of fiscal year 2023 to the fourth quarter of fiscal year 2022.

Finally, all references to the year are to the fiscal year and not calendar year, unless otherwise stated. Please be advised that during this call, we will be making forward-looking statements, which are predictions or projections about future events. These statements are based on current expectations and assumptions that are subject to risks and uncertainties that could cause actual results to differ materially from those anticipated. Risks relating to our business are described in our quarterly earnings release and our filings with the SEC. Additional information concerning factors that could cause actual results to materially differ from those anticipated is contained in our SEC filings, including Item 1A, Risk Factors of our quarterly reports on Form 10-Q and our annual report on Form 10-K.

The information in this discussion speaks as of today’s date, and we assume no obligation to update or revise the forward-looking statements in this discussion. On today’s call, we will discuss certain non-GAAP financial measures. These non-GAAP measures are not presented in accordance with, nor are they a suitable for GAAP financial measures. We provide a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP financial measure in our earnings press release, which is posted on our website. I will now turn the call over to Sunny.

Sunny Sanyal: Thank you, Chris, and good afternoon, everyone. We are pleased to report sales of $206 million for the first quarter consistent with our expectations. This was a result of a more balanced operating environment, driven by good demand, and improved supply chain and our internal supply chain initiatives. That said, while demand levels were as expected, product mix was less favorable in the quarter and as a result gross margin was lower than what we had originally anticipated. With that, let’s discuss our results for the quarter. Revenue in the first quarter was down 11% sequentially, but up 3% year-over-year. Revenue in the Medical segment declined 12% sequentially, while the Industrial segment revenue declined 9%.

Non-GAAP gross margin in the first quarter was 32%, which was below our expectation, due to a shift in our product sales mix to mid and lower tier products during the quarter. Sam will talk more to this during his prepared remarks. Adjusted EBITDA in the first quarter was $25 million and non-GAAP EPS was $0.21. We ended the quarter with $108 million of cash, cash equivalents and marketable securities on the balance sheet, down $5 million from $113 million in the prior quarter, this was primarily due to higher inventory in the quarter. Now let me give you some high-level insights into the market environment based on an assessment of demand that we are seeing for different modalities and applications. Medical segment revenues increased 3% year-over-year and decreased 12% sequentially.

Across our product portfolio, we believe our customers are exhibiting cautiousness as they asses an uncertain economic environment ahead. Many of them are still facing challenges fulfilling their backlog, primarily due to material shortages. As a result, demand globally for CT tubes were soft, while demand in other medical modalities including fluoroscopy, oncology and mammography was flat to down. Demand for dental and radiographic products were stable to up. Revenues in our Industrial segment increased 5% year-over-year and declined 9% sequentially. Demand for industrial tubes and detectors remained strong in the quarter, led by strength across non-destructive inspection products. Security markets continued to slowly improve as our customers converted their prior period tender wins into orders for us at a higher rate.

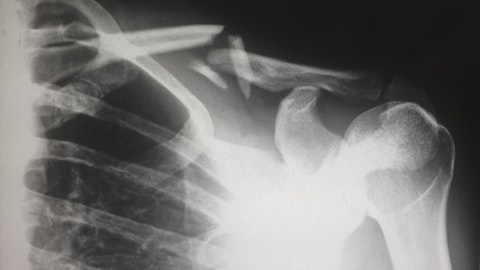

Throughout Varex’s history, we are focused on investment in R&D and innovation in the field of X-ray imaging. We see the X-ray based imaging industry continuing to evolve and as long-term component supplier to imaging OEMs, we are at the center of this evolution. This is very evident as we met with our customers at RSNA this year. As you may know, each November, we attend the Annual Radiological Society of North America Conference in Chicago. This is the largest radiology trade show of the year and is well attended by both our OEM customers and our peers. With over 31,000 participants in attendance, this conference provides us a significant opportunity to take the pulse of the markets we participate in. This year, RSNA was a very meaningful event for Varex as our customers returned to the show with a pre-COVID level presence and enthusiasm.

Specifically, we saw a significant shift from conversation centered around supply chain woes to active conversations around new product development and our role as a component supplier to them for these future products. Photon counting technology stood out as a key highlight of our discussions at the conference with many customers interested in our technology and how it could be integrated into their new products. The focus was mainly on performance, resolution, image quality of photon counting technology, as well as dose reduction and spectral imaging capabilities. We believe there is a significant opportunity with our photon counting technology for both medical and industrial applications and we continue to make progress with our CT customers for potential integration into their systems.

Copyright: gmast3r / 123RF Stock Photo

With regard to some of our other detector products, customers continue to show a high level of interest in our dynamic detector platform called Azure. A number of our customers are already using this platform across various modalities and we expect continued integration given the level of interest we saw. Our radiographic customers remain excited about our LUMEN detectors, which continue to gain interest. LUMEN is a highly competitive radiographic detector platform currently targeted at the approximately $400 million segment of radiographic market where we have low market share. We are excited about the LUMEN family of detectors and are working on a number of projects in 2023. While AI software has been part of our RSNA in the past, it felt more palpable this year with a very large exhibit footprint dedicated to this technology.

A key area of interest was AI software related to lung screening. As we have highlighted in the past, we believe our AI aided lung cancer screening software Veolity will benefit from a global focus on proactive lung screening. Last year, we installed six Veolity platforms in various locations in British Columbia. All of these systems are working well and have provided runway to be involved with a tender process in Manitoba. In Ontario, we have a test installation that could also lead to a tender process. The conversations with current and prospective customers support our view for the continued evolution of the X-ray industry towards new technologies. While some of these products are several years from being commercialized, there is no doubt that the industry is evolving into a higher technology arena in line with where we have dedicated R&D dollars.

With over 70-years of expertise in the imaging industry and strong customer relationships, we are a critical player in making this evolution a reality. Turning back to the quarter, while demand in the first quarter was per our expectation, as we start the second quarter, we’re seeing a softer demand environment. We expect this change in market dynamic to lead to revenues that will be flat to slightly up for the year. Further, we expect the less favorable product mix we experienced in the first quarter to continue into the second quarter. With that, let me hand over the call to Sam.

Sam Maheshwari: Thanks, Sunny, and hello everyone. As a reminder, unless otherwise indicated, I’ll provide sequential comparison of our results for the first quarter of fiscal 2023 with those of our fourth quarter of fiscal 2022. In the first quarter, demand and supply came in balance. As a result, we are reporting sales of $206 million at the midpoint of our guidance. Non-GAAP gross margin was 32% below our expectations, primarily due to lower margin product mix. Non-GAAP EPS was $0.21. First quarter revenues were down 11%, compared to the seasonally high fourth quarter of fiscal ’22. Medical revenues were $160 million and industrial revenues were $46 million. Medical revenues were 78% and industrial revenues were 22% of our total revenues for the quarter.

Looking at revenue by region, Americas decreased 7% sequentially, while EMEA decreased 13% and APAC decreased 14%. This was against a seasonally strong fourth quarter. Sales to China were 17% of our overall revenue for the quarter. Let me now cover our results on a GAAP basis. First quarter gross margin was 31%, 100 basis points lower than the prior quarter. Operating expenses were $50 million flat, compared to the fourth quarter of fiscal €˜22 and operating income was $13 million, down $12 million. Net earnings were $3 million and GAAP EPS was $0.08 based on fully diluted 41 million shares. Moving on to the non-GAAP results for the quarter. Gross margin of 32% was down 100 basis points sequentially driven primarily by low margin product mix.

While demand in the quarter was in line with our expectations of a product mix in the medical segment changed. We saw reduced sales of higher margin, higher-end CT tube and certain detector products. In the Industrial segment, we saw lower service revenue, which typically carries a higher margin profile. This product mix shift caused approximately 100 basis points of margin compression in the quarter, compared to the fourth quarter. We believe some customers are taking a more cautious stance either due to the macroeconomic environment or challenges fulfilling their backlog, due to supply chain shortages. R&D spending in the first quarter was $20 million flat, compared to the prior quarter. It was 10% of revenues at the high-end of our targeted 8% to 10% range, due to seasonally low sales level in Q1.

SG&A was approximately $27 million flat compared to the prior quarter as a result as G&A was 13% of revenue. Operating expenses were $47 million or 23% of revenue, which was flat sequentially. Operating income was $18 million, down $11 million sequentially, due primarily to the lower gross margin. Operating margin was 9% of revenue, compared to 13% in the fourth quarter of fiscal 2022. Tax expense in the first quarter was $2 million or 15% of pretax income, compared to $4 million or 17% in the fourth quarter of fiscal 2022. We are now modeling 25% tax rate for full fiscal year 2023, due to certain tax reform related favorable items, as well as increasing R&D and foreign tax credits. Net earnings were $8 million or $0.21 per diluted share, down $0.22 sequentially.

Average diluted shares for the quarter on a non-GAAP basis were $41 million. Now turning on to the balance sheet. Accounts receivable decreased by $15 million from the prior quarter, due to lower sales in the quarter, compared to the prior quarter and DSO increased two days to 70 days. Inventory increased $17 million in the first quarter. As a result of this, days of inventory increased to 203 days. While it is common for our inventory to increase in our first fiscal quarter, we expect inventory to decrease going forward. Accounts payable increased by $8 million and days payable was 55 days. Now moving to debt and cash flow information. Net cash flow from operations was a use of $4 million in the first quarter, due to an increase in inventory, employee incentive payments and the biannual coupon payment on our debt.

We ended the quarter with cash, cash equivalents and marketable securities of $108 million, a decrease of $5 million from the fourth quarter of fiscal 2022. Gross debt outstanding at the end of the quarter was $450 million and debt net of $108 million of cash and marketable securities was $342 million. Adjusted EBITDA for the quarter was $25 million and adjusted EBITDA margin was 12% of sales. Our net debt leverage ratio was 2.5 times at quarter end. Now moving on to guidance for the second quarter. As we talked about earlier, we are providing outlook for revenue in fiscal 2023 to be flat to slightly up, compared to the prior year. Separately, we believe hospitals are seeing good patient and elective procedure volume. However, higher in capital expenditures and long-term payback projects are being reevaluated.

This phenomenon is cascading over to us as a somewhat unfavorable product mix. As a result for the second quarter of fiscal year 2023, revenues are expected between $205 million and $225 million and non-GAAP earnings per diluted shares are expected between $0.05 and $0.25. Non-GAAP earnings guidance includes an anticipated $2 million payment for technology transfer milestones in R&D. This would equate to approximately $0.04 in non-GAAP EPS. Our expectations are based on non-GAAP gross margin in a range of 31% to 32%, non-GAAP operating expenses in a range of $48 million to $49 million, temporarily high due to the anticipated R&D milestone payments. Tax rate of about 25% for the second quarter and the rest of fiscal year 2023 and non-GAAP diluted share count of about 41 million shares.

With that, we will now open the call for your questions.

See also 12 Best S&P 500 Dividend Stocks To Buy and 12 Cheap Biotech Stocks To Buy.

Q&A Session

Follow Varex Imaging Corp (NASDAQ:VREX)

Follow Varex Imaging Corp (NASDAQ:VREX)

Receive real-time insider trading and news alerts

Operator: Thank you. We will now be conducting a question-and-answer session. Thank you. Our first question is from Young Li with Jefferies. Please proceed with your question.

Young Li: All right, great. Hey, everyone. Thanks for taking our questions. Can you hear me alright?

Sunny Sanyal: Yes, we can hear you alright, Young.

Young Li: All right, perfect. I guess maybe just to start on the cautiousness from customers’ comments. I was wondering if you can expand upon that a little bit more, which products, end markets, geographies are more impacted? And what’s holding up better? I mean, it sounds like some of your customers are maybe seeing some more deferrals or cancellations as well?

Sunny Sanyal: Hey, this is Sunny. The cautiousness comes from just the general conversations that we’ve had with customers and the actual softening in order intake rates of the call offs as we call them that we’re seeing from them. And without exception, every conversation that we’ve had with our customers, they’ve indicated to us that they’re sitting on a backlog of whip that they can’t get out of the door, because they’re missing some component in their systems that they’re building. These are not in our tubes or detectors; these are other parts and components that they’re missing. So — and that’s causing them to rebalance some of their inventory and enhance the orders to us. Now that’s what’s driven us to look at our forecast for the rest of the year and we’ve indicated that we’re seeing some softening.

Young Li: All right, great. Very helpful. I guess maybe one more on I guess, the China market is attractive and important. I guess, what are you seeing and hearing on the ground related to the COVID disruptions during the quarter? And how has that changed, if any, in January? And how long do you think that market might take to sort of normalize?

Sunny Sanyal: Li, what we’re seeing in China, first of all, with COVID, there was disruption across the board for most of our customers. They’re trouble getting people to work and get product out of the door. So there is somewhat of a similar situation as I described earlier with — unable to get product out of the door, but in their case, it was a lot of it was also tied to labor. We motor through it, we managed to deliver all the things that were needed. In terms of CT and our strength in China is heavily — we’ve been very heavy on CT and doing well with CT. There’s been a lot of CT buying and although the Chinese government continues to reinforce their investment in healthcare. This year, we expect that there’ll be some softening in demand and going down from the traditional just (ph) buying to more traditional growth rates.

So again, early signs, early indicators, there’s no sign of slowing down of overall investments in healthcare and CT buying we expect will continue. And for us, it’s a two-pronged, right? One is new sockets that we get through a lot of these activity. By the way, there’s been continued activity with R&D and new design wins as the Chinese OEMs continue to bring out new models. So one — first prong is new sockets and the second prong is we’ve now sold quite a bit of new sockets into China. We expect their replacement revenue stream from that to continue and should help us in the future.

Young Li: All right, great. Appreciate the color. I’ll get back in queue.

Sunny Sanyal: Thanks, Young.

Operator: Thank you. Our next question is from Larry Solow with CJS Securities. Please proceed with your question.

Larry Solow: Great. Thanks and good afternoon or good evening. Just a follow-up just on the demand or the questions on the somewhat lower at least from a high level of the revenue outlook. So it seems like it’s a combination of things. I guess, it’s some — just supply chain issues that are continuing and you mentioned just things caught up in the whip. But I guess also the hospital spending over capital expenditure sort of reassessment. That seems to be somewhat of a newer phenomenon, I guess. And how does that flow to the OEM like, are there orders? It sounds like the OEM orders are still good, so I’m just trying to figure out does this hospital slowdown? Is that like a next step? So, does that maybe make this slow down a little bit longer? Just trying to kind of connect the dots there.

Sam Maheshwari: So, hi, Larry. This is Sam. Yes, so what we are hearing from hospitals and the CEOs, what they’re saying is that although they are seeing very good patient volume and elective procedure volume. And as you know from prior history, we have — we are connected to the hospital CapEx somewhat particularly to the elective procedure volume overall. And what they are saying is that they are under tremendous profit pressure, so to say, in the sense their expenses are running quite high. And so in order to maintain their profits, they are looking at everything. And this is what we’ve heard more from the United States based hospitals. And as they look at it, they’re scrutinizing their capital expenditures and also everywhere that they can manage their expenses better.

And in this scenario, what we are hearing is that longer term ROI type of projects which are much higher in terms of capital layout. Those are probably being deferred or delayed. And anything that can increase patient volume, et cetera, is already being taken care of. So we believe that is causing a little bit of push out on the higher end products or higher end machines and that is cascading over to us. That’s what we believe it’s happening over there. Of course, we are one step removed, but that’s what we mean.

Larry Solow: Right. Okay. So it sounds like it’s obviously end market demand is all based on — well patient volumes to sure drive your long-term business? But I guess you can never — customer behavior can shift around and maybe they can decide to hold less CT machines or whatever in the long run. But I guess that’s very hard to decide for — in a couple of quarters. And then just on China, so just trying to get a little better read on that. I feel like — I put China in the govern, they’re still behind this initiative in terms of the CT machine build out. And then I thought that was sort of accelerating in 2020 to have all these freestanding centers that are just CT centers or imaging centers including CT. So how would that slow? Like, to me, two years, it doesn’t seem like catch up that fast as to where they’d be slowing down noticeably up to you guys at least. So I’m just trying to get a little more, yes color on that.