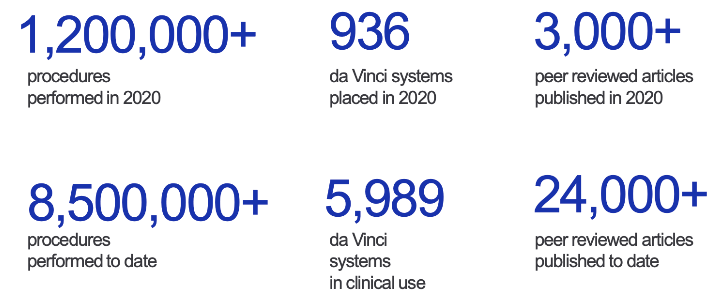

Intuitive Surgical, Inc. (NASDAQ:ISRG) was founded in 1995 to create innovative, robotic-assisted systems that help empower doctors and hospitals to make surgery less invasive than an open approach. Since the da Vinci and Ion surgical systems became one of the first robotic-assisted systems cleared by the FDA for general laparoscopic surgery, they’ve taken robotic-assisted surgery from “science fiction” to reality. Working with doctors and hospitals, they’re continuing to develop new, minimally invasive surgical platforms and future diagnostic tools to help solve complex healthcare challenges around the world.

Intuitive sells da vinci machines in the U.S., Europe, Asia, China, Japan, South Korea, India, Taiwan. In China, they took up a deal with the government to place their robots into hospitals, which means that no other robotics company will be able to enter.

It is estimated that the surgical robotics market will be worth $10B by 2027. They still have the chance to expand to other countries or to add more to their contract with China.In Q1 20, started seeking opportunities to expand outside of its robotic surgical systems niche. Acquired Orpheus Medical, which provides clinical and imaging documentation solutions. This move into hospital information is good for the digital health trend.

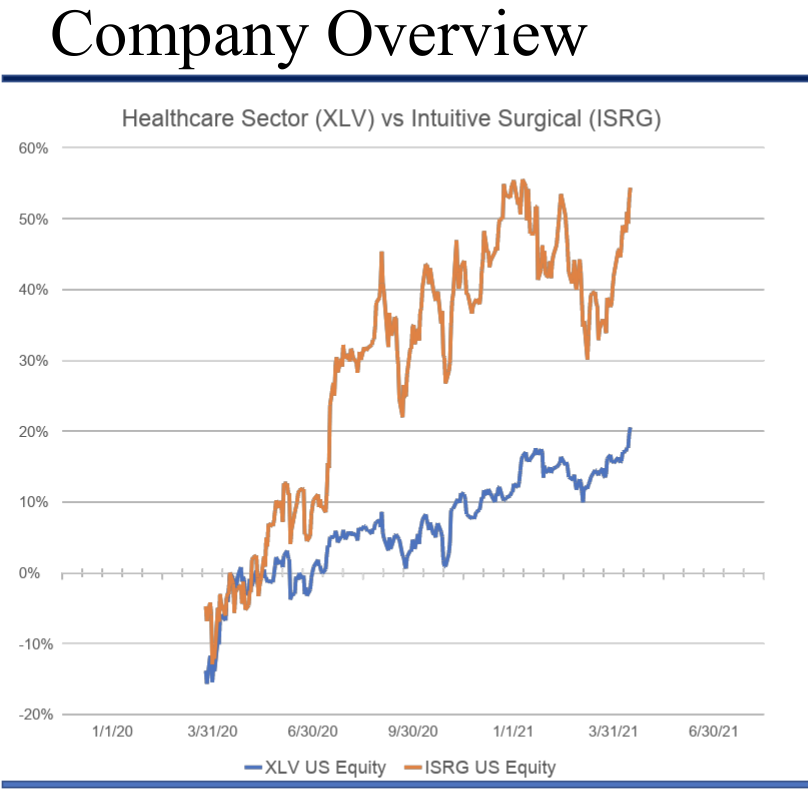

Healthcare Sector

Towards the beginning of the pandemic, healthcare had become a spotlight sector. However, as time went on and the uncertainty of the vaccine became prevalent, values started to decrease as investors took their gains and pulled out of their healthcare positions. We believe this was mainly due to the volatility within the sector.

The sector has performed in line with S&P at the start of the pandemic, then began to outperform S&P during the month of April. As uncertainty and fear of Covid-19 became much more prevalent the healthcare industry has been underperforming in comparison to the S&P 500 ever since.

The sector has risks of Cyberthreats (the healthcare industry’s new shift to electronic records has created new patient privacy exposure as records are more easily accessed by consultants), Tax reforms, as well as Biden’s administration may propose new policies on drug pricing affecting not only big pharma companies but the entire healthcare sector.

The sector will continue to grow with new technological advancements such as artificial intelligence and robotic surgery. The number of surgical procedures performed by robots worldwide has been expanding with double-digit growth for several years, and we believe this trend will continue. There is an increased demand for minimally invasive care. Although this has been in high demand for the last decade, covid has definitely sparked more interest within patients. Key drivers include the aging population, the general health of the population, different life styles The market of robotic surgery is expected to sport a compound annual growth rate of 21.55% through 2023.

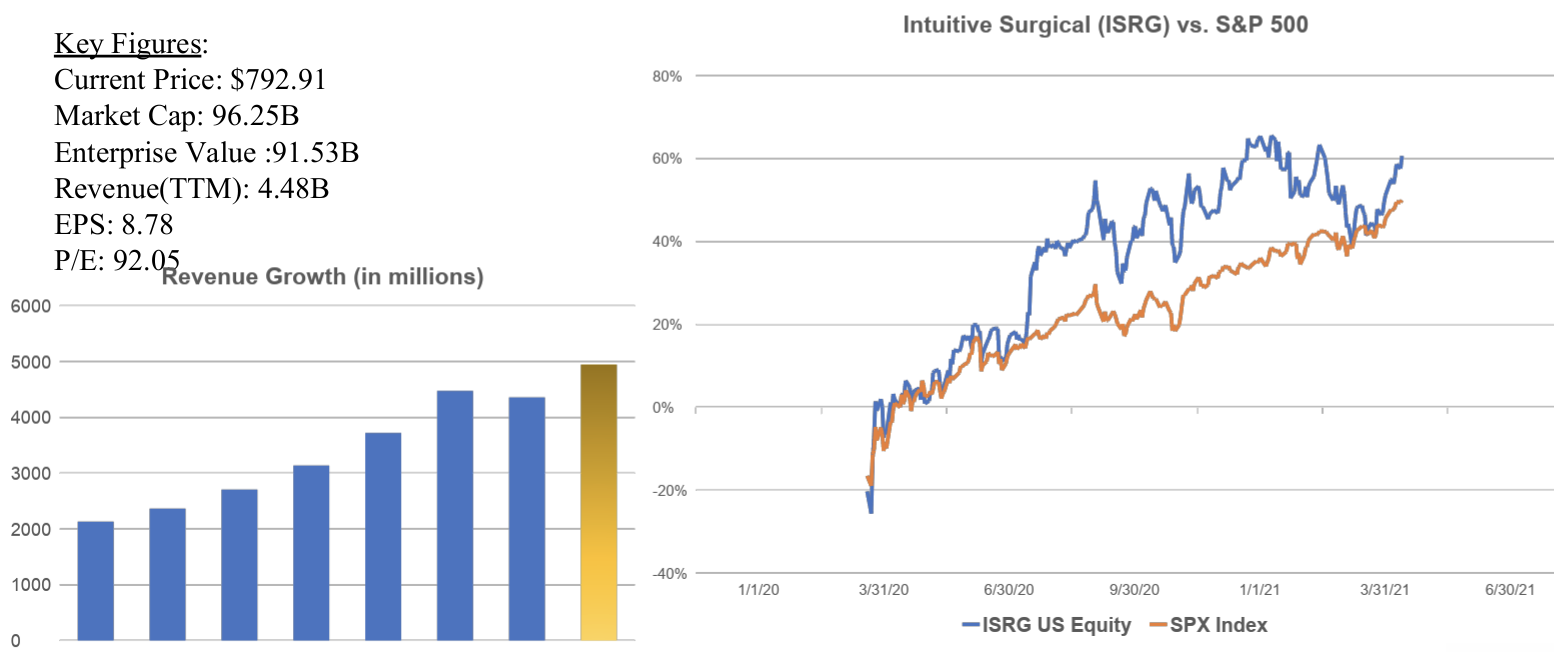

Trading Data

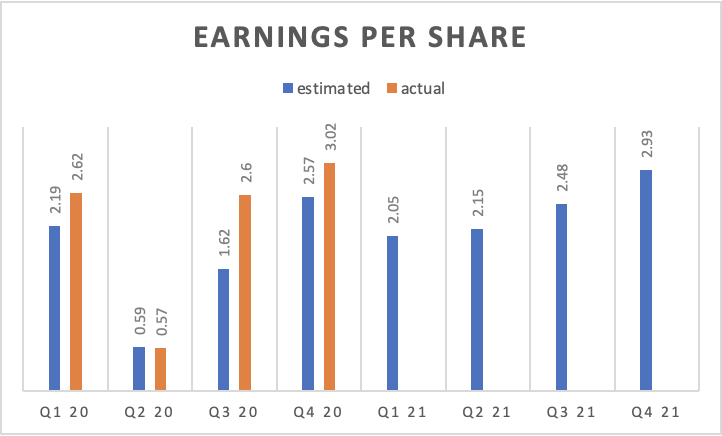

Due to postponed elective surgeries and the fact that many hospitals faced a funding crunch that impacted their ability to pay for essential robotic surgery products, IRSG was negatively impacted by covid however isrg continues to outperform the S&P 500 and we are very confident this company has a lot of room for growth. The drop during february was due to their q4 results as it was a bit disappointing to see sales at the company grow 4% (as preannounced), but earnings grow only 1% (as just announced). In total, yearly revenue has exploded, growing from $1.05 billion in 2009 to reach $4.47 billion as of 2019 I expect Intuitive to also develop new products for pre- and post-operative care, like imaging systems and software analytics suites. These will most likely build on the successes of its lung biopsy suite, which is currently its only product line other than the da Vinci robots.

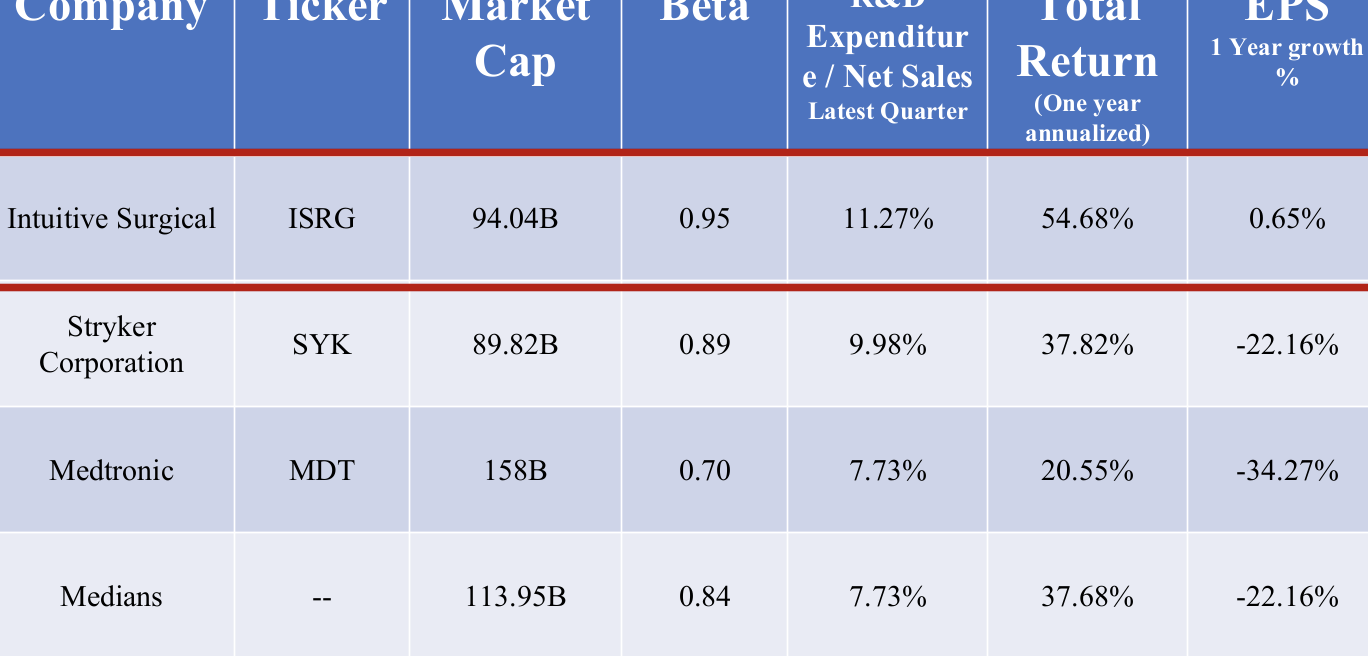

Competitor Analysis

Initiative’s shares are up more than 38% year to date while Medtronic is up only slightly at 1.45% in 2020. Over the past five years, it has increased revenue 87.8%, compared to Medtronic’s modest revenue growth of 0.28% in that same stretch.

While Medtronic plans to outsource and launch its own surgical robot that will compete directly against da Vinci, more entrants will actually help Intuitive over the long run by expanding the market. Intuitive’s huge head start and extensive track record will allow it to fend off most of its competition.

Medtronic PLC (NYSE:MDT) is on a different reporting schedule and their Q1 21 earnings declined 13.2%, claiming all due to covid. Their revenue was mostly from ventilators, which aren’t as highly recommended now in the pandemic due to long term side effects. Inntuitive won’t have that bump.

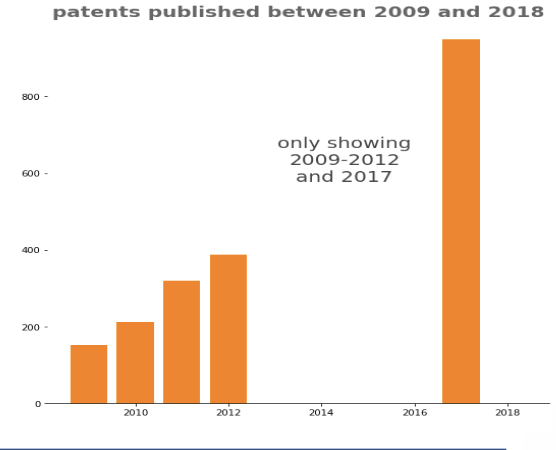

ISRG has 2341 patents. Stryker has 6,600 patents, with most of them expired and has been sued for $250M. Medtronic has requested 15,000 patents, but only 5,000 were approved. Some, like Stryker’s Mako system or Smith & Nephew’s Navio system are specifically designed for orthopedic surgical procedures, while others like Titan Medical’s SPORT system and the TransEnterix systems provide surgical robots to perform some of the same procedures performed by the da Vinci Surgical System. Verb Surgical, a new startup backed by Google and Johnson & Johnson is also developing a system that will likely also compete with the Intuitive Surgical system.

In terms of JNJ, they use a broad differentiation strategy and their involvement in the robotics surgery segment does not seem too worrisome, we can look at it as just more exposure to the growing robotics surgery market.

Even if competitors try to steal Intuitive’s market share, they probably won’t be able to affect its recurring revenue, at least in the short term. Hospitals won’t want to retrain their surgeons on a new robotic surgery system, which gives Intuitive a small but significant moat. It also means that when Intuitive develops new accessories for the da Vinci, the company will be able to increase its revenue from its existing customers.

Although many other companies are working on their own surgical robots, ISRG has a major head start in relation to its competitors. For example, they have $100 million ready to invest within their new venture capital fund. By creating this fund, Intuitive is ensuring that it doesn’t need to take on 100% of the excessive research and development costs that will create the robotic surgery technologies of the future. It’ll also gain the ability to potentially buy out companies that could become its competitors in the long term.

Da Vinci Surgical System & Ion System

A da vinci surgical system costs approximately $1.75million. In addition, there are maintenance contracts plus expenditures for instruments used during surgery. Surgical procedures performed with the robot take longer than traditional ones, but has better outcomes. There is also the Ion endoluminal system, Intuitive’s robotic-assisted platform for minimally invasive biopsy in the lung. It Provides more reach, stability, and precision. The Ion system caches lung cancer early than without using it.

They are not the first robotic company. Computer Motion had actually gotten into the robotic surgery field earlier than Intuitive Surgical, with its own system, the ZEUS Robotic Surgical System. Although the ZEUS system was approved in Europe, the U.S. Food and Drug Administration had not yet approved it for any procedure at the time that the FDA first approved the da Vinci system. In 2003, Intuitive Surgical and Computer Motion agreed to merge. The ZEUS system was ultimately phased out in favor of the da Vinci system. After the merger, the stock price rose significantly primarily because of the growth in systems sold and the number of surgical procedures performed

On the right is a graph showing patents published in the past 11 years. typically patents have a life of 20 years. However, this does not mean Intuitive Surgical will be left without any patent coverage for its products, as most of the 649 patents or published applications referenced above will not expire anytime soon, not to mention any other patents to which the company may have rights. Intuitive Surgical also continues to file new patent applications for its latest technologies.

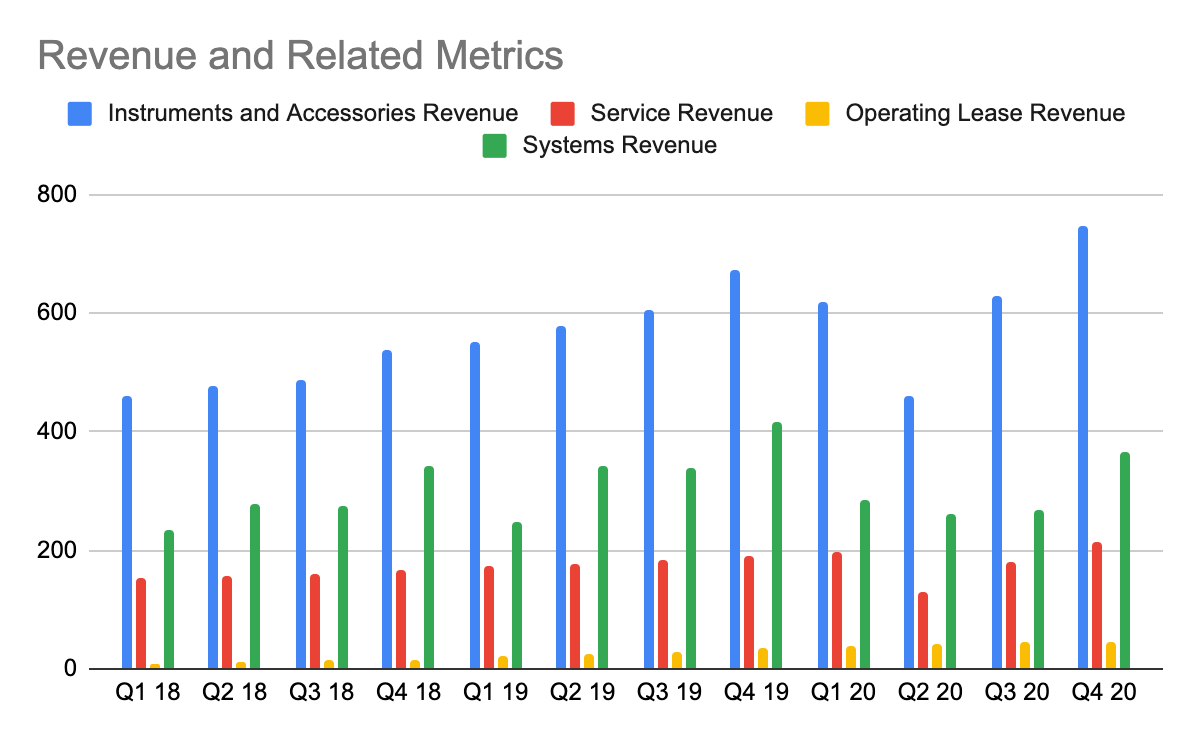

Fourth-quarter 2020 instruments and accessories revenue increased by 11% to $747 million, compared with $671 million in the fourth quarter of 2019, primarily driven by approximately 6% growth in da Vinci procedure volume and stocking orders associated with the Company’s launch of Extended Use Instruments.

Fourth-quarter 2020 systems revenue decreased by 12% to $367 million, compared with $416 million in the fourth quarter of 2019. The Company shipped 326 da Vinci Surgical Systems in the fourth quarter of 2020, compared with 336 systems in the fourth quarter of 2019. The fourth quarter 2020 system shipments included 120 systems shipped under operating lease and usage-based arrangements, compared with 126 systems in the fourth quarter of 2019.

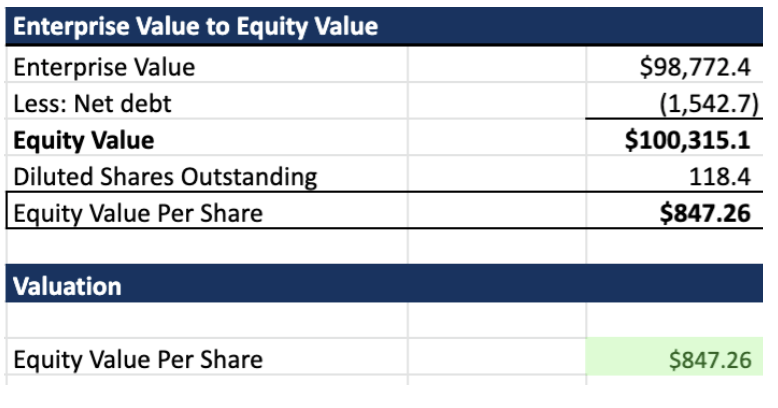

Recommendation – Buy

- Continuous innovation. For Over 20 years, da Vinci platforms have pioneered new capabilities in the OR, transforming the field of minimally invasive surgery. Through more than 5 million surgeries, Intuitive has become the proven leader in surgical robotics, increasing the adoption of minimally invasive surgery. And the innovation continues with a new generation of integrated systems and single port capabilities. they continue their commitment to designing minimally invasive solutions that reduce variability in surgery and help deliver better care.

- A connected and cohesive ecosystem. Surgical robotics means more than technology in an OR. Education and training for surgeons and staff is critically important for delivering quality surgical care. And support and analytics provide programmatic insights that can potentially help improve patient outcomes or cost of care.

- Innovation and integration. Through the systems, you can access an increasing variety of surgical procedures. Flexible, modular da Vinci systems feature a standard user experience that may help drive reproducible outcomes. With integration of their multi-faceted vision technologies, energy systems, stapling and instruments they’re continuing to invent new ways to help transform the surgical niche.

- Capital for reinvestment. Intuitive continues to introduce new innovations that enable even more types of procedures to be performing using robotic assistance.

- The Intuitive Foundation, which is, among other functions, the philanthropic arm of Intuitive, is spearheading the coordination of many of these efforts like donating PPE.

Suggested Articles: