Loose Ends

As with any young company, there are loose ends to tie up that affect value. In particular, I would point to the following:

a. Subsidized debt: Tesla was the beneficiary of subsidized loans from the DOE, amounting to roughly $465 million. While this loan loomed large two years ago, when Tesla was a smaller company with more default risk, it has faded in importance partly because of Tesla’s success (and the resulting access to capital markets). Since Tesla has been paying down the loan, it has little effect on value.

b. Net Operating Loss carry forward: At the end of 2012, Tesla had a net operating loss of just over a billion that it is carrying forward. I used the NOL to shelter income from taxes in the early forecast years, pushing up cash flows in those years. As a consequence, Tesla’s income is sheltered from taxes for the first six years of forecasts.

c. Management/Employee Options: Of larger import are the management/employee options that Tesla has been generous in granting in the last few years. As of the most recent 10K, the company had approximately 25 million options outstanding, with an average strike price of $21.20 and 7 years left to expiration. Since there only 121.45 million shares outstanding, the value of these deep in-the-money, long term options represents a significant drag on value.

The Bottom line

The ingredients that make a young, money-losing company into a valuable, mature company are no secret: small revenues have to become big revenues, operating losses have to turn to profits, there has to be enough reinvestment (but not too much) to make these changes and the risk has to subside. I am assuming all of these at Tesla but my estimated value per share of $67.12 is well below the market price of $168.76. You can download my valuation spreadsheet by clicking here.

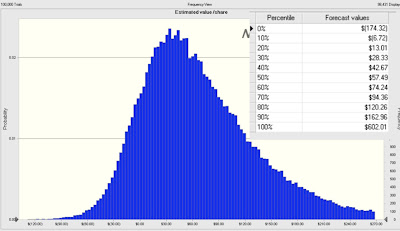

Is the value sensitive to my assumptions? Of course, and especially because Tesla is a young company in transition. In fact, replacing my point estimates for the input variables (revenue growth, target operating margin, sales/capital, cost of capital) with distributions yields a distribution of value for Tesla that reflects my uncertainty about the future:

Note that there are scenarios where the value per share exceeds the current market price ($168.76), but I would add two cautionary notes. First, at least based on my estimates, the probability that the value exceeds the price is small (less than 10%) Second, the combination of outcomes (high revenue growth, high margins and low risk) that would yield these high values are difficult to pull off.

You can accuse me of being too pessimistic in my assumptions, but the narrative that underlies my valuation is an optimistic one. I am assuming that Tesla Motors Inc (NASDAQ:TSLA) will grow to be as large as Audi, while delivering operating margins closer to Porsche’s. Even with these assumptions, I cannot see a rationale for buying the company at today’s market price but that is just my personal judgment. You are welcome to disagree. In fact, if you download my valuation and change the key assumptions, please take a minute to report your estimate of value per share in this Google shared spreadsheet. Let’s see how the crowd valuation plays out!