The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Valeritas Holdings, Inc. (NASDAQ:VLRX).

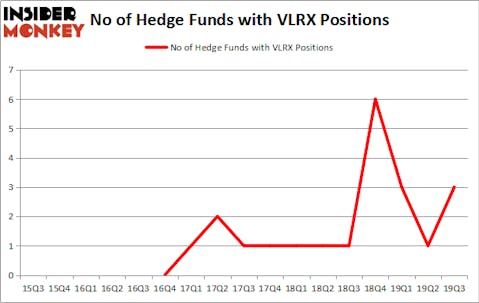

Valeritas Holdings, Inc. (NASDAQ:VLRX) investors should pay attention to an increase in hedge fund interest of late. Our calculations also showed that VLRX isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Ken Griffin of Citadel Investment Group

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a glance at the new hedge fund action regarding Valeritas Holdings, Inc. (NASDAQ:VLRX).

What have hedge funds been doing with Valeritas Holdings, Inc. (NASDAQ:VLRX)?

Heading into the fourth quarter of 2019, a total of 3 of the hedge funds tracked by Insider Monkey were long this stock, a change of 200% from the previous quarter. On the other hand, there were a total of 1 hedge funds with a bullish position in VLRX a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Steven Boyd’s Armistice Capital has the biggest position in Valeritas Holdings, Inc. (NASDAQ:VLRX), worth close to $1.5 million, corresponding to 0.1% of its total 13F portfolio. Coming in second is Alyeska Investment Group, led by Anand Parekh, holding a $0.5 million call position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors with similar optimism encompass Israel Englander’s Millennium Management, Ken Griffin’s Citadel Investment Group and . In terms of the portfolio weights assigned to each position Armistice Capital allocated the biggest weight to Valeritas Holdings, Inc. (NASDAQ:VLRX), around 0.1% of its portfolio. Alyeska Investment Group is also relatively very bullish on the stock, earmarking 0.01 percent of its 13F equity portfolio to VLRX.

As aggregate interest increased, some big names were leading the bulls’ herd. Millennium Management, managed by Israel Englander, established the most outsized position in Valeritas Holdings, Inc. (NASDAQ:VLRX). Millennium Management had $0.1 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $0 million investment in the stock during the quarter.

Let’s go over hedge fund activity in other stocks similar to Valeritas Holdings, Inc. (NASDAQ:VLRX). We will take a look at Aevi Genomic Medicine, Inc. (NASDAQ:GNMX), Jason Industries Inc (NASDAQ:JASN), Ameri Holdings, Inc. (NASDAQ:AMRH), and IZEA Worldwide, Inc. (NASDAQ:IZEA). This group of stocks’ market valuations resemble VLRX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GNMX | 3 | 402 | 0 |

| JASN | 4 | 2289 | -1 |

| AMRH | 1 | 33 | 0 |

| IZEA | 1 | 126 | -1 |

| Average | 2.25 | 713 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 2.25 hedge funds with bullish positions and the average amount invested in these stocks was $1 million. That figure was $2 million in VLRX’s case. Jason Industries Inc (NASDAQ:JASN) is the most popular stock in this table. On the other hand Ameri Holdings, Inc. (NASDAQ:AMRH) is the least popular one with only 1 bullish hedge fund positions. Valeritas Holdings, Inc. (NASDAQ:VLRX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Hedge funds were also right about betting on VLRX, though not to the same extent, as the stock returned 4.9% during the fourth quarter (through 11/22) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.