China sneezes and mining companies catch a long and damaging cold; this corruption of an old adage has never been more appropriate. The combination of a weak global economy and slowing Chinese demand for raw materials is punishing mining companies and forcing many to drastically revise future capex forecasts and jettison non-core assets. Vale SA (NYSE:VALE) is a case in point. And assuming that the Chinese economy does not return to the strong double-digit growth of the last decade (few if any analysts predict it to do so), the readjustment could be a long and painful one. Here’s one way to position your portfolio for China, though, that’s flying under the radar.

Vale is the second largest mining company in the world (after BHP Billiton Limited (NYSE:BHP)), the world’s largest producer of iron-ore and the world’s second largest producer of nickel. Vale’s shares have taken a sound beating over the past two years at the hands of economic weakness and is responding to falling demand by selling off non-core assets (of which it has many) and significantly scaling back planned capital expenditures for the foreseeable future.

Recent manufacturing data from China suggest that economic conditions in the country may be improving. Nevertheless, significant doubts remain about the resilience and sustainability of Chinese growth. Analysts have raised concerns about the proportion of GDP growth fueled by investment alone and the potentially dire consequences of severe imbalances in the distribution of resources in the Chinese economy.

The longer such imbalances continue, the more painful a long-run adjustment to appropriate levels of investment-GDP ratios will be for the country. But as long as the Chinese government can delay such an adjustment, the country will benefit from its disproportionately investment-driven growth model. Vale will also suffer from the long-run adjustment away from investment as a driver of economic growth and, also like China, benefits from short-term government support of investment demand.

The combination of slowing Chinese demand and broader global economic weakness sent iron ore prices plummeting to under $90/tonne over the summer, from highs of over $180/tonne in 2011. Prices have since recovered to around $110/tonne but are unlikely to return to the frothy highs of 2011 any time soon.

In the midst of macroeconomic uncertainty, Vale is confronting a shipping boondoggle, struggling to accommodate intransigent governments in China and Guinea, and grappling with underperforming operations in Brazil, Oceania, and Guinea. The company has taken heavy flak from a number of groups for its significant investment in a fleet of thirty-five massive iron ore carriers of between 380,000 and 400,000 deadweight tons each, each breaking the previous record for largest bulk carrier in the world, at a projected unit cost of at least $110 million.

Vale projected that operating its own fleet of so-called “Valemax” would save the company an estimated 20% to 25% on shipping costs and improve its ability to compete with iron ore produced by rivals Rio Tinto plc (NYSE:RIO) and BHP Billiton, both of which benefit from sourcing iron ore from mining operations much closer to China. However, Chinese authorities have banned the country’s ports from allowing the massive carriers to dock without explicit permission from the government, ostensibly due to safety concerns relating to the size of the ships.

More likely than not, the cited safety concerns are a thinly veiled protectionist gambit aimed at protecting Chinese shipping companies from the glut of capacity caused by the construction of the Valemax fleet. According to the CEO of BIMCO, the world’s largest shipowners’ group, the Vale fleet is expected to cause a vast overcapacity in the shipping market, displacing nearly 15% of the existing fleet of bulk carriers and pulling shipping rates down by as much as 35%.

In addition to its shipping problems, in Guinea, where Vale has poured much investment into a massive iron ore mine, the national government is waffling over financing restrictions, environmental regulations, and logistical plans for allowing the export of iron ore. Capex cutbacks have put a copper mine in Gambia and a pellet plant in Brazil on hold. The Goro copper mine in Oceania, purportedly the world’s largest, produced nothing in the third fiscal quarter as a result of processing problems. Oil and gas assets (once acquired to reduce fuel costs), a 22% stake in a Norwegian aluminum venture, and a majority stake in logistics company VLI SA are among many Vale assets currently on the auction block.

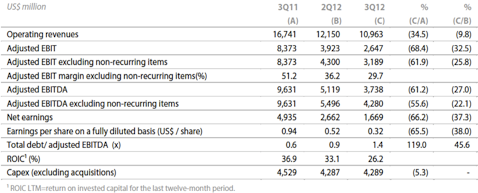

Vale’s recent quarterly results cannot be described as anything but dismal. Net sales fell 34 percent to $10.7 billion and adjusted EBITDA fell 62 percent to 3.74 billion reais. EBITDA margin fell from 59% to 39%. Vale’s realized price per metric ton of iron ore, which comprises about 90% of Vale’s profits, averaged $112.12, a decrease of 36% on one year earlier. Net earnings were US$ 1.7 billion in 3Q12, equal to US$ 0.32 per share. Net earnings fell 66% on one year earlier and 37% on the previous quarter.

Vale does have several major selling points that endear it to investors over such competitors as Rio Tinto, BHP Billiton, Fortescue (NASDAQOTH:FSUMF), Anglo-American (NASDAQOTH:AAUKY) and Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX).

First, the company is cheap based on prevailing valuation metrics. Vale trades under 9 times trailing twelve-month earnings compared to 13 and 25 for BHP and Rio, respectively. Unfortunately, this is probably a reflection of current weakness rather than a discounted share price. However, this may bode well for the company in the event of improving economic conditions and, considering BHP and Rio are largely plagued by the same macroeconomic woes and reactionary capex adjustments, it could be interpreted as a comparatively positive figure.

Second, Vale boasts a strong dividend; shares yield 3.3%. However, fissures in the company’s financial condition cast doubt on whether the company has the capacity and the will to maintain this payout level, especially in light of the substantial yield reductions earlier in 2012.

Finally, and most importantly, Vale ADR shares have bounced nicely of late and may indicate that the stock is gaining momentum on news of its strategy of readjustment and a rising iron ore price since its summer trough.

Vale’s best-case scenario would include a slow smooth adjustment of China’s growth model, away from investment and steady demand growth from other markets to offset slowing or even falling Chinese raw materials purchases. This would lend some measure of price stability in raw materials markets – especially in the market for iron ore – and allow Vale to adjust its once aggressive capex to reflect more modest demand forecasts. And Chinese flexibility on Valemax ships docking in the country would also be a great help. There are many “ifs” in this rosy scenario.

More likely, mining companies will be forced to adjust once heady expectations to conform to slowing demand mitigate the effects of rising extraction costs over at least a one or two year time horizon. A familiar wildcard will dictate the pace and duration of a readjustment of growth scenarios for mining companies: Chinese economic policy. Doubling down on investment-driven growth will lift mining shares sooner but may have an ultimately negative long-run impact. A commitment to re-balancing would have the opposite impact.

Vale shareholders, their company trading at basement valuation metrics and just beginning a recovery from internal missteps and low iron ore prices, could just be comparative winners among a great many losers in raw materials industries. Vale ADR shares have had a good run in the past 30 days and price strength looks set to continue. The completion of an adjustment to a new normal for Vale may just be beginning, but now may be the time for investors to take advantage of it.

In the hedge fund industry, some of Vale’s top supporters include Ken Fisher (+215%), Cliff Asness (+42%), and Steven Cohen (+1466%), who were all upping their stakes in the miner last quarter. Here’s a longer look at Ken Fisher’s portfolio, while Steven Cohen’s other top stock picks can be seen on SAC Capital’s profile page on Insider Monkey.