In the midst of macroeconomic uncertainty, Vale is confronting a shipping boondoggle, struggling to accommodate intransigent governments in China and Guinea, and grappling with underperforming operations in Brazil, Oceania, and Guinea. The company has taken heavy flak from a number of groups for its significant investment in a fleet of thirty-five massive iron ore carriers of between 380,000 and 400,000 deadweight tons each, each breaking the previous record for largest bulk carrier in the world, at a projected unit cost of at least $110 million.

Vale projected that operating its own fleet of so-called “Valemax” would save the company an estimated 20% to 25% on shipping costs and improve its ability to compete with iron ore produced by rivals Rio Tinto plc (NYSE:RIO) and BHP Billiton, both of which benefit from sourcing iron ore from mining operations much closer to China. However, Chinese authorities have banned the country’s ports from allowing the massive carriers to dock without explicit permission from the government, ostensibly due to safety concerns relating to the size of the ships.

More likely than not, the cited safety concerns are a thinly veiled protectionist gambit aimed at protecting Chinese shipping companies from the glut of capacity caused by the construction of the Valemax fleet. According to the CEO of BIMCO, the world’s largest shipowners’ group, the Vale fleet is expected to cause a vast overcapacity in the shipping market, displacing nearly 15% of the existing fleet of bulk carriers and pulling shipping rates down by as much as 35%.

In addition to its shipping problems, in Guinea, where Vale has poured much investment into a massive iron ore mine, the national government is waffling over financing restrictions, environmental regulations, and logistical plans for allowing the export of iron ore. Capex cutbacks have put a copper mine in Gambia and a pellet plant in Brazil on hold. The Goro copper mine in Oceania, purportedly the world’s largest, produced nothing in the third fiscal quarter as a result of processing problems. Oil and gas assets (once acquired to reduce fuel costs), a 22% stake in a Norwegian aluminum venture, and a majority stake in logistics company VLI SA are among many Vale assets currently on the auction block.

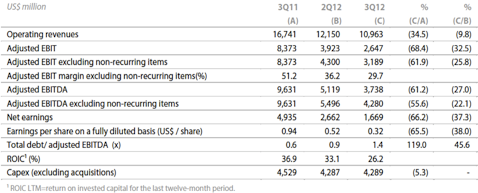

Vale’s recent quarterly results cannot be described as anything but dismal. Net sales fell 34 percent to $10.7 billion and adjusted EBITDA fell 62 percent to 3.74 billion reais. EBITDA margin fell from 59% to 39%. Vale’s realized price per metric ton of iron ore, which comprises about 90% of Vale’s profits, averaged $112.12, a decrease of 36% on one year earlier. Net earnings were US$ 1.7 billion in 3Q12, equal to US$ 0.32 per share. Net earnings fell 66% on one year earlier and 37% on the previous quarter.

Vale does have several major selling points that endear it to investors over such competitors as Rio Tinto, BHP Billiton, Fortescue (NASDAQOTH:FSUMF), Anglo-American (NASDAQOTH:AAUKY) and Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX).