Keeping this in mind, let’s analyze whether US Foods Holding Corp. (NYSE:USFD) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

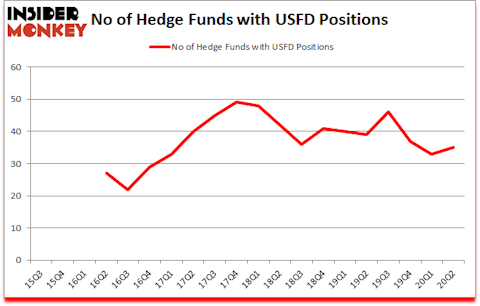

Is US Foods Holding Corp. (NYSE:USFD) a cheap investment today? The best stock pickers were buying. The number of bullish hedge fund bets increased by 2 lately. US Foods Holding Corp. (NYSE:USFD) was in 35 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 49. Our calculations also showed that USFD isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most traders, hedge funds are perceived as worthless, outdated financial tools of the past. While there are over 8000 funds with their doors open at the moment, Our researchers look at the bigwigs of this club, around 850 funds. These investment experts preside over most of all hedge funds’ total capital, and by shadowing their matchless investments, Insider Monkey has come up with a few investment strategies that have historically surpassed the market. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Our portfolio of short stocks lost 34% since February 2017 (through August 17th) even though the market was up 53% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

Ricky Sandler of Eminence Capital

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Last week, most investors overlooked a major development because of the presidential elections: Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 biggest telecom companies to identify fast growing companies in various industries. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Keeping this in mind let’s take a look at the key hedge fund action surrounding US Foods Holding Corp. (NYSE:USFD).

What have hedge funds been doing with US Foods Holding Corp. (NYSE:USFD)?

At Q2’s end, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from the first quarter of 2020. By comparison, 39 hedge funds held shares or bullish call options in USFD a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Eminence Capital was the largest shareholder of US Foods Holding Corp. (NYSE:USFD), with a stake worth $178.6 million reported as of the end of June. Trailing Eminence Capital was Sachem Head Capital, which amassed a stake valued at $88.7 million. D E Shaw, Two Sigma Advisors, and Citadel Investment Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Cloverdale Capital Management allocated the biggest weight to US Foods Holding Corp. (NYSE:USFD), around 8.22% of its 13F portfolio. Sachem Head Capital is also relatively very bullish on the stock, earmarking 6.32 percent of its 13F equity portfolio to USFD.

As one would reasonably expect, key hedge funds were breaking ground themselves. King Street Capital, managed by Brian J. Higgins, created the most valuable position in US Foods Holding Corp. (NYSE:USFD). King Street Capital had $31.6 million invested in the company at the end of the quarter. David Brown’s Hawk Ridge Management also initiated a $28.2 million position during the quarter. The following funds were also among the new USFD investors: Will Cook’s Sunriver Management, Traci Lerner’s Chescapmanager LLC, and Kamyar Khajavi’s MIK Capital.

Let’s go over hedge fund activity in other stocks similar to US Foods Holding Corp. (NYSE:USFD). These stocks are Devon Energy Corporation (NYSE:DVN), MAXIMUS, Inc. (NYSE:MMS), Nomad Foods Limited (NYSE:NOMD), Landstar System, Inc. (NASDAQ:LSTR), II-VI, Inc. (NASDAQ:IIVI), CAE, Inc. (NYSE:CAE), and Noble Energy, Inc. (NYSE:NBL). All of these stocks’ market caps match USFD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DVN | 45 | 403872 | 3 |

| MMS | 26 | 158400 | 0 |

| NOMD | 34 | 437867 | 0 |

| LSTR | 23 | 207278 | 1 |

| IIVI | 28 | 176363 | 8 |

| CAE | 14 | 106251 | -6 |

| NBL | 38 | 364034 | 3 |

| Average | 29.7 | 264866 | 1.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.7 hedge funds with bullish positions and the average amount invested in these stocks was $265 million. That figure was $562 million in USFD’s case. Devon Energy Corporation (NYSE:DVN) is the most popular stock in this table. On the other hand CAE, Inc. (NYSE:CAE) is the least popular one with only 14 bullish hedge fund positions. US Foods Holding Corp. (NYSE:USFD) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for USFD is 62.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and beat the market again by 20.1 percentage points. Unfortunately hedge funds that were betting on USFD were slightly disappointed as the stock returned 6% since the end of June (through 10/30) and underperformed the market. Things changed on a dime yesterday after Pfizer’s vaccine announcement though. Hedge funds betting on USFD were vindicated as the stock gained more than 30% in the last couple of days.

Follow Us Foods Holding Corp. (NYSE:USFD)

Follow Us Foods Holding Corp. (NYSE:USFD)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.