In this article we will take a look at whether hedge funds think US Foods Holding Corp. (NYSE:USFD) is a good investment right now. We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

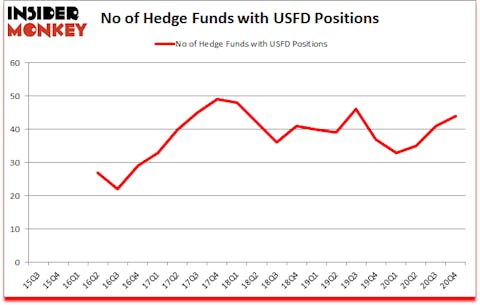

US Foods Holding Corp. (NYSE:USFD) shareholders have witnessed an increase in hedge fund sentiment in recent months. US Foods Holding Corp. (NYSE:USFD) was in 44 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 49. Our calculations also showed that USFD isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 124 percentage points since March 2017 (see the details here). We have been able to outperform the passive index funds by tracking the moves of corporate insiders and hedge funds, and we believe small investors can benefit a lot from reading hedge fund investor letters and 13F filings.

Ricky Sandler of Eminence Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s check out the fresh hedge fund action regarding US Foods Holding Corp. (NYSE:USFD).

Do Hedge Funds Think USFD Is A Good Stock To Buy Now?

At the end of December, a total of 44 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from the previous quarter. By comparison, 37 hedge funds held shares or bullish call options in USFD a year ago. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Leonard Green & Partners, managed by Leonard Green, holds the number one position in US Foods Holding Corp. (NYSE:USFD). Leonard Green & Partners has a $366.4 million position in the stock, comprising 5.1% of its 13F portfolio. On Leonard Green & Partners’s heels is Sachem Head Capital, led by Scott Ferguson, holding a $166.6 million position; the fund has 5.8% of its 13F portfolio invested in the stock. Remaining peers with similar optimism encompass Ricky Sandler’s Eminence Capital, Robert Boucai’s Newbrook Capital Advisors and Benjamin Pass’s TOMS Capital. In terms of the portfolio weights assigned to each position Clearfield Capital allocated the biggest weight to US Foods Holding Corp. (NYSE:USFD), around 10.25% of its 13F portfolio. Dendur Capital is also relatively very bullish on the stock, setting aside 6.75 percent of its 13F equity portfolio to USFD.

As aggregate interest increased, specific money managers have been driving this bullishness. Newbrook Capital Advisors, managed by Robert Boucai, initiated the largest position in US Foods Holding Corp. (NYSE:USFD). Newbrook Capital Advisors had $81.3 million invested in the company at the end of the quarter. Benjamin Pass’s TOMS Capital also initiated a $58.7 million position during the quarter. The other funds with brand new USFD positions are Malcolm Levine’s Dendur Capital, Joseph Samuels’s Islet Management, and Christopher Pucillo’s Solus Alternative Asset Management.

Let’s check out hedge fund activity in other stocks similar to US Foods Holding Corp. (NYSE:USFD). We will take a look at Arrow Electronics, Inc. (NYSE:ARW), Allakos Inc. (NASDAQ:ALLK), argenx SE (NASDAQ:ARGX), UGI Corp (NYSE:UGI), Under Armour Inc (NYSE:UA), Pan American Silver Corp. (NASDAQ:PAAS), and Signature Bank (NASDAQ:SBNY). This group of stocks’ market caps match USFD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARW | 27 | 764402 | -1 |

| ALLK | 11 | 558097 | 2 |

| ARGX | 22 | 1363063 | 0 |

| UGI | 25 | 181156 | 2 |

| UA | 47 | 1451753 | -1 |

| PAAS | 27 | 466677 | -1 |

| SBNY | 28 | 571010 | -7 |

| Average | 26.7 | 765165 | -0.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.7 hedge funds with bullish positions and the average amount invested in these stocks was $765 million. That figure was $1243 million in USFD’s case. Under Armour Inc (NYSE:UA) is the most popular stock in this table. On the other hand Allakos Inc. (NASDAQ:ALLK) is the least popular one with only 11 bullish hedge fund positions. US Foods Holding Corp. (NYSE:USFD) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for USFD is 80.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 90.7% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 35 percentage points. These stocks gained 13.6% in 2021 through April 30th and still beat the market by 1.6 percentage points. Hedge funds were also right about betting on USFD as the stock returned 24.5% since the end of Q4 (through 4/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Us Foods Holding Corp. (NYSE:USFD)

Follow Us Foods Holding Corp. (NYSE:USFD)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.