The first quarter earnings season for retail has certainly been a bit of a mixed bag. Two of the largest retailers in the US, Wal-Mart Stores, Inc. (NYSE:WMT) and Target Corporation (NYSE:TGT), reported negative same-store sales revealing cautious spending patterns from American consumers. On the other hand, home improvement giant The Home Depot, Inc. (NYSE:HD) registered wonderful sales gains as the firm continues to ride the housing recovery. Let’s take a look at the results of some retailers leveraged to discretionary income.

Urban Outfitters, Inc. (NASDAQ:URBN)

Urban Outfitters, Inc. (NASDAQ:URBN) posted a solid first quarter, even though its revenue was slightly lighter than expected. Revenue rose 14% year-over-year to $648 million, driving earnings growth of 39% to $0.32 per share. A 120 basis point increase in the firm’s gross margin coupled with 80 basis points of fixed cost leveraging helped increase operating margins 200 basis points compared to the same period a year ago (to 11.2%).

Retail comparable store growth was fantastic, with a 9% aggregate comp growth rate during the period. Flagship Urban Outfitters, Inc. (NASDAQ:URBN)’ retail comp sales were up 6%, while home decorum brand Anthropologie’s comp sales were up 8%. While we at Valuentum like both brands, particularly Anthropologie as the housing market recovers, Free People is doing incredibly well, as comp sales at the brand rose 44% year-over-year. Free People is well-differentiated from the other brands, in our view, and its styles won the hearts of women during the spring season.

Although fashion retailing can be a fickle business, we think the brand has a lot of momentum behind it at the moment, and we see little signs of it slowing. With a number of potential product expansions, we’re optimistic that Free People could be a long-term growth driver for the company.

Although we’re seeing Urban Outfitters, Inc. (NASDAQ:URBN) make a comeback led by increasing success in e-commerce, stronger margins at Anthropologie, and great potential at Free People, we don’t think shares look attractive at current prices.

The TJX Companies, Inc. (NYSE:TJX)

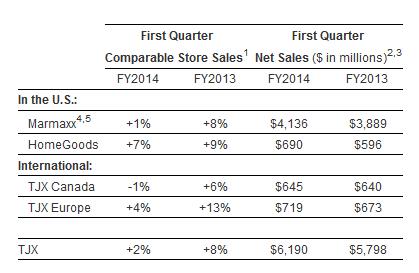

The parent of popular stores TJ Maxx, Marshall’s and HomeGoods, The TJX Companies, Inc. (NYSE:TJX) remains one of the greatest retail businesses in Valuentum’s coverage universe. The firm reported results for its fiscal year 2014 first quarter, with sales growing 7% year-over-year to $6.2 billion and earnings per share 13% year-over-year to $0.62.

Source: TJX

Same-store sales were actually somewhat weak during the quarter, increasing only 2% year-over-year. As with practically every other apparel retailer, management blamed the weak growth at Marmaxx (Marshall’s/TJ Maxx) on weather and tough comparisons.

We don’t disagree, particularly with the fact that comparisons were incredibly difficult, and we think this short blip could simply push sales into the second quarter. HomeGoods continues to ride the housing wave that helped Home Depot and Urban Outfitters. We could see this segment really take off with an increase in household formation. Europe was also a bright spot for the company—highlighting the resiliency of the off-priced business model.

We were happy to see the company address e-commerce, which currently contributes little, if anything, to the top line. We’ve mentioned several times that we think The TJX Companies, Inc. (NYSE:TJX)’s business model is somewhat immune to the same online pressures faced by other retailers since it sells an experience, but we appreciated CEO Carol Meyrowitz’s comments:

“We see e-commerce as another platform to reach and introduce our great values to the approximately 75% of U.S. shoppers who do not shop T.J. Maxx and Marshalls today. Whether brick-and-mortar, e-commerce or mobile, our goal is to reach an extremely wide customer demographic with our values. While we have e-commerce expenses reflected in our plans, we have only a little top line benefit assumed in the near- and long-term expectations at this time.”

Again, valuation is our main issue with the company. While we think its business model is superb, The TJX Companies, Inc. (NYSE:TJX) trades at the high end of our fair value range. Therefore, the risk/reward simply isn’t compelling enough to warrant a position in the portfolio of Valuentum’s Best Ideas Newsletter.

Nordstrom, Inc. (NYSE:JWN)

On a higher end than both The TJX Companies, Inc. (NYSE:TJX) and Urban Outfitters, Inc. (NASDAQ:URBN), department store Nordstrom, Inc. (NYSE:JWN) reported relatively weak first quarter results. Though revenue was 5% higher than a year ago at $2.7 billion and earnings per share were 4% higher at $0.73, both numbers fell short of consensus estimates.

Same-store sales for the company were decent, registering 3.1% for the quarter. However, performance at its brick-and-mortar locations weren’t so strong. Full-line same-store sales were flat and sales at the usually steady Nordstrom, Inc. (NYSE:JWN) Rack were up just 0.8%.

Naturally, weather was a component of the problem, but we think one of the other issues is industry promotional behavior. With competitors like J. Crew, Madewell, and even Macy’s constantly running promotions, we think the company might be having a hard time attracting customers at its higher price points. As for the Rack, we think the business will recover in the coming quarters.

Looking ahead, the firm slightly reduced its full-year sales growth outlook range to 4%-6% from 4.5%-6.5%, but kept its full-year earnings guidance of $3.65-$3.80. Although we like the long-term trajectory of the Rack business, we think Nordstrom, Inc. (NYSE:JWN)’s aspirational price level could experience a slump after performing exceptionally well for the past few years. Thus, we’ll remain on the sidelines for now.

The article Mixed Results From Retail’s Best originally appeared on Fool.com and is written by RJ Towner.

RJ Towner has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. RJ is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.