Upslope Capital Management, an investment management firm, released its second-quarter 2024 investor letter. The firm had a promising start in Q2 but ended with difficulties. A copy of the letter can be downloaded here. There was macro and geopolitical uncertainty, and markets were expensive. These have usually been in favor of Upslope’s strategy. The fund returned -2.6% (net) in Q2 compared to -3.5 % and +1.7% for the S&P Midcap 400 ETF (MDY) and HFRX Equity Hedge Index, respectively. YTD, the fund’s return was +2.8% (net) compared to +6.1% and +5.1% returns, respectively, for the indexes. In addition, you can check the fund’s top 5 holdings to determine its best picks for 2024.

Upslope Capital Management highlighted stocks like Ball Corporation (NYSE:BALL), in the second quarter 2024 investor letter. Ball Corporation (NYSE:BALL) is an aluminum packaging products supplier for the beverage, personal care, and household products industries. The one-month return of Ball Corporation (NYSE:BALL) was 2.47%, and its shares gained 7.82% of their value over the last 52 weeks. On July 17, 2024, Ball Corporation (NYSE:BALL) stock closed at $61.92 per share with a market capitalization of $19.219 billion.

Upslope Capital Management stated the following regarding Ball Corporation (NYSE:BALL) in its Q2 2024 investor letter:

“The Fund exited Ball Corporation (NYSE:BALL) (BALL, leading beverage can producer), Tecan (TECN-SWX, lab automation and liquid handling) and CACI International (CACI, defense/government IT contractor). Each of the three sales was for a different reason. For Ball, it was due to partial thesis realization and disappointment with management’s recent investor day communication (in particular, the flippant discussion about the company’s storied EVA/ROIC framework).”

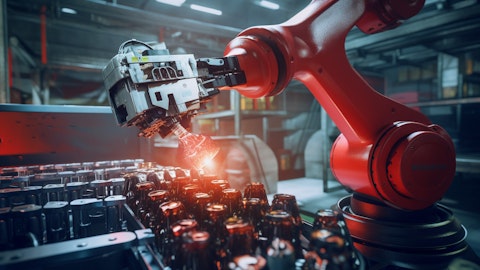

A high-speed robotic arm carefully packing aluminum cans into a cardboard carton.

Ball Corporation (NYSE:BALL) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 29 hedge fund portfolios held Ball Corporation (NYSE:BALL) at the end of the first quarter which was 28 in the previous quarter. In the first quarter 2024, Ball Corporation’s (NYSE:BALL) comparable diluted earnings per share was $0.68 compared to $0.69 in Q1 2023. While we acknowledge the potential of Ball Corporation (NYSE:BALL) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Ball Corporation (NYSE:BALL) and shared the list of stocks democrats and corporate insiders are buying. In addition, please check out our hedge fund investor letters Q2 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.