Recently, Elliott Management, under billionaire Paul Singer’s leadership, has been more active in Hess Corp. (NYSE: HES). Elliott said that it would nominate five executives to the board to push for restructuring. Elliott, which manages $21.5 billion in assets, has taken a 4% stake in Hess. The investment in Hess could be considered the largest initial investment in Elliott’s history. Elliott mentioned that if Hess did what Elliott said, Hess would be worth $126 per share, more than twice the current trading price of $62.50 per share. Should investors follow Elliott into Hess? Let’s find out.

Business Snapshot

Hess, incorporated in 1920, is a global energy company operating in many countries such as Algeria, Australia, Denmark, Egypt, France, and Ghana. The company’s total proved reserves were estimated to be more than 1.57 billion BOE. The majority of revenue, $19.46 billion, or 50.6% of the total revenue, was generated from refined petroleum products. Crude oil and natural liquids were the second biggest revenue contributor, generating $9 billion in 2011 revenue. Hess has a high insider ownership level. John Hess, the Chairman and CEO, owns a 10.6% stake in the company. Nicholas Brady, the lead independent director, holds 5.57% of the total voting shares, while Thomas Kean, the independent director, is the owner of 7.43% stake.

Hess Owns Great Assets But Still Underperforms

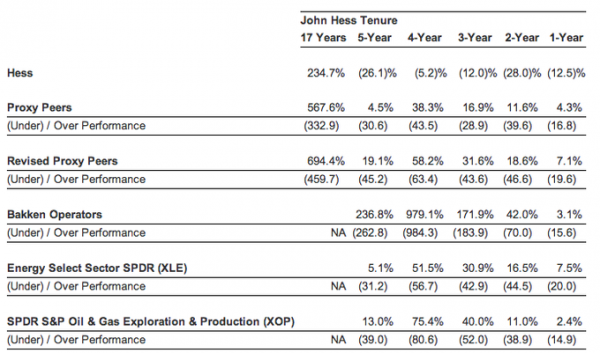

At the end of January, Elliott revealed its intention to buy an additional $800 million worth of shares of Hess, as Elliott thought Hess might gain substantial value after restructuring. In a letter to Hess’s shareholders, Elliott highlighted that over the last 17 years, Hess has been underperforming its peers. Under John Hess leadership Hess gained nearly 235%, while its peers have gained more than 567%. In the last 5 years, Bakken operators have returned 236.8%, whereas Hess delivered a loss of 26.1%. It has also underperformed SPDR S&P Oil & Gas Exploration and Production by 39%.

Source: Elliott’s letter to Hess’s shareholders

Elliott also said that the company’s board had the lowest independence rate. In addition, the independent directors of the company had no experience in the oil/gas industry. The majority of board members had personal and financial relationships with the Hess family. Thus, the independence in the board was questionable. However, Hess has very valuable oil/gas assets. Hess has around 900,000 net acres in the Bakken oil shale play in North Dakota. Hess’ Bakken asset has a higher per acre value than Continental Resources, Inc. (NYSE: CLR) and Oasis Petroleum Inc. (NYSE: OAS). Continental Resources is considered the biggest leaseholder in Bakken oil deposit with more than 1.1 million net acres, while Oasis has more than 300,000 acres. According to Von Gonten, a leader in petroleum engineering and geological service, the total value of Hess’s Bakken acreage was equivalent to the total value of Continental’s Bakken acres. In addition to the Bakken play, the value of Eagle Ford and Utica acreage are quite valuable. Furthermore, Hess holds significant interests in several “crown jewel” long life assets in the North Sea, Southeast Asia, Africa, and the Gulf of Mexico.

Three Steps to Unlock Hidden Asset Values

In order to unlock Hess’s potential hidden asset values, Elliott recommended three things. First, the company should spin off the Bakken, Eagle Ford, and Utica acreage. The spin off is estimated to create over $28 per share of additional value for Hess. Second, Hess should divest the downstream assets and monetize its midstream assets through MLP or REIT structures to release up to $5.5 billion of capital that could be returned to shareholders. This transaction could bring an additional value of $11 per share to shareholders. Last but not least, Hess was recommended to streamline the remaining international portfolio. The spinoff, downstream divestment, and midstream monetization would leave Hess International with many valuable long life oil assets globally. If Hess was valued at a similar valuation to its peers, more than $36 per share of additional value would be created for Hess’s shareholders. Thus, all three steps would bring total more than $76 per share of additional value, a 150% upside on the current share price.

Peer Comparison

Indeed, Hess has a much cheaper valuation compared to its peers, including Continental and Oasis. Hess’s enterprise value is $30.25 billion. The market is valuing Hess at 3.76x EV/EBITDA. At $83.70 per share, Continental has the most expensive valuation, with 12.37x EV/EBITDA. Oasis is trading at $37.05 per share, with the enterprise value of $4.1 billion. It is valued at 10.6x EV/EBITDA. Among the three, Oasis and Continental are not paying any dividends, while Hess is paying 0.6% dividend yield.

Foolish Bottom Line

Personally, I think Hess is quite undervalued compared to the values of its assets. However, it might take a long time for the company to unlock its hidden values. I would rather wait to see any further corporate developments before initiating a long position in this company.

The article Unlock Hess’ Hidden Asset Value originally appeared on Fool.com and is written by Anh HOANG.