World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

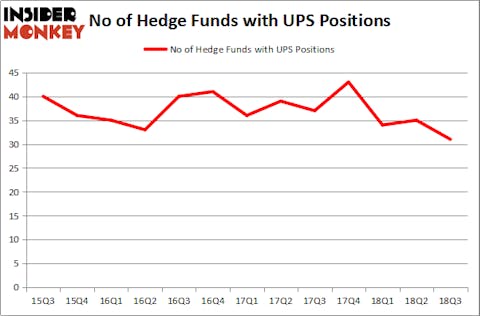

United Parcel Service, Inc. (NYSE:UPS) was in 31 hedge funds’ portfolios at the end of the third quarter of 2018. UPS investors should be aware of a decrease in enthusiasm from smart money lately. There were 35 hedge funds in our database with UPS positions at the end of the previous quarter. Our calculations also showed that UPS isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are several signals investors have at their disposal to value publicly traded companies. Two of the less utilized signals are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the top picks of the top hedge fund managers can beat the broader indices by a solid margin (see the details here).

We’re going to view the key hedge fund action regarding United Parcel Service, Inc. (NYSE:UPS).

Hedge fund activity in United Parcel Service, Inc. (NYSE:UPS)

At Q3’s end, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -11% from the second quarter of 2018. On the other hand, there were a total of 43 hedge funds with a bullish position in UPS at the beginning of this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

Among these funds, Eagle Capital Management held the most valuable stake in United Parcel Service, Inc. (NYSE:UPS), which was worth $588.2 million at the end of the third quarter. On the second spot was Bill & Melinda Gates Foundation Trust which amassed $528.3 million worth of shares. Moreover, Two Sigma Advisors, Southpoint Capital Advisors, and Citadel Investment Group were also bullish on United Parcel Service, Inc. (NYSE:UPS), allocating a large percentage of their portfolios to this stock.

Since United Parcel Service, Inc. (NYSE:UPS) has experienced falling interest from the entirety of the hedge funds we track, it’s easy to see that there lies a certain “tier” of hedge funds who were dropping their positions entirely in the third quarter. It’s worth mentioning that Steve Cohen’s Point72 Asset Management said goodbye to the biggest position of the 700 funds tracked by Insider Monkey, totaling close to $61.6 million in stock, and Dmitry Balyasny’s Balyasny Asset Management was right behind this move, as the fund dumped about $34 million worth. These transactions are interesting, as aggregate hedge fund interest fell by 4 funds in the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as United Parcel Service, Inc. (NYSE:UPS) but similarly valued. These stocks are AstraZeneca plc (NYSE:AZN), Gilead Sciences, Inc. (NASDAQ:GILD), GlaxoSmithKline plc (NYSE:GSK), and Lockheed Martin Corporation (NYSE:LMT). All of these stocks’ market caps are similar to UPS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AZN | 26 | 1239121 | 3 |

| GILD | 56 | 3046981 | -1 |

| GSK | 24 | 1444760 | 3 |

| LMT | 36 | 2016945 | 3 |

| Average | 35.5 | 1936952 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.5 hedge funds with bullish positions and the average amount invested in these stocks was $1.94 billion. That figure was $1.91 billion in UPS’s case. Gilead Sciences, Inc. (NASDAQ:GILD) is the most popular stock in this table. On the other hand GlaxoSmithKline plc (NYSE:GSK) is the least popular one with only 24 bullish hedge fund positions. United Parcel Service, Inc. (NYSE:UPS) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard GILD might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.