As investors, we try to get in on trends while they are still young, as this one is. We also look for companies that are well-diversified, fiscally sound, and have lots of growth potential. This is why my favorite way to ride the healthy lifestyle trend is with United Natural Foods, Inc. (NASDAQ:UNFI), the leading U.S. distributor of natural and organic foods.

What the Company Does

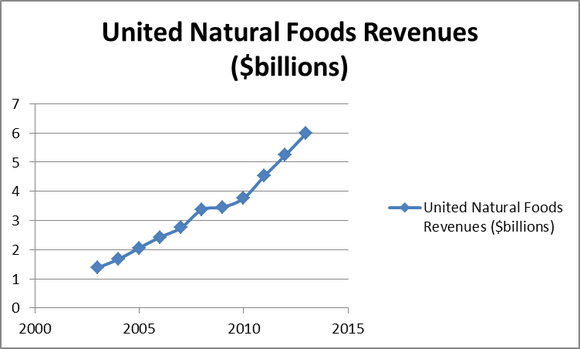

United Natural Foods, Inc. (NASDAQ:UNFI) distributes natural and organic products, including grocery items, produce, frozen food, supplements, personal care items, and more. The company has done very well as a result of expanding their number of suppliers and increasing their distribution capacity, as shown in the company’s 10-year revenue growth chart:

As I mentioned earlier, one of the things I love to see in potential long-term investments is diversification of the business. This way, if one part of their revenue stream goes bad, the overall bottom line is not severely impacted. United Natural Foods, Inc. (NASDAQ:UNFI) is diversified in terms of both suppliers and customers. As of last June, the company purchased products to distribute from around 4,800 different suppliers, the largest of which accounts for just 6% of all supplies. The company also serves over 23,000 customer locations, which are almost perfectly split between independent retailers (35%), natural food chains (36%), and conventional supermarkets and other stores (29%).

Whole Foods Market, Inc. (NASDAQ:WFM), the largest chain of health food stores is by far the biggest customer of United Natural Foods, accounting for 36% of sales, or the entire natural food chains portion of their business. While this does mean that more of their business is dependent on one customer, their agreement with Whole Foods Market, Inc. (NASDAQ:WFM), which was originally set to expire this year, has been extended until September 2020. If the growth of Whole Foods Market, Inc. (NASDAQ:WFM) is any indication, this should greatly benefit United Natural Foods, Inc. (NASDAQ:UNFI)’ bottom line for years to come.

The Numbers

With very strong growth projected over the next several years, United Natural Foods, Inc. (NASDAQ:UNFI) trades at a premium valuation of about 27 times last year’s earnings. The company is expected to earn $2.19 per share this year, and then $2.48 and $2.81 in 2014 and 2015, respectively. This translates to an average annual earnings growth rate of just over 13%, which justifies the premium. If the revenue growth chart is any indication, these projections look rather modest.