United Microelectronics Corporation (NYSE:UMC) Q4 2023 Earnings Call Transcript January 31, 2024

United Microelectronics Corporation beats earnings expectations. Reported EPS is $0.17, expectations were $0.15. UMC isn’t one of the 30 most popular stocks among hedge funds at the end of the third quarter (see the details here).

Operator: Welcome, everyone, to UMC’s 2023 Fourth Quarter Earnings Conference Call. [Operator Instructions]. For your information, this conference call is now being broadcasted live over the Internet. Webcast replay will be available within an hour after the conference is finished. Please visit our website, www.umc.com, under the Investor Relations, Investors Events section. Now I would like to introduce Mr. Michael Lin, Head of Investor Relations at UMC. Mr. Lin, please begin.

Michael Lin: Thank you, and welcome to UMC’s conference call for the fourth quarter of 2023. I am joined by Mr. Jason Wang, President of UMC; and Mr. Chi-Tung Liu, the CFO of UMC. In a moment, we will hear our CFO present the fourth quarter financial results, followed by our President’s key message to address UMC’s focus and the first quarter of 2024 guidance. Once our President and CFO complete their remarks, there will be a Q&A section. UMC’s quarterly financial reports are available at our website, www.umc.com, under the Investors Financial section. During this conference, we may make forward-looking statements based on management’s current expectations and beliefs. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially, including the risk that may be beyond the company’s control.

For a more detailed description of these risks and uncertainties, please refer to our recent and subsequent filings with the SEC and the ROC security authorities. During this conference, you may view our financial presentation material, which is being broadcast live through the Internet. Now, I would like to introduce UMC’s CFO, Mr. Chi-Tung Liu, to discuss UMC’s fourth quarter 2023 financial results.

Chi-Tung Liu: Thank you, Michael. I would like to go through the 4Q 2023 investor conference presentation material, which can be downloaded or viewed in real-time from our website. Starting on Page 4. The fourth quarter of 2023, consolidated revenue was NT54.96 billion with gross margin at 32.4%. Net income attributable to the stockholder of the parent was NT13.2 billion. Earnings ordinary shares were NT1.06 in Q4 2023. On Page 5, this is the sequential performance. Revenue declined 3.7% quarter-over-quarter to NT54.9 billion. Gross margin rate dropped roughly 3.5 percentage point to 32.4% or NT17.8 billion, with a net non-operating income of NT2.22 billion, the net income come to NT13.19 billion or EPS of NT1.06. This is compared to NT1.29 in the previous quarter of 2023.

For year-over-year comparison on Page 6. Revenue declined roughly by 20% year-over-year to NT222 billion. This is largely due to the lower capacity utilization rate as our wafer shipment declined roughly 27% year-over-year from 2022 to 2023. Gross margin rate as a result declined from 45.1% in 2022 to 34.9% in 2023. Overall, net earnings in 2023 was NT50.99 or close to NT61 billion. Net income rate was 27.4%, compared to 31.3% in the year of 2022. EPS as a result is NT4.93 million in 2023, compared to NT7.09 in 2022. On Page 7. Our cash on hand is still around NT132 billion and total equity of the company has come to NT359.5 billion. Book value per share is close to NT29 per share at the end of 2023. On Page 8, starting from 2024, we have changed our ASP unit as well as capacity unit to 12 inches and 12 inches equivalent to express the ASP number as well as the capacity number.

For the past five quarters, as you can see the trend chart here, the first three quarters was edging up and the last quarter was relatively firm on a 12 inches wafer equivalent ASP trend. On Page 9, for the revenue breakdown by geography, Asia is getting a little bit bigger to 62% of our total revenue, when North America is above 23% of our total revenue. For year-over-year comparison on Page 10, Asia actually declined from 51% in 2022 to 57% in 2023 and the rest of the three main regions didn’t change much. On Page 11, IDM continued to increase HF to 22% and Fabless is around 78% in Q4 of 2023. On our year-over-year comparison on Page 12, the increase in IDM is more notable from 15% in 2022 to 2023 of 22%. In terms of application breakdown on Page 13, communication remained the biggest of 47% and the spread among different applications didn’t change much quarter-over-quarter.

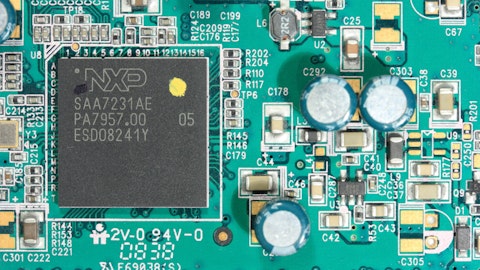

As far year-over-year change, computer declined from 15% in 2022 to 11% in 2023. And we continue to see bigger exposure to other segment, which is mostly Automotive and Industrial, around 20%, compared to 14% in the previous year. For technology breakdown, we are happy to see that, revenue come from 40 nanometer and below now represent 50% of our total revenue, and this is compared to about 45% in the previous quarter. And 22 and 28 is our largest share of revenue around 36% in the Q4 of 2023. For the full-year numbers, the trend is also similar. We see the 22, 28 revenue of 31% compared to 24% in the previous year. On Page 17, as I mentioned earlier, the unit of capacity wafer also changed to 12 inches equivalent. Right now, our quarterly available capacity is a bit over NT1.2 million a quarter in terms of 12 inches equivalent capacity, and we will continue to see some minor increase out of our 12 inch capacity given our P6 expansion is continuing.

On the last page of my presentation, CapEx for 2024 is currently budget at $3.3 billion with majority of that over 95% close to 12 inches capacity expansion in both Tainan and also Singapore. The above is a summary of UMC’s results for Q4 2023. More details are available in the report, which has been posted on our website. I will now turn the call over to President of UMC, Mr. Jason Wang.

Jason Wang: Thank you, Chi-Tung. Good evening, everyone. Here, I would like to share UMC’s fourth quarter results. In the fourth quarter, challenging macroeconomic conditions continue to prolong the inventory correction in the semiconductor industry, as our wafer shipment decreased 2.5% quarter-over-quarter, while overall fab utilization rate slightly fell to 66%. As our Tainan 1286 facility continues to ramp, our 22/28 nanometer represented 36% of our Q4 wafer revenue, reflecting record high in revenue as well as percentage of the wafer sales. Overall, 2023 was a year, where UMC demonstrated its financial resilience in face of challenging external environment, we were able to achieve yearly 34.9% gross margin despite the utilization rates significantly in 2023 This resilience can be attributed to our relentless pursuit of technology innovation differentiation, customer synergy and stickiness enhancement and manufacturing quality excellent and cost reductions.

As a result, we have improved our product mix and customer portfolio, which led ASP by single-digit in 2023. Looking into the first quarter of 2024, we anticipate overall wafer demand will increase mildly. However, customer maintains a cautious approach in their inventory management. Moving forward, UMC will continue to navigate headwinds amid an increasing competitive landscape and swallowing geopolitical tensions. We have diversified the manufacturing base and differentiation in 12 inches specialty technologies. Our 12 nanometer FinFET collaboration is a step forward in advancing our strategy of pursuing cost-efficient capacity expansion and technology, no advancement in continuing our commitment to customers. This effort will enable our customer to smoothly migrate to this critical new note, and also benefit from a resiliency of an added Western footprint.

We anticipate 12 nanometer FinTech Cooperation will broaden our addressable market and significantly accelerate our development roadmap. Now let’s move on to first quarter 2024 guidance. Our wafer shipments will increase by 2% to 3%. ASP in U.S. dollars will decrease by 5%. Gross margins will be approximately 30%. Capacity utilization rate will be in the low 60% range. Our 2024 cash base CapEx will be budgeted at $3.3 billion. That concludes my comments. Thank you all for your attention. Now we are ready for questions.

See also 30 Best Cardiology Hospitals In the US and 20 Most Corrupt Countries in Asia.

Q&A Session

Follow United Microelectronics Corp (NYSE:UMC)

Follow United Microelectronics Corp (NYSE:UMC)

Receive real-time insider trading and news alerts

Operator: Thank you, President, Wang. [Operator Instructions]. Now the first question will be coming from Randy Abrams, UBS.

Randy Abrams : I wanted to ask the first question probably multi-part, because wanted to get a few more details on the Intel partnership, which looks like a big move in a new direction. A few — maybe I’ll run off the questions we had. First if you could discuss funding of the CapEx, and then if there’s any IP or NRU [ph 0:13:59.0] proceeds that UMC would get by supplying the technology. I’ll start with those. I have a few follow up.

Jason Wang : Well, I mean for the 12 nanometer collaboration with Intel. On the funding side, the development cost for collaboration will be shared mutually, and they are some use equipment will significantly reduce the upfront investment for both parties for this cooperation. So, there’s not much more to discuss in detail for the funding part. This cooperation will result positive impact to our P&L and once the volume ramps up, and the profit will be recognized at the time.

Randy Abrams : Okay. So, it sounds like no, there’s no process transfer because it’s a co-development. You’ll co-fund it in R&D. And then as it ramps, how’s the sales approach? Would it be each company respectively sells to their respective customer base that offering and would it be the same offering or you would focus on different parts of the market?

Jason Wang : Well, I mean this — well, the first of all, the 12 nanometer address the gap in the no portfolio for both parties. This 12 nanometer is the offering that expanding our product offering. And we will be serving our customer and this will be a vertical cooperation between us and Intel.

Chi-Tung Liu : If I’m head on to that, basically, you can see this is extension of our technology offering to our existing customer and potential customers. Coming from 2022, down 14 and certainly this technology roadmap will be perceived as a continuous advancement for a lot of UMC-based customers and potential customers.

Randy Abrams: A question on the timeline, I think previously you were talking about freezing the process in early 2025 and then a year to go into volume from that initial freezing. The timeline was listed as ’27. I guess, two questions. Would you still do a process in your existing Asian fabs or is this a new focus and would the timeline push out or could you try to pull that development timeline in?

Jason Wang: I mean, from our original milestone, we targeted to have the process ready by 2025, as reported in the past. And now, while we joined developers to complete this development, we will follow that timeline from PDK readiness, on a customer engagement to the production ramp, this still going to be a year-and-a-half on that. Now we put it to expecting shipment, I mean the production will begin at 2027. In the meantime, we will align with our customer and to finalize the final ramp schedule.

Randy Abrams: Okay. Probably just sorry, so many on this one. The last one I just have on this topic, the cost of product, would it be considered as an Intel fab, so you’d be paying a foundry fee, like, they are manufacturing it on their line or would you have operators. How do you handle the transfer pricing, if the cost structure is not there or how much control do you have on the process?

Jason Wang: I mean, there is a comprehensive collaboration details that I’m not be able to elaborate it here. As a result, like I said, the result will be a positive impact to our P&L based on collaboration agreements.

Randy Abrams: Okay. It looks like an asset light way to do it versus at least building, I think the original plan, if you would build a line to do FinFET in one of the other fabs, if this is the approach.

Jason Wang: Right. This is truly just a commercial cooperation. The party will be able to share the cost, while leveraging the expertise. We believe this will be a good way to leverage the synergy on both party tend to accelerate to this market.

Randy Abrams: Okay. I know it was a multi part. I will just ask one other question. If you could talk about, just on the pricing with the first quarter, it was a 5% ASP decline. Could you talk how much is a mix, like, the tech migration is moving very aggressively to 28. Is there a shift in mix involved or how much is like-for-like pricing? Just after that, because there are more concerns about the mature node, the 8 inches ongoing pressure, should we view it as a one-time reset on pricing or do you expect we may start getting into as long as the fabs aren’t full and there is competition, mild price erosion? Like, how do you see it, from I think first the mix versus pricing and then from the first quarter level, how you see pricing environment?

Jason Wang: Maybe I’ll start off. First of all, there is no change in our pricing strategy, which is respect to the foundry market, the Q1 ASP guidance included annual one-off pricing adjustment of 2024 as well as the change in product mix. Nevertheless, I mean, UMC is being fully aware of the market dynamics and the competition situation. And we will support our customer and we will closely be monitoring the market, align with them, and on appropriate pricing position to safeguard and protect UMC towards our customers rather than market share. We will only support our customer in order to maintain or increase their market share in selected market segment. We have no intention to fall into a price war, often reflected in a commodity market.