So in that our solution will offer to enable those edge AI devices to achieve the optimal balance among comp performance, form factor, power efficiency, and we’ll continue to work closely with the customers, bring those innovative edge AI solution to the market. Well, I mean, like I thought at the beginning, while we are still in the early stage of a port foliating the edge AI, we are recognizing the growth potential of the AI market, and we are ready to capture those emerging opportunities, and based on the, even we are early, but based on the current projection, we are expecting UMC’s addressable market within the overall AI semiconductor market will be around 10% to 20%.

Randy Abrams: Okay, so you have captured 10% to 20% of the AI, TAM, with your portfolio, okay.

Jason Wang: I’m sorry, Randy, actually, that’s the most attractable. I hope I can….

Randy Abrams: I should say not capture, yes. You can, your solutions can target, and then it’s a share event, that makes sense. And to clarify, too, on the silicon interposer, do you plan to expand from the 6,000? I think that was the last guidance you gave, 6,000, if you would add further capacity to that.

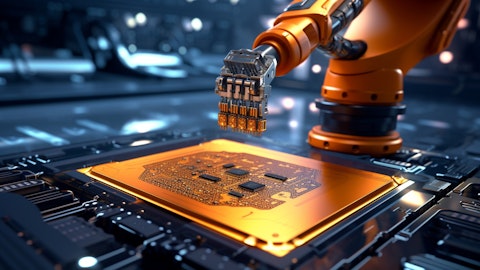

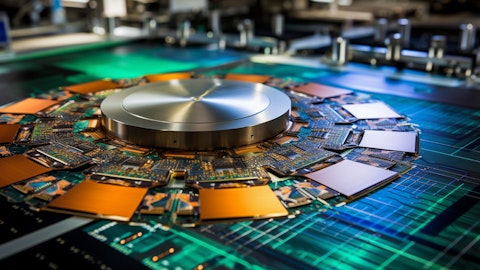

Jason Wang: Yes, that’s the current 2.5D, interposers. Let me maybe elaborate a little bit more on our 3D IC space. Being efficient to the interposer, our 3D IC offering includes the wafer to wafer hybrid bounding active interposer with TSV and the 2M-HAPT [ph] interposer with DTC. And so the interposer is the one of the offering, which that’s where the market is today. But we are cautious in monitoring the expansion of the current interposer capacity and continuing to focus on the expanding on the rest of the solution. Those solutions end to provide a cost effective performance efficiency alternative for some cannot be devised through a vertical stack of a silicon wafer or dice, which delivers small-form factor enhance the bandwidth and lower power consumption for various applications, including the edge AI and the data center and communications.

So we are cautious about the current solution with interposer expansion. We want to end for the future expansion for the interposer with DTC and other interposer with TSV and as well the wafer to wafer hybrid bounding.

Randy Abrams: Okay, great. Thanks a lot Jason for the call.

Jason Wang: Thank you, Randy.

Operator: Next one, Gokul Hariharan, JPMorgan. Go ahead please.

Gokul Hariharan: Yes, hi. Thanks for taking my question. My first question, Jason, I think last call you mentioned that you’ve appropriate expectation for boundaries about high single digit and expect your MC to kind of grow at a similar pace or strive to go at a similar pace. Is that still your expectation right now or has anything changed given the slow world automotive industry or recovery? Has anything changed on the numbers?

Jason Wang: Hi, Gokul. I mean, yes, you remember well and let me give you a bit of update. There are some changes. One, some area we did not change. For instance, we still project the semi-industry will grow in a mid-single digit, that did not change. For the boundary, you will grow at a low ting year-over-year and that didn’t change. However, majority of the 2024 growth in the boundary will be driven by the AI servers. We actually continue to monitor that. I think the biggest momentum is coming out from the AI servers and therefore the growth for the UMC addressable market now remain flattish for 2024. However, you’re right. Our intention is still to expect to outperform our addressable market by seeing the current addressable market projection for us is flattish for 2024.

Gokul Hariharan: Understood. That is quite clear. Second question is on some of the specialty projects that you have on RFSOI that you called out and also the high voltage driver ICs on OLED. Could you talk a little bit about your market presence, especially in RFSOI, how big this is because it seems like you’re starting to gain some market share from the current market leader on some of these platforms. Could you talk a little bit about the specialty platforms, especially RFSOI and OLED driver ICs?

Jason Wang: Sure. First of all, we continue to address all specialty technology, not just limited at RFSOI. However, we are seeing a good momentum for RFSOI market penetration. We are seeing a significant market share gain in this space. However, I don’t have a specific number to share with you right now. I may be able to update you next time. The wealth for the non-volatile memory and we also gain some traction on that while we have a maintaining our market position on the embedded high voltage [ph].

Gokul Hariharan: Understood. One more question I had is on the IPL [ph] kind of moving towards spending primarily for the Fab12i P3. Are there any CapEx offsets that we will potentially get for the Singapore Fab or is it mostly the prepayment from customers and the government incentives are mostly on tax breaks and other kind of profit-driven subsidy?

Jason Wang: Maybe, Gokul, if you can repeat that question.

Gokul Hariharan: Yes, so I was asking for Singapore Fab, do we get any capital offsets like CapEx offsets that offset our CapEx or is it mostly going to be tax breaks and other kind of subsidies which kick in once you start production?

Jason Wang: Yes we cannot go into detail, but there are government incentives issued by the Singapore government including both test breaks as well as the subsidies on capital expenditures. The overall package is equal or better than our previous investment, the P1P2, because of the more advanced technology investment we have in Singapore. So we are very grateful for the strong support from the Singapore government. And the enlarged hub in our Singapore operation actually will enable us to receive even more benefit out of this greater economic scale.

Gokul Hariharan: Thank you, Doug. So the 5 billion spent that we had projected earlier that is more like a gross CapEx number we should assume?

Jason Wang: Yes, roughly for P3.

Gokul Hariharan: Okay, understood. And one more question I had is on 8-inch, given 8-inch seems to be still pretty sluggish. Are there any plans on flexibility for the 8-inch capacity? Is there any plans to potentially convert 8-inch to other areas, compound semiconductors or silicon carbide or any of those areas?