United Microelectronics Corporation (NYSE:UMC) Q1 2024 Earnings Call Transcript April 24, 2024

United Microelectronics Corporation isn’t one of the 30 most popular stocks among hedge funds at the end of the third quarter (see the details here).

Operator: Welcome, everyone, to UMC’s 2024 First Quarter Earnings Conference Call. [Operator Instructions]. For your information, this conference call is now being broadcasted live over the Internet. Webcast replay will be available within two hours after the conference is finished. Please visit our website, www.umc.com, under the Investor Relations, Investors Events section. Now I would like to introduce Mr. Michael Lin, Head of Investor Relations at UMC. Mr. Lin, please begin.

Michael Lin: Thank you, and welcome to UMC’s conference call for the first quarter of 2024. I am joined by Mr. Jason Wang, President of UMC; and Mr. Chi-Tung Liu, the CFO of UMC. In a moment, we will hear our CFO present the first quarter financial results, followed by our President’s key message to address UMC’s focus and the second quarter 2024 guidance. Once our President and CFO complete their remarks, there will be a Q&A section. UMC’s quarterly financial reports are available at our website, www.umc.com, under the Investors Financial section. During this conference, we may make forward-looking statements based on management’s current expectations and beliefs. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially, including the risk that may be beyond the company’s control.

For a more detailed description of these risks and uncertainties, please refer to our recent and subsequent filings with the SEC and the ROC security authorities. During this conference, you may view our financial presentation material, which is being broadcast live through the Internet. Now, I would like to introduce UMC’s CFO, Mr. Chi-Tung Liu, to discuss UMC’s first quarter 2024 financial results.

Chi-Tung Liu: Thank you, Michael. I would like to go through the first quarter 24 investor conference presentation material, which can be downloaded or viewed in real-time from our website. Starting on Page 4. The first quarter of 2024, consolidated revenue was NT$54.63 billion with gross margin at 30.9%. Net income attributable to the stockholder of the parent was NT$10.46 billion. Earnings ordinary shares were NT$0.84. Utilization rate in first quarter of 2024 was 65%, similar to 66% in Q4 of last year. However, the shipment has increased by about 4.5% sequentially. On Page 5, for the sequential financial comparison, revenue declined slightly to NT$54.6 billion. Gross margin was down 5.1%, to 30.9 percentage point, or NT$16.899 billion.

The operating expenses normally in first quarter is seasonal low point. Therefore, we can see the operating expenses was down 13.4% to NT$5.7 billion in Q1 of 2024. Our other operating income mainly is subsidies from governments, declined quite a bit to NT$513 million in Q1. This is largely coming from our shipment operation. Their government subsidies recognition is in line with their depreciation curve, which has come down significantly in 2024. And overall, net income attributable to the shareholder of the parent was NT$10.4 billion in Q1 versus NT$13.1 billion in Q4 of last year. EPS was NT$0.84 for first quarter. On Page 6, the year-over-year comparison, revenue also stayed similar range, almost slight increase of 0.8%. And gross margin, however, declined from 35.5 percentage point to 30.9 percentage point in Q1, many due to increasing cost, such as depreciation expenses.

And for the non-operating income, there’s also a big difference, many due to our portfolio holdings, investment holdings. This is the mark-to-mark again. It’s only about $1 billion in Q1 versus $4.6 billion in the same period of last year. On Page 7, our cash is now about NT$119 billion, and our total equity is NT$378 billion. Most of the increases in the PP&E property plan and equipment, which right now stands at NT$254 billion. On Page 8, there’s a one-time annual adjustment in our ASP in Q1 of 2024, which also the main reason offset the 4% to 5% increase in wafer shipment in Q1. So the magnitude is quite similar to that in first quarter ASP. On Page 9, the original [ph] breakdown of our revenue stay relatively similar quarter-over-quarter.

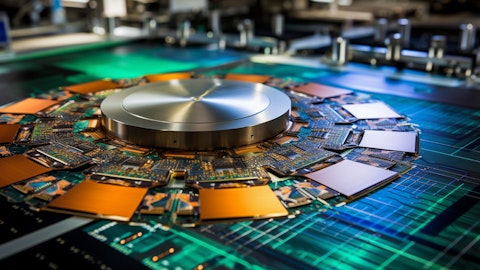

Europe declined 3% from 11% in Q4 last year to 8% in first quarter this year. On next Page, page 10, there’s also a big change in the IDM compensation versus fabulous revenue. So this quarter is 18% versus 82%, while last quarter was 22% versus 78%. On Page 11, the application breakdown remain relatively stable. On Page 12, we see a seasonal downward adjustment in some of our customers, which lead to a small decrease in our 20 to 28 revenue percentage point of 33%. And the rest of the technology geometries are relatively stable. On Page 13, our capacity breakdown in 12-inch equivalent capacity, most of the increase is coming from 12A in our Tainan [ph] fab, which is our P6 expansion. And there will be some spotty areas of efficiency improvement for some of our other FABs. Total 12-inch equivalent capacity is 1.2 million in Q1 this year.

Our CapEx for after first quarter remain unchanged, still stay around NT$3.3 billion cash base CapEx for 2024. Majority of that will be attributed to 12-inch capacity expansion. So the above is a summary of UMC results for Q1 2024. More details are available in the report, which has been posted on our website. I will now turn the call over to President of UMC, Mr. Jason Wong.

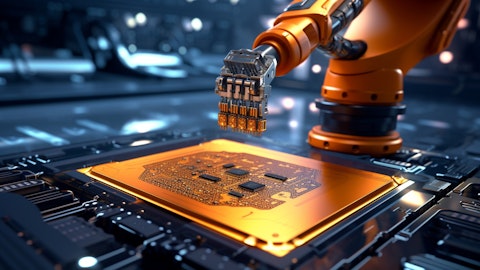

Jason Wang: Thank you, Chi-Tung. Good evening, everyone. Here I would like to share UMC’s first quarter results. In the first quarter, our wafer shipments increased to 4.5% quarter-over-quarter, as we saw a pickup in the computer segment. Despite a slight drop in the utilization rate to 65%, we were able to maintain relative healthy margins due to a continuous cost control and operational efficiency effort. Contribution from our specialty business increased to 57% of total revenue, driven by demand for power management ICs, RFSOI chips, and silicon interposers for AI servers. During the quarter, our team continued to make good progress on key pipeline projects, both customized solutions for customers as well as new technology platforms to serve high-growth segments within the 5G, AIoT, and automotive markets.

This includes embedded high-voltage, embedded non-volatile memory, RFSOI, and 3D IC solutions. In line with our policy to provide a stable and predictable dividend to our shareholders, UMC’s Board of Directors recently approved a shareholder cash distribution of approximately NT$3 per share, which will be a higher payout ratio than the previous years. This is subject to approval by shareholders at an Annual General Meeting in May. Looking ahead to the second quarter, we expect to see an increase in wafer shipments as the inventory situation in the computing, consumer, and communication segment improves to a healthier level. As for the automotive industrial segment, demand remains muted, as the pace of inventory digestion has been slower than anticipated.

While we still expect some lingering impact on macro uncertainties and cost headwinds in the near term, UMC will continue to invest in technology, capacity, and people to ensure UMC is ready to capture the next phase of growth driven by 5G and AI innovations. Now, let’s move on to the second quarter 2024 guidance. Our wafer shipments will increase by low single-digit percentage. ASP in US dollars will remain firm. Growth margins will be approximately 30%. Capacity utilization rate will be in the mid 60% range. Our 2024 cash-based CapEx will be budgeted at a US $3.3 billion. That concludes my comments. Thank you all for your attention. Now we are ready for questions.

See also 12 Ridiculously Cheap Stocks to Buy Now and Hold for the Long Term and 15 Most Populated Cities in South America.

Q&A Session

Follow United Microelectronics Corp (NYSE:UMC)

Follow United Microelectronics Corp (NYSE:UMC)

Receive real-time insider trading and news alerts

Operator: Thank you, President Wong. [Operator Instructions] First question we’ll have Randy Abrams, UBS. Go ahead, please.

Randy Abrams: Okay, yes. Thank you and good evening. The first question I wanted to ask on the 28 nanometer where you mentioned it seasonally dipped in first quarter. Could you talk about the outlook? Like if you see that recovering and how do you see the P6 as you bring up the rest of that capacity? How do you see application to build that capacity or keep it loaded?

Jason Wang: Well, I mean, for Q1, the 22 and 28, we saw a decline — the experiencing of smartphone seasonality which would lead to a lighter 28 and 28 loading. We do expect to pick up the 28 nanometer wafer shipment in Q2 2024. Our 28 loading will remain at a relatively healthy level based on current projection and which is supported by product in all eight drivers, logic technology such as ISP, Wi-Fi, and SOC process application. After the Q1 2024, we will see higher wafer shipment and driven by the demand from both communication and consumer.

Randy Abrams: Okay. And the blended pricing is firm overall, but you do have the mix shift coming back to 28. Could you talk about the like-for-like pricing environment if you see next few quarter’s negotiation? Would there be any like-for-like pressure or do you expect it would be like first quarter each year would be the time the bigger negotiation happens?

Jason Wang: Well, I mean, that’s the typical practice. As we mentioned in January call, the ASP will remain firm after a one-off pricing refresh [ph] in Q1 and we are still expecting that. The company’s pricing strategy has remained consistent, which is based on our value proposition. And at this time, we still expect the pricing will remain firm in the second half of 2024, however, we do believe this, the like-to-like pricing adjustment and so on. We believe the focus should be elevating our customers products competitiveness and to help them win more market share. So while our pricing strategy is remain consistent and aligned with our value proposition, but it also includes to stay competitive and resilience against the market dynamics. So then we’ll continue monitoring the market dynamics.

Randy Abrams: Okay. So something broadly firm, but some flexibility where needed. If it’s, yes, like if it’s a competitive situation.

Jason Wang: Yes, that’s correct.

Randy Abrams: Okay. And to revisit the CapEx, I think you mentioned last quarter, majority of it was either residual for P6 or infrastructure. So a lot of the equipment spend is still to come. But I think you were planning it to start up sometime around Q2 of next year. So is there a way to think about how much capacity in the first phase? And have you made that decision to bring up like a first phase? Like if you have an amount or how much you might need to outlay? And I would think it would be mostly in 2025.

Jason Wang: Are you referring to P6 or P3?

Randy Abrams: Oh, sorry. It’s Singapore. Actually, I was referring to, because you’re doing the construction of Singapore, so how much you plan to bring up in Singapore next year?

Jason Wang: Yes, so, well, first of all, you’re right. And last quarter, we did mention, among the 2024 CapEx number around 60% of the 2024 CapEx will be spend from the 12i P3 infrastructure, and as well some minimum [Indiscernible], so they are, we are spending on the P3, but mainly for the infrastructure. And given the current market dynamics and the customer alignment, we are projecting the 12i P3 production range will actually start in January 2026 now. And the P3 will ramp up with high volume starting from the second half of 2026.

Randy Abrams: Okay, does that imply like off the big CapEx this year, would you still, it sounds like most of the equipment that would push maybe some next year, some actually in 2026, so we should think, I mean, is there a rough way to think about it? Because it would affect, like depreciation has been rising, but that could maybe level it out with that push out.

Jason Wang: Right, I mean, we are, we certainly are managing that. We are projecting the CapEx will peak out this year, and will not impact the company cash dividend policy first. I believe that you don’t care about that, as we have stated in the past. Our CapEx strategy continues to remain disciplined and ROI-driven, and also along with our affordability, so that means we are managing that. But the CapEx will be peaked out at this year in 2024.

Randy Abrams: Yes, and I did see you have the $3 dividend that you confirmed. Actually, the last question, it ties to the AI, like a lot of the attention goes to the high-end, like the GPU, the A6, but you did put in your remarks, kind of reminded on the, you have the Silicon interposer, but could you kind of outline where you still have opportunity, like since that seems like the strongest, still the strongest momentum driver, like where UMC can participate, like Silicon interposer or other components into AI or HPC?

Jason Wang: Yes, I mean, we certainly will like to express [ph] more, but not yet. Well, at this point, while the recent focus of AI chips has been on the most advanced computational chips to run the AI model, and the chips will require handling data transmission, and the power management are also equally important. And so UMC’s focus is on those two areas. The data transmission has slowed the power management. Specifically, the AI server will need a high-speed IO chip and memory controller to handle the data transmission and the the power management IC for every computing and memory unit to optimize the power consumption. Similarly, technology offering from 55 nanometers, 12 nanometers, specialty technology, non-biotype memory, 3D IC, they are all well suited for the edge AI applications, such as wearable, smartphone, etc.