There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze United Continental Holdings Inc (NYSE:UAL).

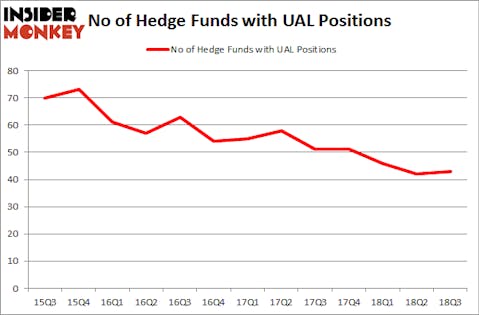

Is United Continental Holdings Inc (NYSE:UAL) a superb stock to buy now? The best stock pickers are turning bullish. The number of bullish hedge fund positions inched up by 1 recently. Our calculations also showed that UAL isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Warren Buffett of Berkshire Hathaway

Let’s analyze the fresh hedge fund action encompassing United Continental Holdings Inc (NYSE:UAL).

How have hedgies been trading United Continental Holdings Inc (NYSE:UAL)?

At the end of the third quarter, a total of 43 of the hedge funds tracked by Insider Monkey were long this stock, a change of 2% from the previous quarter. On the other hand, there were a total of 51 hedge funds with a bullish position in UAL at the beginning of this year. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

The largest stake in United Continental Holdings Inc (NYSE:UAL) was held by Berkshire Hathaway, which reported holding $2314.2 million worth of stock at the end of September. It was followed by PAR Capital Management with a $1391.5 million position. Other investors bullish on the company included Altimeter Capital Management, Lansdowne Partners, and Diamond Hill Capital.

Consequently, key hedge funds were leading the bulls’ herd. Renaissance Technologies, managed by Jim Simons, established the most valuable position in United Continental Holdings Inc (NYSE:UAL). Renaissance Technologies had $100.6 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $23.3 million position during the quarter. The other funds with brand new UAL positions are Lee Ainslie’s Maverick Capital, Joel Greenblatt’s Gotham Asset Management, and Israel Englander’s Millennium Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as United Continental Holdings Inc (NYSE:UAL) but similarly valued. These stocks are Kellogg Company (NYSE:K), Red Hat, Inc. (NYSE:RHT), Hilton Worldwide Holdings Inc (NYSE:HLT), and Sun Life Financial Inc. (NYSE:SLF). This group of stocks’ market valuations resemble UAL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| K | 25 | 329765 | 4 |

| RHT | 21 | 633851 | -8 |

| HLT | 45 | 3394338 | -10 |

| SLF | 13 | 148464 | 1 |

| Average | 26 | 1126605 | -3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $1.13 billion. That figure was $7.04 billion in UAL’s case. Hilton Worldwide Holdings Inc (NYSE:HLT) is the most popular stock in this table. On the other hand Sun Life Financial Inc. (NYSE:SLF) is the least popular one with only 13 bullish hedge fund positions. United Continental Holdings Inc (NYSE:UAL) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HLT might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.