One of the main stats that investors look at when choosing a stock is a company’s Return on Equity (ROE), which results from the following formula: Net Income/Shareholders’ Equity. Shareholders’ equity is measured as a firm’s total assets minus its total liabilities. The ROE reveals the amount of net income returned as a percentage of shareholders’ equity. This ratio helps us asses a company’s profitability by revealing how much profit it generates with the amount shareholders have invested -in other words, how efficiently does the management use resources to generate earnings growth.

In 1972, Buffett implied that a rate of return on equity of at least 14% was desirable. Although, at times, Warren Buffett has appeared to downplay the importance of Return on Equity, he constantly refers to a high rate of return as a basic investment principle. Nonetheless, ratios vary enormously amongst different sectors of the economy. That is why, in order to know if a certain level of return on equity is high or low, one must compare it with those of its industry peers.

So, let’s take a look at two stocks that insiders have been buying (which can be interpreted as a bullish signal), which also boast above-average returns on equity, in order to elucidate if they stand as good investment options.

First off is Montpelier Re Holdings Ltd. (NYSE:MRH), a $1.46 billion market cap provider of customized and innovative insurance and reinsurance solutions to the global market. On May 2, the company saw Susan Sutherland, Board Director, purchase 2,700 Preferred Shares (Series A) for $26.96 per share. In addition to these shares, Mrs. Sutherland holds 6,000 Restricted Share Units and 3,000 Common Shares of the company.

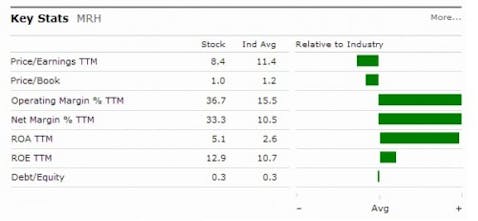

Fundamentally, Montpelier Re Holdings looks appealing. Its stock trades at 8.4 times the company’s earnings, versus an industry average of 11.4x, while it boasts industry leading margins and above average returns on equity and assets (see table below).

Source: Morningstar

The second company in this list is Hanmi Financial Corp (NASDAQ:HAFC), a $ 676 million market cap community bank that provides its services to small- to medium-sized businesses. It also offers insurance products such as; life, commercial, automobile, health, and property and casualty. Once again, Hanmi provides above average returns on equity (10.2% vs. an industry average of 9.3%). Its return on assets and margins also surpass its peers’ mean values. However, trading at 1.7 times its book-values, compared to an industry mean of 1.4x, one must asses if the stock if worth the premium.

Since the beginning of the year, the company witnessed two insider purchases. On May 2, David Rosenblum, Board Director, started a position in the stock with 5,000 shares of Common Stock, for which he paid $21.92 per share. Earlier this year, on Feb. 4th, Joseph Rho, another Director, acquired 2,400 shares of Common Stock for $20.50 per share. Mr. Rho now owns 364,966 shares of the company –he declared having received 2,000 shares as a stock grant, a few days later.

Disclosure: Javier Hasse holds no position in any stocks mentioned

Recommended Reading: