Tupperware Brands Corporation (NYSE:TUP) is known across the world for its successful direct sales methodology and a unique strategy which is central to the participation of women as sales representatives giving them the opportunity to expand their wings beyond the perimeters of their home.

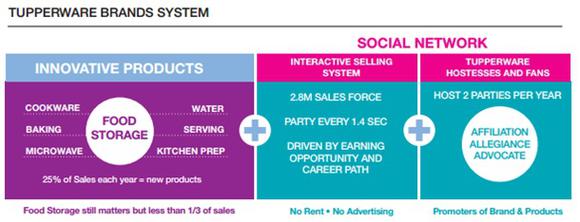

The company realized the potential of women as a major sales force and gave them an opportunity to run a business independently, marking the beginning of an extremely successful strategy ending the year 2012 with a sales force of over 2.8 million.

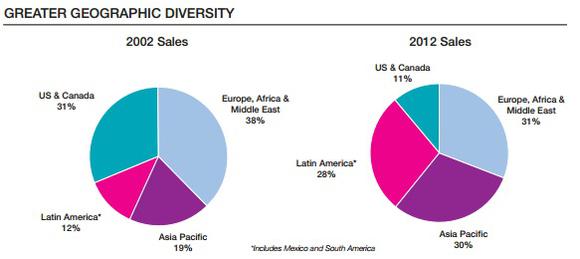

2012 marked an extremely successful year for the company on the back of strong growth in major emerging markets, especially in APAC and Latin American regions, growing at 11%, constituting 61% of the total revenues.

Source: CEO Letter 2012

Tupperware Brands Corporation (NYSE:TUP)’s internal assessment pegs a penetration of less than 25% in residences in India, Brazil and Indonesia creating massive opportunities of growth.

Another factor working in company’s favor is the incredible potential of tapping into the scores of women in these geographic areas who are left out of the mainstream owing to various reasons, and giving them a respectable and dignified way to earn money and support their families providing a boost their self-confidence.

It all boils down to the 4 key elements

Tupperware Brands Corporation (NYSE:TUP)’s success is a result of continued commitment to the 4 key elements they identify as the critical success drivers of their businesses.

Source: Company Website

Tupperware Brands Corporation (NYSE:TUP), realizing the importance of generating real return for the shareholders, has, in the last 3 years, generated a total return of 42% in the form of extensive buyback programs and continuous growth in dividends.

Furthermore, the company for the year 2013 has increased its share repurchase program by $800 million and increased the quarterly dividend by over 70% in a bid to continually add value to shareholders wealth.

Moving ahead on these solid fundamentals, the company looks set for a continued and sustained growth across business segments and geographies, and at the same time empowers women to add value to their lives and society at large.

Let’s see what the competitors are up to

The company’s prime competitors are Avon Products, Inc. (NYSE:AVP) and Newell Rubbermaid Inc. (NYSE:NWL).

Newell Rubbermaid Inc. (NYSE:NWL)’s diversified product portfolio ranging from home solutions and baby products to commercial products puts the company in a formidable position.

The company strives on its brands, which are clearly evidenced from the chart below, putting many of their brands in a commanding position in their home markets.

The company is taking strong and large strides in a bid to enhance itself as a major player in the global markets and move on the path of high growth.

As part of their global strategy the company has developed a fivefold model which it believes puts them in a commanding position to establish itself in high growth emerging markets of Asia and Latin America.

Source: Company presentation

Admittedly, continued stress in the developed economies did create some pressure on the company’s revenue, but the same was offset by a strong performance in the Latin American and Asian markets.

As the company continues to move along the lines of its global growth strategy and backed by a strong balance sheet and sustained growth in operating cash flows to support its activities, the company has a bright future going forward.

Avon Products, Inc. (NYSE:AVP) once the first choice for every woman’s beauty care needs is slowly and steadily facing a decline in demand and sales.

2012 saw the company face a year-over-year 5% decline in overall revenues clocking in $10.7 billion, a 5 % decline in beauty products and a percentage point decline in representative count. Although, with over 6 million representatives the company remains the largest direct selling company in the world.

CEO Sheri McCoy has expressed a sense of urgency in dealing with the matters and has been active in making changes.

Whether it is acquiring new talent to lead the global marketing, legal, supply chain and human resources functions, or setting robust targets for capacity expansions and IT infrastructure by way of retiring existing legacy systems and introducing state of the art IT infrastructure to boost supply chain and overall representative experience, the new management is leaving no stone unturned to get the wheels rolling and put the company back on the growth trajectory.

Tupperware: The company with a heart

Tupperware Brands Corporation (NYSE:TUP)’s name will go down in the history books as not just a company which worked for profits, but an organization with values and integrity. An organization which believed in the power of women and the immense potential they have to contribute to their family not just by taking care of them physically and emotionally but also financially.

The company now has its eye set on the emerging markets of BRIC, and if the company continues to move on the standards it has set for itself, there is no end for the good times to come for the company, its 3 million sales force and most importantly you – the investor.

The article Tupperware – Incredibly Foolish !!! originally appeared on Fool.com and is written by Lalita Chauhan.

Lalita Chauhan has no position in any stocks mentioned. The Motley Fool owns shares of Tupperware Brands (NYSE:TUP). Lalita is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.