The market has been volatile as the Federal Reserve continues its rate hikes to normalize the interest rates. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points through November 16th. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, and the funds’ movements is one of the reasons why the major indexes have retraced. In this article, we analyze what the smart money thinks of TTM Technologies, Inc. (NASDAQ:TTMI) and find out how it is affected by hedge funds’ moves.

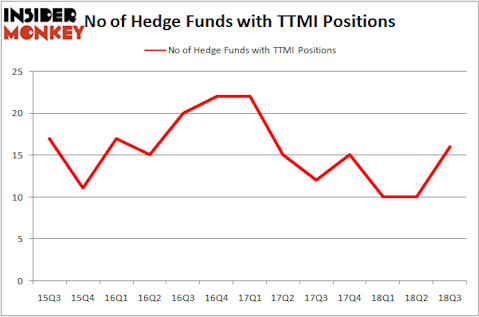

TTM Technologies, Inc. (NASDAQ:TTMI) investors should be aware of an increase in enthusiasm from smart money of late. TTMI was in 16 hedge funds’ portfolios at the end of the third quarter of 2018. There were 10 hedge funds in our database with TTMI holdings at the end of the previous quarter. Our calculations also showed that TTMI isn’t among the 30 most popular stocks among hedge funds.

According to most investors, hedge funds are seen as underperforming, old investment vehicles of years past. While there are greater than 8,000 funds trading at the moment, Our experts look at the upper echelon of this club, about 700 funds. It is estimated that this group of investors administer the majority of the hedge fund industry’s total asset base, and by monitoring their matchless equity investments, Insider Monkey has revealed various investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a gander at the key hedge fund action regarding TTM Technologies, Inc. (NASDAQ:TTMI).

What have hedge funds been doing with TTM Technologies, Inc. (NASDAQ:TTMI)?

Heading into the fourth quarter of 2018, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 60% from the previous quarter. By comparison, 15 hedge funds held shares or bullish call options in TTMI heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the largest position in TTM Technologies, Inc. (NASDAQ:TTMI). Royce & Associates has a $23.2 million position in the stock, comprising 0.2% of its 13F portfolio. Sitting at the No. 2 spot is Laurion Capital Management, led by Benjamin A. Smith, holding a $11.2 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other peers with similar optimism contain Paul Marshall and Ian Wace’s Marshall Wace LLP, Jim Simons’s Renaissance Technologies and D. E. Shaw’s D E Shaw.

As industrywide interest jumped, specific money managers have been driving this bullishness. Laurion Capital Management, managed by Benjamin A. Smith, assembled the largest position in TTM Technologies, Inc. (NASDAQ:TTMI). Laurion Capital Management had $11.2 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also made a $7 million investment in the stock during the quarter. The other funds with new positions in the stock are Matthew Tewksbury’s Stevens Capital Management, Roger Ibbotson’s Zebra Capital Management, and Ernest Chow and Jonathan Howe’s Sensato Capital Management.

Let’s check out hedge fund activity in other stocks similar to TTM Technologies, Inc. (NASDAQ:TTMI). We will take a look at Walker & Dunlop Inc. (NYSE:WD), Bazaarvoice Inc (NASDAQ:BV), LendingClub Corp (NYSE:LC), and Raven Industries, Inc. (NASDAQ:RAVN). This group of stocks’ market caps resemble TTMI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WD | 18 | 74453 | 6 |

| BV | 13 | 35464 | -8 |

| LC | 9 | 5901 | -1 |

| RAVN | 15 | 91757 | 3 |

| Average | 13.75 | 51894 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $52 million. That figure was $58 million in TTMI’s case. Walker & Dunlop Inc. (NYSE:WD) is the most popular stock in this table. On the other hand LendingClub Corp (NYSE:LC) is the least popular one with only 9 bullish hedge fund positions. TTM Technologies, Inc. (NASDAQ:TTMI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard WD might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.