Before we spend many hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We would like to do so because the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of TriMas Corp (NASDAQ:TRS).

Is TriMas Corp (NASDAQ:TRS) a buy right now? Hedge funds are becoming hopeful. The number of long hedge fund positions inched up by 1 recently. Our calculations also showed that TRS isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s view the latest hedge fund action surrounding TriMas Corp (NASDAQ:TRS).

Hedge fund activity in TriMas Corp (NASDAQ:TRS)

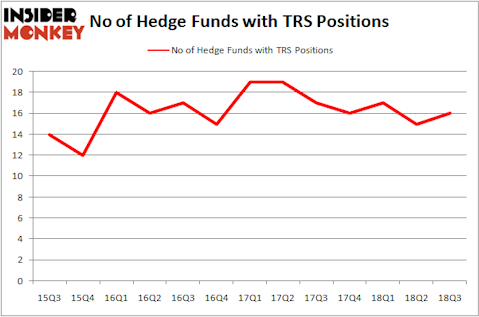

At the end of the third quarter, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards TRS over the last 13 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

The largest stake in TriMas Corp (NASDAQ:TRS) was held by Pzena Investment Management, which reported holding $69.5 million worth of stock at the end of September. It was followed by Royce & Associates with a $21.6 million position. Other investors bullish on the company included Barington Capital Group, Renaissance Technologies, and Diamond Hill Capital.

Consequently, key hedge funds have jumped into TriMas Corp (NASDAQ:TRS) headfirst. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, established the most outsized position in TriMas Corp (NASDAQ:TRS). Marshall Wace LLP had $1.4 million invested in the company at the end of the quarter. Michael Platt and William Reeves’s BlueCrest Capital Mgmt. also initiated a $0.8 million position during the quarter. The only other fund with a new position in the stock is Frederick DiSanto’s Ancora Advisors.

Let’s go over hedge fund activity in other stocks similar to TriMas Corp (NASDAQ:TRS). These stocks are The Liberty Braves Group (NASDAQ:BATRA), American Woodmark Corporation (NASDAQ:AMWD), CURO Group Holdings Corp. (NYSE:CURO), and OSI Systems, Inc. (NASDAQ:OSIS). This group of stocks’ market valuations are closest to TRS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BATRA | 8 | 68522 | -1 |

| AMWD | 17 | 55957 | 8 |

| CURO | 16 | 184077 | -2 |

| OSIS | 9 | 36006 | 1 |

| Average | 12.5 | 86141 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $86 million. That figure was $142 million in TRS’s case. American Woodmark Corporation (NASDAQ:AMWD) is the most popular stock in this table. On the other hand Liberty Media Corporation (NASDAQ:BATRA) is the least popular one with only 8 bullish hedge fund positions. TriMas Corp (NASDAQ:TRS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard AMWD might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.