It’s another quiet day on Wall Street as the three major indexes are just moderately in the red. The Dow is down by 22 points, while the NASDAQ and S&P 500 are off 0.15% and 0.41%, respectively.

Among the stocks showing more volatility and making headlines are GrubHub Inc (NYSE:GRUB), Best Buy Co Inc (NYSE:BBY), PTC Therapeutics, Inc. (NASDAQ:PTCT), Deutsche Bank AG (USA) (NYSE:DB), and CONSOL Energy Inc. (NYSE:CNX). Let’s find out why each equity is trending and analyze hedge fund sentiment towards them.

Through extensive research, we determined that imitating some of the picks of hedge funds and other institutional investors can help generate market-beating returns over the long run. The key is to focus on the small-cap picks of these investors, since they are usually less followed by the broader market and are less price-efficient. Our backtests that covered the period between 1999 and 2012, showed that following the 15 most popular small-caps among hedge funds can help a retail investor beat the market by an average of 95 basis points per month (see the details here).

GrubHub Inc (NYSE:GRUB) shares are 3% in the red after Fox News reported that CEO Matt Maloney had sent a company-wide email hinting that anyone who supported Trump’s views and behaviors should resign. Given that President-elect Trump will soon become the most powerful person in the world and seeing as a large percentage of GrubHub’s customer base is Republican, the email was not exactly the smartest thing in the world to send. To try and pacify the situation, Maloney subsequently elaborated:

I want to clarify that I did not ask for anyone to resign if they voted for Trump. I would never make such a demand. To the contrary, the message of the email is that we do not tolerate discriminatory activity or hateful commentary in the workplace, and that we will stand up for our employees.

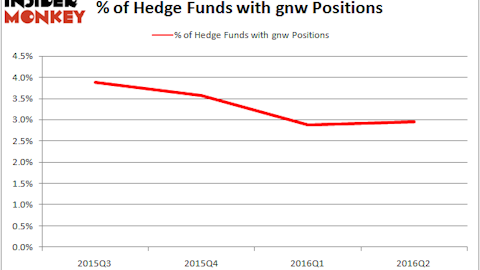

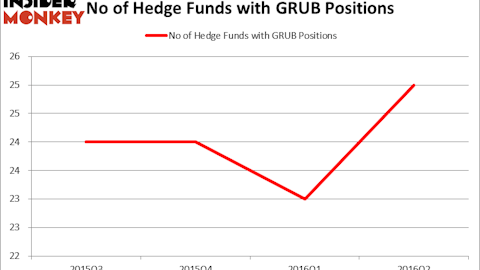

Of the 749 elite funds we track, 25 funds owned $992.28 million of GrubHub Inc (NYSE:GRUB) and accounted for 37.70% of the float on June 30, versus 23 funds and $636.28 million respectively on March 31.

Follow Grubhub Inc. (NASDAQ:GRUB)

Follow Grubhub Inc. (NASDAQ:GRUB)

Receive real-time insider trading and news alerts

Best Buy Co Inc (NYSE:BBY) has fallen 4% on the back of some negative Street commentary. First, the research firm Off Wall Street initiated a ‘Sell’ rating and a $28 price target on the retailer, citing increasing competition in upcoming growth categories such as the connected home and wearables. In addition, the research firm sees softness for crucial segments such as smartphones and TVs. Second, Michael Lasser of UBS said that Best Buy’s out-performance relative to the rest of the sector could slow somewhat due to a variety of factors. Lasser has a $38 price target and a ‘Neutral’ rating. The number of elite funds with holdings in Best Buy Co Inc (NYSE:BBY) rose by 1 quarter-over-quarter to 29 at the end of June.

Follow Best Buy Co Inc (NYSE:BBY)

Follow Best Buy Co Inc (NYSE:BBY)

Receive real-time insider trading and news alerts

On the next page, we examine PTC Therapeutics Inc, Deutsche Bank AG (USA), and CONSOL Energy Inc.