Volatility on Wall Street remains low as traders await the outcome of the U.S. election. If Clinton wins, the status quo will more or less continue. If Trump wins, many things will likely change.

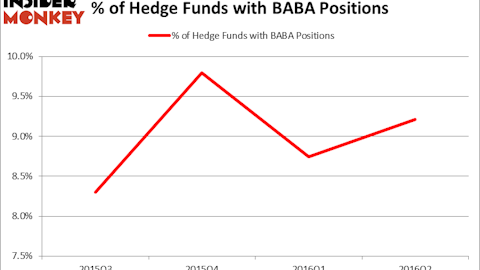

With that said, let’s take a look at why four tech companies and one major financial institution, Facebook Inc (NASDAQ:FB), Microsoft Corporation (NASDAQ:MSFT), Bank of America Corp (NYSE:BAC), Alibaba Group Holding Ltd (NYSE:BABA), and JD.Com Inc(ADR) (NASDAQ:JD) are trending. In addition, we will uncover the hedge fund sentiment toward the names.

While there are many metrics that investors can assess in the investment process, the hedge fund sentiment is something that is often overlooked. However, hedge funds and other institutional investors allocate significant resources while making their bets and their long-term focus makes them the perfect investors to emulate. This is supported by our research, which determined that following the small-cap stocks that hedge funds are collectively bullish on can help a smaller investor to beat the S&P 500 by around 95 basis points per month (see the details here).

d8nn / Shutterstock.com

Although Microsoft Corporation (NASDAQ:MSFT) may be on friendly terms with Facebook Inc (NASDAQ:FB), the warm feelings between the two hasn’t stopped Mark Zuckerberg and Co from going after LinkedIn Corp (NYSE:LNKD). Just a few months after Microsoft Corporation (NASDAQ:MSFT) agreed to buy LinkedIn for over $26 billion in cash, TechCrunch reports that Facebook Inc (NASDAQ:FB) is ‘experimenting with a slew of recruiting features’ aimed at small businesses. Among the features is a ‘share a job opening’ option, as well as an ‘apply now’ option. Given that billions of people use Facebook every month, the social media giant’s moves might slow growth for LinkedIn. They could also be yet another revenue source for Facebook down the road. According to our database of 749 funds, the smart money liked both tech giants, with 148 funds holding shares of Facebook and 131 funds reporting stakes in Microsoft as of the end of June.

Follow Meta Platforms Inc. (NASDAQ:META)

Follow Meta Platforms Inc. (NASDAQ:META)

Receive real-time insider trading and news alerts

Follow Microsoft Corp (NASDAQ:MSFT)

Follow Microsoft Corp (NASDAQ:MSFT)

Receive real-time insider trading and news alerts

Although many investors expect the Federal Reserve to raise rates in December, Bank of America Corp (NYSE:BAC) is in the red today after Matt O’Connor of Deutsche Bank downgraded the equity to ‘Hold’ from ‘Buy’. Citing the stock’s massive 50% run-up since February, O’Connor sees only modest upside potential left in Bank of America without a meaningful uptick in macro-economic conditions. O’Connor has a $17.5 price target. According to our records, some elite funds are also taking some money off the table. Ken Fisher’s Fisher Asset Management cut its stake in in Bank of America Corp (NYSE:BAC) by 18% to 35.7 million shares in the third quarter.

Follow Bank Of America Corp (NYSE:BAC)

Follow Bank Of America Corp (NYSE:BAC)

Receive real-time insider trading and news alerts

On the next page, we find out why traders are watching Alibaba Group Holding Ltd, and JD.Com Inc(ADR).