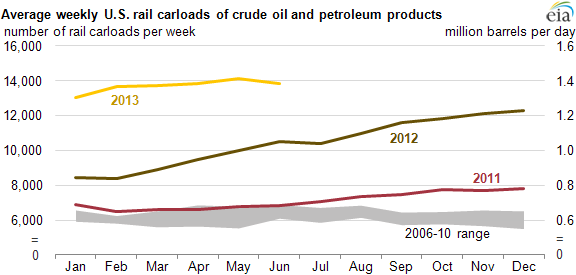

Oil production in the U.S. has zoomed higher over the past couple of years and is now at the highest level in about two decades. That has created quite a problem for our nation’s oil pipeline infrastructure, which has been filled to capacity. Many oil producers have turned to rail in an effort to get oil to refineries. The following chart shows just how impressive the oil-by-rail growth has been:

Source: EIA

As the chart shows, while still growing, oil shipments by rail have slowed in ascent compared to 2012. Overall, crude oil and refined products shipped by rail in the U.S. still grew by 48% over the first half of last year. That’s well ahead of the midway point last year, where traffic was up 38% over 2011. However, such heady growth on a percentage basis isn’t as likely in the future because it’s off a larger base and additional pipeline capacity will be coming on line.

Those costs could really be affected by the recent tragic events in Canada because the industry could face increased regulations to make oil-by-rail even safer, despite the fact that oil-by-rail has a relatively stellar safety record. According to data from the U.S. Department of Transportation, the “spill rate” for railroads from 2002-2012 was only 2.2 gallons per million crude oil ton-miles generated. The comparable spill rate for pipelines was about 6.3 gallons per million ton-miles, which is about three times the rate of rail.

The biggest concern here is that 2013 has been a terrible year for oil-by-rail; the recent disaster in Canada isn’t the only derailment. Canadian Pacific Railway Limited (USA) (NYSE:CP) had three derailments involving oil tank cars in the first four months of this year. One of the accidents, in Minnesota, resulted in 30,000 gallons of oil being spilled. It remains to be seen if these spills will be the tipping point for the approval of additional pipeline projects.

A Canadian Pacific train transporting oil (Source: Flickr/roy.luck)

In the meantime, rail will continue to play a vital role for oil transportation. The biggest beneficiaries will be those refiners that are gaining access to cheaper oil from the Bakken and the Canadian oil sands. Phillips 66 (NYSE:PSX) and Tesoro Corporation (NYSE:TSO) have focused on using rail to deliver oil to coastal refineries. Phillips 66, for example, has ordered 2,000 rail cars in order take crude oil from the Bakken to its refineries in Ferndale, Wash., and Bayway, N.J. In addition to the rail cars, it has signed several logistics deals regarding the loading and unloading of crude oil onto those cars. This is because every $1 per barrel of oil the company can save each year translates to an extra $450 million of net income.

Tesoro Corporation (NYSE:TSO) has also been looking to take further advantage of the explosive growth of oil-by-rail transport. The company is planning a terminal in the Port of Vancouver capable of handling 380,000 barrels of oil per day. Accessing 380,000 barrels of cheaper U.S.-produced oil could save the company $1.37 million per day, given the current discount at which U.S.-benchmarked crude oil trades. This particular project, which could cost $100 million, would be capable of sending oil to West Coast refineries as well as be a potential location for future oil exports.

The other big beneficiaries of oil-by-rail transport are of course the railway owners like Canadian Pacific Railway Limited (USA) (NYSE:CP) and Berkshire Hathaway Inc. (NYSE:BRK.A), which owns Burlington Northern. In fact, crude oil shipments helped Canadian Pacific deliver its best first-quarter results ever. The company expects those numbers only to improve, and even double its crude oil deliveries.