Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed over the past few years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that hedge funds do have great stock picking skills, so let’s take a glance at the smart money sentiment towards Floor & Decor Holdings, Inc. (NYSE:FND).

Is Floor & Decor Holdings, Inc. (NYSE:FND) the right investment to pursue these days? Even though hedge funds reduced their bets on the stock during the second quarter (the number of bullish hedge fund bets were cut by 3), we are seeing signs of reversal in the last few days. Robert Karr’s Joho Capital took advantage of the sharp declines in FND stock and more than tripled its position in FND. Karr now owns more than 5% of the stock’s outstanding shares.

To most traders, hedge funds are assumed to be underperforming, old financial tools of yesteryear. While there are more than 8000 funds trading at present, Our experts choose to focus on the moguls of this club, around 700 funds. These hedge fund managers manage bulk of the smart money’s total capital, and by paying attention to their inimitable equity investments, Insider Monkey has formulated a few investment strategies that have historically exceeded Mr. Market. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here).

Before going into why the stock declined, let’s take a look at the latest hedge fund action encompassing Floor & Decor Holdings, Inc. (NYSE:FND).

Hedge fund activity in Floor & Decor Holdings, Inc. (NYSE:FND)

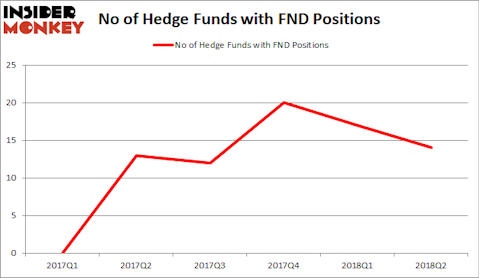

At Q3’s end, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of -18% from the previous quarter. By comparison, 20 hedge funds held shares or bullish call options in FND heading into this year. The graph below depicts the hedge fund sentiment in the stock over the last 6 quarters.

Among these funds, Joho Capital held the most valuable stake in Floor & Decor Holdings, Inc. (NYSE:FND), which was worth $73.9 millions at the end of the second quarter. On the second spot was Scopus Asset Management which amassed $21.7 millions worth of shares. Moreover, Buckingham Capital Management, Atika Capital, and Columbus Circle Investors were also bullish on Floor & Decor Holdings, Inc. (NYSE:FND), allocating a large percentage of their portfolios to this stock.

Seeing as Floor & Decor Holdings, Inc. (NYSE:FND) has experienced a decline in interest from the smart money, logic holds that there exists a select few money managers that decided to sell off their full holdings by the end of the second quarter. At the top of the heap, Louis Bacon’s Moore Global Investments dumped the biggest investment of the “upper crust” of funds followed by Insider Monkey, totaling about $13 million in stock, and Jim Simons’s Renaissance Technologies was right behind this move, as the fund said goodbye to about $5.5 million worth. These moves are important to note, as total hedge fund interest was cut by 3 funds by the end of the second quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Floor & Decor Holdings, Inc. (NYSE:FND) but similarly valued. These stocks are NewMarket Corporation (NYSE:NEU), H&R Block, Inc. (NYSE:HRB), Acuity Brands, Inc. (NYSE:AYI), and 2U Inc (NASDAQ:TWOU). All of these stocks’ market caps resemble FND’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NEU | 11 | 33057 | 0 |

| HRB | 20 | 220232 | 1 |

| AYI | 28 | 991791 | 0 |

| TWOU | 19 | 187731 | 1 |

As you can see these stocks had an average of 19.5 hedge funds with bullish positions and the average amount invested in these stocks was $358 million. That figure was $151 million in FND’s case. Acuity Brands, Inc. (NYSE:AYI) is the most popular stock in this table. On the other hand NewMarket Corporation (NYSE:NEU) is the least popular one with only 11 bullish hedge fund positions. Floor & Decor Holdings, Inc. (NYSE:FND) is not the least popular stock in this group but hedge fund interest is still below average. This was a negative signal in terms of future performance of the stock and hedge funds were actually right. The stock lost a third of its value since the end of the second quarter.

Floor & Decor Holdings looks like a super cheap growth stock that is growing its topline by close to 30%, investing in future, and still delivering positive earnings. Its growth strategy is definitely responsible. However, the stock lost more than half of its value until last week mainly because of its huge China exposure. FND imports approximately 45% of the products it sells from China. It has 12 employees in China to source and deal with its suppliers. Donald Trump seems like a loose cannon but he does what he says. If China doesn’t compromise, Trump will keep his promise and eventually impose a 25% import tax for most of the goods that FND is currently importing from China. The effects of a prolonged trade war will be very damaging to FND’s business model.

The bottom line is that FND’s situation is very fluid. The stock’s price jumped 25% after it reported earnings last week but in my opinion there is nothing surprising about its growth rate. The risk isn’t about FND’s same store sales numbers or growth strategy, or execution. The risk is overwhelmingly political. If it wasn’t the case, this is the type of stock we recommend in our premium monthly newsletter. As you can guess, I am recommending this stock to our premium members. It is just too risky.

Disclosure: None. This article was originally published at Insider Monkey.