Since the article is focusing on a Canadian sector I chose to show stock information from the Toronto Stock Exchange instead of the NYSE. Dollar amounts and stock information are in Canadian dollars.

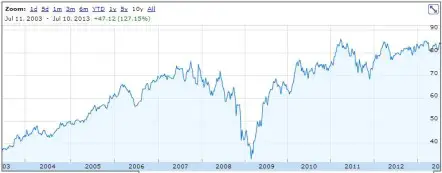

10 year stock chart

The 10 year annual average return is 8.6%. If we include the dividend payments over the past 10 fiscal years (total dividends paid of $20.73) then the total average annual return would be 11.0% with the average return from dividends representing 2.4%.

Out of the big six Canadian banks, Toronto-Dominion Bank (USA) (NYSE:TD)’s 10 year capital gain has been the best.

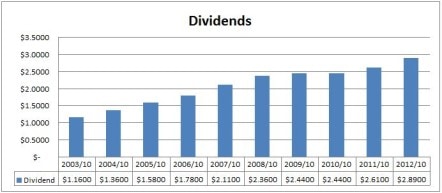

Dividends

Toronto-Dominion Bank (USA) (NYSE:TD) has increased its dividend for 2 consecutive years in a row. Prior to this, it had a 16 year dividend streak from 1994 to 2009. The most recent increase occurred with the dividend recorded in April, when management increased the quarterly dividend by 5.2% from $0.77 to $0.81. This was the company’s second increase in the past year. Prior to the 5.2% increase it raised the quarterly dividend from $0.72 to $0.77. This would make the most recent annual increase from $0.72 to $0.81 which is a 12.5% increase.

In the chart, you can see where dividend growth slowed around 2008-2010. The overall trend is good, and it looks like dividend growth has started to improve since the global financial crisis.

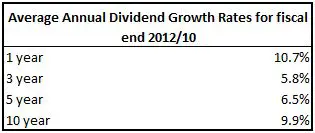

Dividend growth

You can see the affects of the global financial crisis on the 3 and 5 year average annual dividend growth rates. The 10 year rate is good, and it looks like dividend growth has improved recently with the 1 year rate above 10%.

Estimated future dividend growth

Toronto-Dominion Bank (USA) (NYSE:TD) stated in a recent quarterly earnings presentation that it is targeting a payout ratio of 40-50% in the medium term. In the past few years, the payout ratio has been around 40-50%, and other banks like Canadian Imperial Bank of Commerce (USA) (NYSE:CM) and Bank of Montreal (USA) (NYSE:BMO) have stated that they are targeting a payout ratio of 40-50%. Based on these factors I think it is reasonable to assume that Toronto-Dominion Bank (USA) (NYSE:TD) is also targeting 40-50%.

Analysts expect annual EPS growth to be 7.8% for the next 5 years. Accepting this EPS growth rate and using a payout ratio of 40-50% would result in dividend growth of 6.4% to 11.2%. The company’s most recent annual dividend increase of 12.5% leads me to think that future dividend growth will be at the higher end of this range, likely around 10%.

Competitive advantage & return on equity (ROE)

Looking at the table below, it looks like Toronto-Dominion Bank (USA) (NYSE:TD)’s ROE has been below the industry average.

The Canadian banking industry is dominated by the big six banks. The big six are all very competitive so while there are not a lot of big players in the Canadian market, it is still very competitive. Overall I would say that Toronto-Dominion Bank has a narrow economic moat.

Valuation

Morningstar currently rates Toronto-Dominion Bank as a 3 star stock, as it is currently priced close to their estimated fair value of $93. For Morningstar to rate Toronto-Dominion Bank as a 5 star undervalued stock, the price would have to fall below $55.80. I calculated my own target price and came up with $71. To see the details of this calculation read the full analysis of Toronto-Dominion Bank.

My target price of $71 is 27% higher than Morningstar’s 5 star target. This is quite a difference, so I was worried that my target price wasn’t conservative enough. Looking at the past 10 fiscal years worth of the highest dividend yield’s, I think my target price is still conservative. The 5 star price would result in a dividend yield of 5.8%, and my target price a yield of 4.6%. A yield of 4.6% is still conservative compared to past dividend yields.

Morningstar’s 5 star price is very conservative, and it looks like the only opportunity to buy at a 5.8% yield would’ve been in 2009 in the height of the global financial crisis. Having looked at historic high dividend yields, I’m content to keep my target price at $71.

You can see all of my target prices here.

Other investment options in the same industry

Toronto-Dominion Bank is one of six banks that make up the majority of the Canadian market. They share the industry with The Bank of Nova Scotia (NYSE:BNS), Royal Bank of Canada, CIBC, Bank of Montreal (USA) (NYSE:BMO), and National Bank of Canada (TSX:NA).

All of the banks offer a dividend yield of around 4% or higher which is enticing. They range between Toronto-Dominion Bank’s 3.84% to CIBC’s 5.14%. Their payout ratios are all reasonable with them ranging from National Bank of Canada (TSX:NA)’s 40.00% to Bank of Montreal (USA) (NYSE:BMO)’s 49.50

When it comes to dividend growth and estimated 5-year annual EPS growth, CIBC and Bank of Montreal (USA) (NYSE:BMO) look a little lack lustre compared to the other banks. I think National Bank, The Bank of Nova Scotia (NYSE:BNS) and Toronto-Dominion Bank show the most promise. Royal Bank offers appealing fundamentals, but I prefer the other three banks just mentioned.

Bank of Nova Scotia has increased its dividend for 2 consecutive years, which doesn’t sound very impressive until you look at the bigger picture. It has increased its dividend in 42 of the last 45 years. This is very impressive.

The most recent dividend increase happened with the dividend recorded in April 2013 when management increased the quarterly dividend by 5.3% from $0.57 to $0.60. Recently, management has been increasing the dividend twice a year, so the most recent annual dividend increase would be from $0.55 to $0.60, which is a 9.1% increase. The company’s most recent annual dividend increase of 9.1% leads me to think that future dividend growth will be around 8-10%.

In the past year, National Bank increased its quarterly dividend from $0.79 to $0.83, and then again to $0.87. This is a 10.1% annual increase. I expect annual dividend growth at the higher end of my estimated range of 5.6-11.9%.

National Bank has the lowest payout ratio of all the banks, which also suggests that it has the best ability to grow its dividend. That said National Bank typically likes to keep its payout ratio lower than the other five banks. There are a number of good dividend growth candidates among the Canadian banks, but overall I like National Bank’s dividend growth prospects the best.

Conclusion

Right now Toronto-Dominion Bank is a little above my target price, but should it come down to $71 I’d consider investing. At $71 the dividend yield would be an enticing 4.6%, and I expect future annual dividend growth around 10%. There are other banks that offer similarly enticing dividend fundamentals, so it might just be a matter of waiting for the first one to fall below my target price. Should this happen I’d consider investing in National Bank, Toronto-Dominion Bank, Bank of Nova Scotia, or Royal Bank of Canada.

The article Toronto-Dominion Bank: A Look Into the Canadian Banking Industry originally appeared on Fool.com and is written by Michael Weber.

Michael Weber owns shares of Royal Bank of Canada, Bank of Montreal, Canadian Imperial Bank of Canada and The Bank of Nova Scotia. The Motley Fool recommends The Bank of Nova Scotia (USA). Michael is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.