There are several exchange-traded funds (ETFs) that focus on high dividend stocks. One of them is iShares High Dividend Equity Fund (HDV), which consists of 76 stocks of dividend-paying companies. The fund pays a 12-month distribution yield of 3.2% and assesses a low management fee of 0.4%. After subtracting taxes on distributions and fund sales, the fund has returned 17.16% over the past year.

Many renowned investors and money managers, including value investor Jeremy Grantham and PIMCO boss Bill Gross, are bullish about high-quality dividend stocks. The iShares High Dividend Equity Fund comprises of a number of high-yield, high-quality stocks, which can be good investment choices for investors pursuing the momentum in the quality dividend stocks. Given that the low-yield environment will persist in the near future, high-yield quality dividend stocks are expected to outperform other investments, including speculative equities and bonds. Recommending investor focus on dividend stocks with a track record of sustainable earnings power and dividend growth, we take a glimpse at the main features of the top five holdings in iShares High Dividend Equity Fund. The fund’s largest positions yield well in excess of the 10-year Treasury bond and the S&P 500 and Dow 30 indices.

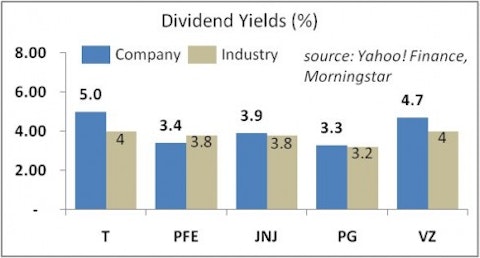

AT&T Inc (NYSE:T) is the single largest position in the fund, representing over 9.3% of the fund’s net assets. The telecom giant boasts the highest dividend yield in the Dow Jones Industrial Index. Currently, the stock is yielding 5.0%. Its dividend payout ratio is 72% of last year’s free cash flow. AT&T’s arch rival Verizon Communications (NYSE:VZ) is yielding 4.7% on a payout ratio of 43% of last year’s free cash flow. The stock has seen modest dividend growth averaging 4.4% per year over the past five years. In the future, as EPS growth reaches 9.3% per year, on average, for the next five years, dividends could see a larger-than-average boost. In the second quarter of 2012, AT&T’s revenue was flat with that reported for the second quarter 2011 and net income was up 9% amid lower costs. Wireless and data service revenues have been strong, while wireline and advertising sales have posted lackluster performance. This year, the company expects to break a record in smartphones sales, which bodes well for a continued strength in wireless and data sales in the future. In addition to its attractive dividend yield, the company has a rich share buyback program that aims to retire 300 million shares, which will contribute to increased shareholder value. AT&T Inc (NYSE:T) has a free cash flow yield of 2.7%, ROE of 4.0%, and return on invested capital [ROIC] of 2.8%. Its forward P/E of 14.7x is lower than Verizon’s of 16.9x. AT&T’s competitor Metro PCS (NYSE:PCS) has a forward P/E of 16.1x. Among fund managers, Phill Gross (Adage Capital), Donald Chiboucis (Columbus Circle Investors—see its top picks), and billionaire Cliff Asness are bullish about the stock.

Pfizer Inc (NYSE:PFE) is also one of the most attractive dividend stocks. This pharmaceutical company is paying a dividend yield of 3.4% on a payout ratio of 66%. Its main competitors Merck & Co. (NYSE:MRK), Novartis (NYSE:NVS), and Sanofi SA (NYSE:SNY) are yielding 3.6%, 3.9%, and 3.7%, respectively. Following a cut in dividends in 2009, Pfizer’s dividend has rebounded some 37.5% since 2010. As the company’s EPS is forecast to expand at an average rate of 2.1% per year over the next five years, Pfizer’s dividend is likely to continue to grow at a modest rate in low single digits. The company’s patent expirations have hurt financial performance; however, the company has weathered the blow fairly well. In Japan, Pfizer Inc (NYSE:PFE) has entered into a generic drug production deal with Mylan Laboratories (NYSE:MYL). The company is developing a fairly robust pipeline of drugs, with 31 compounds in registration or Phase 3 development. Pfizer has a strong balance sheet, sitting on more than $24 billion in cash and short-term investments, well above industry average. Pfizer’s stock has a free cash flow yield of 4.4%, ROE of 10.5%, and ROIC of 9.3%. The stock is considered by some as great value play. In terms of its valuation, the company’s forward P/E of 12.0x compares to the ratios of 13.0x for Merck & Co. and 12.7x for Novartis. The shares have climbed to a new 52-week high. Value investor Ken Fisher has more than $509 million invested in the company.

Johnson & Johnson (NYSE:JNJ), a healthcare giant, is also an attractive dividend stock, belonging to a prestigious club of dividend aristocrats, companies that have raised dividends for at least 25 consecutive years. J&J has raised dividends for 50 years in a row. It currently pays a dividend yield of 3.9%. The company’s payout ratio is 67%. Competitors Covidien PLC (NYSE:COV) and Pfizer Inc (NYSE:PFE) pay dividend yields of 1.8% and 3.4%, respectively. J&J saw its EPS contract at an average annual rate of 1.4% over the past five years, while its dividends grew at an average rate of 8.4% per year. As its EPS growth is expected to revive to 6.7% per year, on average, for the next half decade, J&J’s dividends are assured. Unfortunately, the stock’s performance has been undermined by quality issues and patent expirations. However, the company has just posted better than expected financial performance based on growth in sales of prescription drugs and medical devices. While the company met expectations on revenues, it beat analyst expectations on EPS. J&J has a free cash flow yield of 3.2%, ROE of 14.3%, and ROIC of 12.1%. In terms of valuation, J&J has a forward P/E of 13.4x, which compares to 12.0x for Pfizer and 13.6x for Covidien. Billionaire Ken Fisher is a big fan of this healthcare behemoth. So is Warren Buffett, who reduced his position by 64% in quarter-over-quarter.

Procter & Gamble (NYSE:PG) is the largest consumer packaged goods company in the world. It pays a dividend yield of 3.3% on a dividend payout of 61%. Its closest peers Colgate-Palmolive (NYSE:CL) and The Clorox Company (NYSE:CLX) pay dividend yields of 2.3% and 3.4%, respectively. P&G’s dividends grew at an average annual rate of 10.2% over the past five years, while its EPS expanded at a rate of 1.9% over the same period. Analysts expect that the company will accelerate its EPS growth to an average rate of 8.5% per year for the next half decade. Recently, P&G has underperformed its peers in terms of revenue and EPS growth, which is blamed by some on poor management execution. In fact, an activist fund manager, Bill Ackman, with over $1.3 billion in the stock, is likely to push for the change at the helm of this consumer goods giant. P&G is likely to maintain a leading position in emerging markets, which will bode well for its future sales and EPS growth. The company has a free cash flow of 1.7%, ROE of 13.8%, and ROIC of 12.9%. As regards its valuation, the stock is trading on a forward P/E of 17.4x, which compares to forward P/Es of 19.8x and 17.6x for Colgate-Palmolive and The Clorox Company, respectively. The stock is popular with value investors Warren Buffett and Ken Fisher.

Verizon Communications (NYSE:VZ) is another high-yield U.S. telecommunications stock. It pays a dividend yield of 4.7% on a payout ratio of 43% of last year’s free cash flow. Verizon’s yield is slightly lower than that of its arch rival AT&T Inc (NYSE:T). Verizon has seen marginally lower dividend growth than AT&T, which averaged 4.1% per year over the past five years. The company’s EPS shrank at an average rate of 14.7% per year over the past five years; EPS growth is now expected to average 9.2% per year for the next five years. Verizon has just posted financial results mostly in line with expectations, although its wireless unit profitability beat estimates on strong wireless and data sales. In fact, Verizon Wireless increased the number of customer contracts by 1.54 million in the quarter, beating analyst estimates of 901,000 subscribers, even topping the most optimistic estimate. The strong revenue growth based on wireless and data services is likely to continue amid a continued boom in mobile computing. Still, as regards its balance sheet, Verizon has a high debt-to-equity ratio and large unfunded pension obligations. The stock has a high free cash flow yield of 9.0%, ROE of 7.5%, and ROIC of 3.4%, which are higher than those of AT&T Inc (NYSE:T). In terms of valuation, Verizon’s forward P/E of 16.9x is larger than AT&T’s of 14.7x and well above Verizon’s average multiple over the past few years. Fund managers Phill Gross (Adage Capital) and Peter Rathjens (Arrowsteet Capital) are bullish about Verizon.