What are the benefits of renouncing US citizenship? This decision can help you avoid double taxation, simplify tax obligations, and expand your investment options. Read on to explore the main advantages of giving up US citizenship and see if it fits your situation.

Key Takeaways

• Renouncing US citizenship helps eliminate double taxation and reduces overall tax liabilities for individuals living abroad.

• Simplified tax compliance and reduced legal complexities are major benefits, as renouncing citizenship removes the need to deal with intricate US tax laws and filing requirements.

• Proper planning is crucial when renouncing US citizenship, including compliance with tax obligations and navigating the exit tax to avoid potential financial pitfalls.

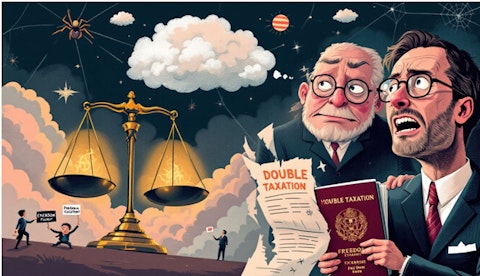

Escape from Double Taxation

Double taxation is a significant burden for US citizens living abroad. It refers to the taxation by both the US and the country of residence on the same income, which can create a heavy financial load. Renouncing US citizenship eliminates the obligation to pay taxes on worldwide income, thus reducing this double taxation.

For many, this change can lead to a lower US income tax liability by minimizing US-sourced income. This newfound freedom from US tax implications on foreign country investments allows individuals to manage their finances more effectively. Investing in foreign bank accounts or other assets without the looming threat of double taxation can bring significant relief.

Accidental Americans, those who were unaware of their US citizenship and the accompanying tax obligations, often find this benefit particularly appealing. Renouncing citizenship helps them escape the heavy tax burdens imposed by the US.

Simplified Tax Compliance

Renouncing US citizenship significantly reduces tax compliance requirements. No longer will you need to deal with additional filing obligations like FATCA and FBAR, which demand detailed reporting of foreign financial assets. This elimination of complex forms related to foreign financial assets, such as those required by FATCA, simplifies financial management for individuals abroad.

Avoiding US government tax requirements can lead to significant savings on legal and reporting fees, allowing for more effective financial planning. A streamlined tax system and fewer bureaucratic hurdles bring peace of mind regarding tax law.

Avoiding the Exit Tax with Proper Planning

The exit tax is a significant consideration for those renouncing US citizenship. This tax applies to covered expatriates, based on IRS criteria like net worth or tax liability thresholds. To avoid being classified as a covered expatriate, individuals must ensure compliance with all US federal tax obligations for the preceding five years.

Strategic planning can mitigate exit tax implications. Timing the renunciation and restructuring assets can uniquely position individuals to reduce their tax liabilities. For instance, transferring or gifting assets before renunciation may lower net worth, thus potentially reducing the exit tax liability. Specialized valuation techniques can also influence asset valuation, playing a crucial role in expatriation planning.

Seeking professional guidance is crucial to navigate the complexities of the exit tax and ensure compliance with immigration regulations. This careful planning can save you from the pitfalls associated with potentially paying a significant exit tax.

Enhanced Investment Opportunities

An investor digitally monitoring their holdings in a securities investment fund.

Renouncing US citizenship opens up broader investment horizons by removing restrictions imposed by US regulations on Passive Foreign Investment Companies (PFICs). Without these constraints, individuals can engage with local markets more freely and pursue investment strategies that align with their financial goals.

Former US citizens may find it easier to manage international investments without the complications of US regulations. This freedom allows for broader investment choices, including rental properties and other foreign assets, without restrictive US regulations.

Increased Global Mobility

Renouncing US citizenship can significantly enhance global mobility. Former US citizens may find it easier to integrate into local economies without the burden of US regulatory requirements. This increased flexibility can be a boon for digital nomads and business professionals who frequently travel or work in countries that limit citizenship holdings.

Giving up US citizenship simplifies the process of obtaining visas or residency in foreign countries, making international living more accessible. This freedom can open doors to a world of opportunities, unencumbered by dual citizenship restrictions in many nations.

Aligning Citizenship with Personal Values

Copyright: vadymvdrobot / 123RF Stock Photo

Renouncing US citizenship can be a powerful statement of personal or political beliefs. For many, this decision reflects disagreements with US political views and policies, aligning their legal status with their deeply held beliefs. This alignment can bring enhanced mental and emotional peace, as individuals feel their citizenship status truly represents their identity and aspirations.

Renouncing US citizenship often stems from a desire to focus on a life that aligns with one’s true identity and aspirations. Whether for political reasons or a stronger allegiance to another country, this choice underscores a personal commitment to living authentically.

Reduced Legal Complexities

Renouncing US citizenship reduces legal complexities related to compliance with US tax laws and navigating legal requirements. This alleviation of burdens associated with filing complex US tax returns simplifies tax compliance.

After renouncing US citizenship, estate and gift taxes become applicable only to US-sourced assets, significantly reducing financial obligations on worldwide assets and their tax consequences. This simplification extends to managing financial accounts and investments abroad, making international legal matters more straightforward.

Preservation of Family Wealth

Renouncing US citizenship can be a strategic move to preserve family wealth. By avoiding US taxation rules, individuals can simplify estate planning and reduce estate and gift tax liabilities. This can be particularly beneficial for those living outside the United States.

After renouncing citizenship, lifetime gifts up to a certain limit can be made tax-free. Additionally, non-US-situs assets can be transferred without triggering US estate or gift taxes if given to non-US persons.

These strategies can help protect family generational wealth from estate and gift taxes.

Impact on Social Security Benefits

Renouncing US citizenship does not affect a person’s entitlement to Social Security benefits, provided the renunciation is handled correctly. Former US citizens can access Social Security benefits if they have paid into the system for at least 40 quarters.

Totalization agreements between the US and other countries may allow former citizens to combine work credits for eligibility. The amount received from Social Security may be calculated based on the contributions made in both the US and the new country of residence.

Relief for Accidental Americans

Accidental Americans, individuals who were unaware of their US citizenship and the accompanying tax obligations, can find relief through a specific IRS procedure. This procedure allows individuals to renounce citizenship without incurring penalties for past non-compliance.

Eligible individuals under the relief program must have never filed a US tax return except for the 1040NR and must file past tax returns for five years to rectify their tax status. The program is targeted at individuals with a net worth below $2 million and without a Social Security Number.

A key benefit of this procedure is that individuals owing less than $25,000 are not required to make any payment. This can provide significant financial relief for those seeking to renounce their US citizenship.

Planning Your Renunciation Process

Pixabay/Public Domain

Proper planning is essential when renouncing US citizenship. One critical step is obtaining a second passport to prevent statelessness. To officially renounce US citizenship, you must make an appointment at a US consulate and apply for a Certificate of Loss of Nationality.

Tax compliance for at least five years before renouncing is required, including filing all necessary US tax returns and reports. After an expatriating act, you must file Form 8854 with the IRS to stop being taxed as a US citizen.

The current administrative fee to renounce US citizenship is $2,350, which is non-refundable. This cost, along with necessary tax compliance, underscores the importance of careful planning and professional guidance.

Summary

Renouncing US citizenship offers a myriad of benefits, from escaping double taxation and simplifying tax compliance to preserving family wealth and enhancing global mobility. Each advantage contributes to a more straightforward, less burdensome financial and legal life for former US citizens.

As you consider this significant decision, weigh the benefits and potential challenges. Proper planning and professional guidance can help you navigate the process smoothly, aligning your legal status with your personal and financial goals.

Frequently Asked Questions

How to renounce us citizenship?

To renounce U.S. citizenship, appear in person before a U.S. consular officer in a foreign country, sign an oath of renunciation, and pay a fee of $2,350.

Can you still live in the US after renouncing citizenship?

No, you cannot live in the US after renouncing your citizenship without obtaining a visa or other legal permission to enter. Renouncing your citizenship eliminates your right to reside in the country.

Is renouncing U.S. citizenship worth it?

Renouncing U.S. citizenship may be worth it for individuals seeking to avoid future legal liabilities or financial obligations tied to their status, but it does not absolve them of past responsibilities. Carefully weigh the potential benefits against the long-term consequences before making this decision.

How does renouncing US citizenship affect my tax obligations?

Renouncing US citizenship frees you from the obligation to pay taxes on worldwide income, simplifying your tax situation. This can significantly reduce concerns about double taxation.

What is the exit tax, and how can I avoid it?

The exit tax is levied on covered expatriates by the IRS, but you can avoid it through strategic planning, such as maintaining tax compliance for five years and restructuring your assets effectively. Taking these steps can significantly reduce the tax burden when you decide to expatriate.