Property investment may sound like a complicated domain, but the truth of the matter is that, once you have given yourself enough time to learn and understand the basics, you can easily become an expert in the field. To help you with this, we would like to present you with a list we have compiled of the top 6 most commons myths about property investment. Read below to find out how some of the most reiterated misconceptions regarding property investment are easily dismantled. Let’s take a look at the countdown.

No. 6: There’s too much competition on the market for me to succeed

The real estate industry does come with its fair share of competition, but this certainly doesn’t mean that there isn’t room for another player. As long as you truly want to make it in this field, you can. And, after all, a little bit of competition can be motivating.

No. 5: There’s not that much to be gained from property investment

While not only people who try their hand at property investment make a profit, this doesn’t mean that it can’t be an extremely rewarding field. Some may make only a small profit, while others an impressive one. It all depends on how committed you are to becoming a good property investor.

No. 4: Any property will grow in value over time

Unfortunately, the notion that the value of any property will only increase over time couldn’t be farther from the truth. Had it been true, there would have probably been a lot more rich people out there. There are a wide range of factors that can influence the value of a property, either positively and negatively, so never assume that the building you have purchased will automatically be more expensive in one year’s time.

No. 3: Property investment is time consuming

You might think that if you already have a full-time job, there’s no way you could possibly try your hand at property investing. However, this activity is not as time consuming as you might think. Simply reduce the number of hours you waste a week, such as watching TV or browsing social networks, and you will have more than plenty of time for property investments.

No. 2: Only wealthy people can go into property investment

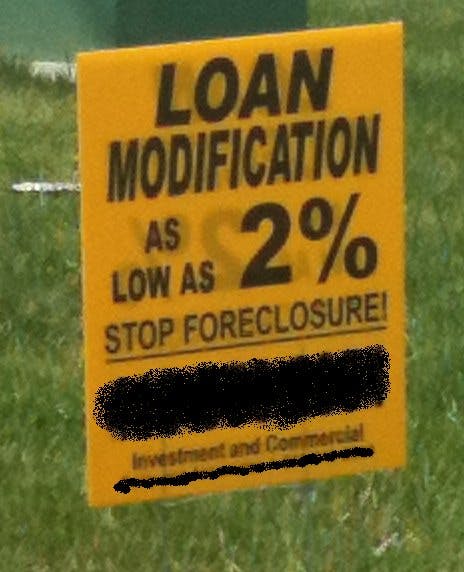

Because buying properties involves a significant financial effort, the vast majority of people believe that property investment is a field reserved only for the wealthy. However, this doesn’t necessarily have to be the case. For the most part, you can receive the required capital through bank loans, in particular if you can also leverage any equity you have built in the home you already own.

No. 1: Real estate is the riskiest industry you could invest in

It is true that housing markets can fluctuate quite a bit in time and that, in some cases, albeit rare, some of them might even crash. However, this doesn’t mean that real estate is a risky industry that you should steer clear of. In fact, a property often is one of the best investments one can make, at least in the long run. What is more, unlike other types of investments, real estate allows you to always keep control of where your money is at and what you do with it.