In this article, we discuss the top 11 AI news and ratings you probably missed.

AI is rapidly evolving, with lower costs making it more accessible and shifting attention from infrastructure to real-world applications. As companies explore new ways to integrate AI, open-source models are gaining momentum, challenging proprietary systems. This shift is reshaping investment strategies and raising questions about the future of AI development and adoption.

The Future of AI Development and Market Trends

Big Technology’s Alex Kantrowitz and Alger’s Dan Chung joined CNBC Closing Bell to discuss AI’s growing power demand, investment trends, and changing perceptions around the technology. Kantrowitz highlighted that AI development is becoming more affordable as it is shifting the focus from infrastructure to practical applications. Companies integrating AI into their products stand to gain the most, while infrastructure-based businesses face uncertainty as models become more accessible. He emphasized the need for real-world applications to sustain AI’s momentum.

Chung shared an optimistic view and noted that lower costs could drive wider AI adoption. He acknowledged the need for further validation of DeepSeek’s claims but recognized its potential to reshape AI development. The conversation also explored the rise of open-source AI, which is challenging proprietary models by promoting collective advancements. While there is some skepticism remaining over DeepSeek’s reported costs, its results suggest a significant shift in AI’s evolution.

AI is evolving quickly, with advancements making it cheaper to develop and more accessible through open-source models. While early discussions centered on infrastructure and cloud computing, the focus is now shifting to real-world applications. Investors and tech leaders are watching closely to see if these breakthroughs will lead to meaningful innovation or if the excitement is outpacing reality. The next phase of AI will depend on how well companies turn these technologies into practical, widely used solutions.

For this article, we selected AI stocks by reviewing news articles, stock analysis, and press releases. We listed the stocks in ascending order of their hedge fund sentiment taken from Insider Monkey’s database of 900 hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

Top 11 AI News and Ratings You Probably Missed

11. Oklo Inc. (NYSE:OKLO)

Number of Hedge Fund Holders: N/A

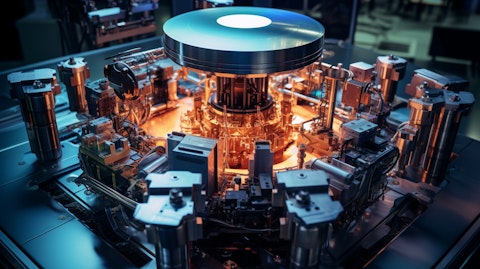

Oklo Inc. (NYSE:OKLO) designs advanced nuclear plants that reuse waste to generate clean energy, meeting AI’s growing power needs.

Lightbridge Corporation has signed a Memorandum of Understanding with Oklo (NYSE:OKLO) to explore the feasibility of co-locating their commercial-scale fuel fabrication facilities and collaborating on nuclear waste recycling. Both companies aim to improve efficiency and reduce costs by sharing resources. Lightbridge’s CEO, Seth Grae, emphasized that this partnership aligns with their commitment to sustainable nuclear energy, while Oklo’s CEO, Jacob DeWitte, highlighted the potential for advancing innovation in the nuclear supply chain and contributing to carbon-free energy solutions.