In this article, we will take a detailed look at the 10 Biggest AI Stock News and Ratings.

The much-feared correction in mega-cap tech stocks is here as investors keep pulling out of AI winners to pile into small-cap stocks as possible rate cuts from the Federal Reserve near. Brent Thill, Jefferies tech research analyst, recently said while talking to CNBC that we are seeing a rotation inside the tech industry where semiconductor and internet companies are performing well while software companies are underperforming. However, Thill reiterated his view that in the back half of the year things will start to change and tech companies will start their rebound. The analyst cited a few software earnings that suggest no signs of “demand cracks.” He said that many semiconductor stocks are now in the overbought territory.

Brent Thill said the selloff has made software stocks more “attractive.”

But Thill also sees a broader rotation ongoing in the stock market, where sectors like financials and industrials are benefitting amid investor exodus from tech.

Asked what is causing a sudden rebound in small-cap stocks, Thill said that interest rate cut expectations and a broader rotation out of mega-cap stocks have a role to play here, in addition to the M&A activity which has increased significantly recently.

Thill thinks the AI “payoff” time is still years away and companies are still at the beginning of the AI spending curve.

For this article we compiled the biggest AI news updates and analyst rating upgrades/downgrades around AI stocks over the past few days. With each stock we have mentioned the number of hedge fund investors. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

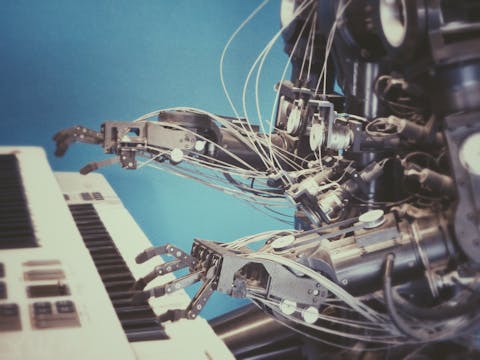

Photo by Possessed Photography on Unsplash

10. Accenture Plc (NYSE:ACN)

Number of Hedge Fund Investors: 57

Earlier this month UBS upgraded Accenture Plc (NYSE:ACN) to Buy from Neutral with a $400 price target.

UBS analyst Kevin McVeigh said in a note that cybersecurity and generative AI should lead to “higher and more durable growth” for Accenture Plc (NYSE:ACN). The analyst thinks the stock is not reflecting the extent of how big generative AI could be for the company.

Accenture Plc (NYSE:ACN) is one of the dominant names in the IT services and consulting industry with $5.06 billion in cash flows as of the end of last year. Accenture is set to benefit from the AI boom as companies need help and consultancy for the actual deployment and implementation of AI technologies.

Accenture Plc (NYSE:ACN) will benefit from secular growth catalysts in the IT services industry. By 2033, IT Service industry revenues are projected to reach $1.06 trillion, from $578.1 billion in 2023, growing at a 6.3% CAGR.

In June Accenture Plc (NYSE:ACN) posted fiscal Q3 results. New bookings in the quarter jumped a whopping 22% year over year, the highest growth in new bookings over the past two fiscal years. The company has made a whopping 35 acquisitions in the fiscal year so far and it’s in an aggressive growth mode. Talking about generative AI business, Accenture Plc (NYSE:ACN) management said during the latest earnings call:

We also have leaned into the new area of growth, GenAI, which is comprised of smaller projects as our clients primarily are in experimentation mode, and this quarter we hit two important milestones. With over $900 million in new GenAI bookings this quarter, we now have $2 billion in GenAI sales year-to-date, and we have also achieved $500 million in revenue year-to-date. This compares to approximately $300 million in sales and roughly $100 million in revenue from GenAI in FY 2023. Leading in GenAI positions us to help our clients take the actions needed to reinvent and to benefit from GenAI, which frequently means large-scale transformations

The stock is trading at 26 times its 2025 EPS estimate of $12.79 set by Wall Street.

Polen Focus Growth Strategy stated the following regarding Accenture plc (NYSE:ACN) in its Q2 2024 investor letter:

“Autodesk and Accenture plc (NYSE:ACN) were also notable absolute detractors in the quarter. For Accenture, the past year has proven to be a weak backdrop for the IT services industry as enterprises rationalize their IT budgets and defer spending on discretionary, shorter-cycle deals. Accenture has not been immune to this broader weakness, as evidenced by slowing growth in recent quarters. However, we would note that later in the quarter, the stock responded very positively to results that showcased AI bookings growing rapidly, though still a small portion of overall bookings. Additionally, as we head into 2025, growth comparisons should ease considerably.”

9. Tesla Inc (NASDAQ:TSLA)

Number of Hedge Fund Investors: 74

Amid a decline in EV sales growth, Elon Musk’s only option is to go all-in on AI. After a Twitter poll that overwhelmingly voted in favor of Tesla Inc (NASDAQ:TSLA) investing capital in xAI, Musks’ AI company, the CEO of Tesla said he’d discuss investing $5 billion in xAI with Tesla Inc (NASDAQ:TSLA).

Elon Musk said in a latest earnings call with analysts that massive discounts from Tesla Inc (NASDAQ:TSLA) competitors created headwinds for the company in the most recently reported quarter.

Tesla Inc (NASDAQ:TSLA) has also delayed its robotaxi event until October. All possible catalysts for Tesla stock lie far into the future and the reality is revealing itself to Elon Musk who admitted during the latest earnings call that he’s been overly optimistic about robo taxis.

“It’s difficult, obviously, my predictions on this have been overly optimistic in the past. So I mean, based on the current trend, it seems as though we should get miles between interventions to be high enough that — to be far enough in excess of humans that you could do unsupervised possibly by the end of this year. I would be shocked if we cannot do it next year.”

During the second quarter, Tesla Inc (NASDAQ:TSLA) automotive gross margin fell to 18.47% from 19.22% the previous year. Non-automotive revenue, now 22% of total sales compared to 14.67% in Q2 2023, has a lower gross margin, negatively impacting overall profitability. Tesla Inc (NASDAQ:TSLA) is still heavily reliant on EVs where demand is falling. Tesla energy business is not strong enough to offset declines in the core business.

Cathie Wood recently set a $2600 price target on Tesla Inc (NASDAQ:TSLA) for 2029, which present a whopping 1300% upside potential from the current levels. Wood thinks the robo taxi project has the potential to deliver $8 to $10 trillion in revenue by 2030.

However, many believe Tesla Inc (NASDAQ:TSLA) won’t be able to live up to the hype around its robo taxi plans. Each robo taxi is expected to have a price target of around $150K to $200K, with some estimates suggesting Tesla Inc (NASDAQ:TSLA) would need about $35 billion to develop a global feet of such cars. Amid inflation and lack of preference for electric cars, American families will probably stay away from spending a fortune on robo taxis, which could cause a blow to Tesla Inc’s (NASDAQ:TSLA) plans in the future.

Baron Partners Fund stated the following regarding Tesla, Inc. (NASDAQ:TSLA) in its first quarter 2024 investor letter:

“The vast majority of the Fund’s underperformance this quarter stemmed from the Fund’s 10-year investment in Tesla, Inc. (NASDAQ:TSLA). Tesla’s shares fell 29.3% during the period and detracted 13.41% from the Fund’s first quarter results. Although Tesla has contributed importantly to the Fund’s performance since 2014, on occasion it has detracted from quarterly performance. In previous instances when Tesla shares have underperformed during a discrete period, they have shortly afterwards reflected the strong growth of the underlying business and the stock has appreciated considerably. We believe that will be the case again, although cannot guarantee it.

A significant decline also occurred at the end of 2022. In that instance, investors had become concerned about a host of external factors. Investors believed the company founder, visionary, and CEO Elon Musk was distracted by his acquisition of Twitter. They also believed a weak Chinese economy emerging from COVID and U.S. government policies would curtail the purchases of Tesla vehicles. These fears proved to be overblown. As the company achieved milestones in the succeeding year, the stock subsequently doubled over the next 12 months…”

8. Applied Materials, Inc. (NASDAQ:AMAT)

Number of Hedge Fund Investors: 79

Analysts at Stifel kept a bullish on on Applied Materials, Inc. (NASDAQ:AMAT) after attending Semicon West 2024 in San Francisco. Brian Chin and Denis Pyatchanin believe Taiwan Semiconductor’s continued spending will benefit the stock. They increased the stock’s price target to $275 from $240.

“Ultimately, we see Applied Materials, Inc. (NASDAQ:AMAT) as well on track to establish higher peak revenue/profitability through the ensuing upcycle, and warranting a higher multiple as it demonstrates improved financial performance across the cycle, and in particular during the downturn,” they said.

Applied Materials, Inc. (NASDAQ:AMAT) is one of those non-fancy AI stocks that don’t get much limelight from the Wall Street. The stock, up 59% this year so far, received an upgrade from Barclays. The investment firm expects the stock to benefit from higher spending in the semiconductor equipment industry. Barclays expects wafer fab equipment spending to hit $96.3 billion in 2024 and $106.4 billion in 2025, up from its previous estimate of $80.6 billion and $89.1 billion, respectively.

In May, Applied Materials, Inc. (NASDAQ:AMAT) posted solid Q2 results. Mizuho Securities analyst Vijay Rakesh upped his price target on the stock to $245 from $225 and kept his Buy rating. Citi analyst Atif Malik also increased his price target on the stock to $250 from $170. The analyst sees “further upside” to Applied Materials, Inc.’s (NASDAQ:AMAT) 2025 estimates.

Applied Materials, Inc.’s (NASDAQ:AMAT) moat is strong and wide. The company makes equipment used to make semiconductor chips. It has a diverse equipment portfolio that addresses the high-growth ICAPS industry (IoT, Communications, Automotive, Power, and Sensors). Last year Applied Materials, Inc. (NASDAQ:AMAT) made a breakthrough announcement by launching Centura Sculpta, a machine that dramatically reduces the number of steps required in chips production. Applied Materials, Inc. (NASDAQ:AMAT) said chipmakers can save a whopping $250 million per 100K wafer starts per month of production capacity in costs.

Wall Street expects Applied Materials, Inc.’s (NASDAQ:AMAT)’ revenue to surge 11% in 2025 while earnings growth is forecasted to come in at 15.60% in the year. The stock’s forward P/E is 23.73, not much higher than the industry average of 27, when seen in the context of growth.

7. Broadcom Inc (NASDAQ:AVGO)

Number of Hedge Fund Investors: 115

TD Cowen in a fresh note named Broadcom Inc (NASDAQ:AVGO) as one of the stocks that can benefit from the rise in AI spending. Analysts at the firm said there are “no signs” of generative AI demand abating and highlighted that Broadcom Inc (NASDAQ:AVGO) recently raised its full-year AI outlook. Broadcom Inc (NASDAQ:AVGO) expects AI-related revenue for 2024 at $11 billion.

Broadcom Inc (NASDAQ:AVGO) recently reported second-quarter results. Revenue in the quarter rose about 43% year over year. AI revenue in the period rose a whopping 280% year over year. Broadcom’s revenue stream is diverse and does not rely on a single source. It includes enterprise, networking, storage, data center/hyperscaler, industrial, and consumer space. For 2024 AVGO has increased its annual revenue guidance to over $51 billion, anticipating growth of over 40%. A significant portion of this growth is expected to come from software, which would also help margins.

The company’s Ethernet business is also strong amid partnerships with Arista Networks (ANET), while the company is also collaborating with Dell (DELL), Juniper (JNPR), and Super Micro (SMCI) in the networking business and other segments. Broadcom has also developed ASIC AI chips in partnership with Google and Meta Platforms.

Based on this strong growth and upcoming catalysts, AVGO’s forward P/E of about 25 makes the stock look undervalued.

Aristotle Atlantic Large Cap Growth Strategy stated the following regarding Broadcom Inc. (NASDAQ:AVGO) in its Q2 2024 investor letter:

“Broadcom Inc. (NASDAQ:AVGO) is a global technology leader that designs, develops and supplies a broad range of semiconductor and infrastructure software solutions. The company strategically focuses its research and development resources to address niche opportunities in target markets and leverage its extensive portfolio of U.S. and other patents and other intellectual property to integrate multiple technologies and create system-on-chip component and software solutions that target growth opportunities. Broadcom designs products and software that deliver high performance and provide mission-critical functionality. The company has a history of innovation in the semiconductor industry and offers thousands of products that are used in end products such as enterprise and data center networking, home connectivity, “set-top boxes broadband access”, telecommunication equipment, smartphones and base stations, data center servers and storage systems, factory automation, power generation and alternative energy systems, and electronic displays. Broadcom differentiates itself through its high-performance design and integration capabilities and focuses on developing products for target markets where it believes it can earn attractive margins.

We view Broadcom’s semiconductor business as being very well positioned to benefit from secular growth in data center networking, which is being driven by AI and cloud computing. The company continues to invest in research and development, and we see this as a competitive advantage for the company. Broadcom’s infrastructure software business is a recurring revenue business model that provides mission-critical mainframe support software to its customer base. The recent VMware acquisition will enhance this business strategy and accelerate the growth rate of this business unit, as VMware’s product suite includes key tools for AI server upgrades. Our long-term investment thesis is supported by Broadcom’s success in its strategy of maintaining technology and market share leadership in mission-critical markets with high switching costs and deep profit pools.”

6. Micron Technology Inc (NASDAQ:MU)

Number of Hedge Fund Investors: 115

Bank of America analyst Vivek Arya recently talked about the latest declines in semiconductor stocks. However, the analyst said most of the declines were due to temporary factors and fundamentals are still “intact.”

“AI still the strongest and most dependable area of capex, driven by domestic US tech companies with solid balance sheets, proven monetization and mission-critical imperatives…” Arya said.

Micron Technology Inc (NASDAQ:MU) posted quarterly results earlier in the month which came in better than expected but the market didn’t welcome the in-line guidance and rising expenses. However, this short-term view misses the fact that Micron Technology Inc (NASDAQ:MU) is investing heavily in high bandwidth memory (HBM) production that is expected to generate billions in sales by fiscal 2025 compared with just hundreds of millions in 2024.

After the earnings, BofA analyst Vivek Arya reiterated a Buy rating and gave a $170 price target on Micron Technology Inc (NASDAQ:MU).

“Mgmt emphasized both CY24 and CY25 volumes are now fully sold out with pricing generally secured, providing visibility to its healthy sales and margin expansions (HBM is GM accretive),” Arya said.

Here is what Micron Technology Inc (NASDAQ:MU) said about HBM during fiscal Q3 earnings call:

“Our HBM shipment ramp began in fiscal Q3, and we generated over $100 million in HBM3E revenue in the quarter, at margins accretive to DRAM and overall Company margins. We expect to generate several hundred million dollars of revenue from HBM in fiscal 2024 and multiple billions of dollars in revenue from HBM in fiscal 2025. We expect to achieve HBM market share commensurate with our overall DRAM market share sometime in calendar 2025. Our HBM is sold out for calendar 2024 and 2025, with pricing already contracted for the overwhelming majority of our 2025 supply. We are making significant strides toward expanding our HBM customer base in calendar 2025, as we design-in our industry-leading HBM technology with major HBM customers. We have sampled our 12-high HBM3E product and expect to ramp it into high-volume production in calendar 2025 and increase in mix throughout 2025.”

ClearBridge Value Equity Strategy stated the following regarding Micron Technology, Inc. (NASDAQ:MU) in its Q2 2024 investor letter:

“Stock selection in the IT sector proved to be the largest contributor to performance, particularly driven by the strong performance of Micron Technology, Inc. (NASDAQ:MU) The company, which designs, develops, manufactures and sells memory and storage products, continued its strong performance alongside other AI beneficiaries as the anticipated demand for new and additional storage essential for housing and training large language AI models continues to grow.”

5. Apple Inc (NASDAQ:AAPL)

Number of Hedge Fund Investors: 150

Apple Inc (NASDAQ:AAPL) AI initiative Apple Intelligence has started to make sense to Wall Street analysts. Recently, Baird raised its price target on the stock to $240 from $200, citing a potential upgrade cycle in iPhone because of Apple Inc (NASDAQ:AAPL) Intelligence.

Baird analyst William Power said in a note that he estimates a whopping 95% of iPhones in the world will need an upgrade at “some point” to take advantage of Apple Intelligence. The analyst mentioned lower upgrade rates at AT&T and Verizon, suggesting consumers might be waiting for AI-integrated smartphones. Based on this catalyst, the analyst upped his fiscal 2025 iPhone estimates by about 20 million units, now projecting iPhone revenue to reach $216.1 billion, a 9% year-over-year increase, surpassing the consensus estimate of 6% growth. Apple Inc (NASDAQ:AAPL) is expected to generate $418.1 billion in full-year revenue and $7.30 per share in earnings, up from previous forecasts of $394.6 billion and $6.73 per share.

However, the assumption that we will see a huge upgrade cycle of iPhone just because of AI is big and comes with a lot of risks. Apple Inc (NASDAQ:AAPL) trades at a forward PE multiple of around 35x, well above its 5-year average of nearly 27x. Its expected EPS forward long-term growth rate of 10.39% does not justify its valuation, especially with the iPhone upgrade cycle assumption. Adjusting for this growth results in a forward PEG ratio of 3.33, significantly higher than its 5-year average of 2.38.

Polen Focus Growth Strategy stated the following regarding Apple Inc. (NASDAQ:AAPL) in its Q2 2024 investor letter:

“The largest relative detractors in the quarter were NVIDIA, Apple Inc. (NASDAQ:AAPL), and Salesforce. In a reversal from some of the concerns driving the stock down in the first quarter, Apple re-emerged as a top performer in the second quarter. The company reported better-than-feared results in its iPhone segment that quelled concerns over weakness in China. Additionally, the company forecast a return to sales growth and announced a $110 billion stock buyback plan, the largest in U.S. history. Later in the period, at its Worldwide Developers Conference, Apple introduced long-awaited new AI features that spurred some optimism around an upgrade cycle for the iPhone and, more generally, the important role Apple may be able to play in the emerging AI landscape. We continue to study Apple closely, which we previously owned the company for many years during its growth phase, to determine if it is poised for another significant revenue and earnings growth period.”

4. Alphabet Inc Class C (NASDAQ:GOOG)

Number of Hedge Fund Investors: 165

Alphabet Inc Class C (NASDAQ:GOOG) shares slipped recently following reports that OpenAI is working on a web search product called SearchGPT. Before that, the stock fell following earnings despite posting strong numbers. Revenue in the second quarter jumped 14% year over year driven by search and Cloud. At a forward P/E of 22, analysts believe Alphabet Inc Class C (NASDAQ:GOOG) continues to be one of the cheapest AI stocks in the market as its valuation remains depressed amid fears caused by an overreaction.

Despite constant alarms going off about its search business, Alphabet Inc Class C (NASDAQ:GOOG) search revenue jumped about 13.7% in the second quarter year over year. As of the end of June, Google has about 91.06% share of the search engine market, just 1.65% lower than the December 2019 levels. With AI overviews and other search initiatives, Alphabet Inc Class C (NASDAQ:GOOG) will be able to stave off any competitors given its dominance in the market.

Cloud and YouTube are two key strong catalysts for Alphabet Inc Class C (NASDAQ:GOOG) shares. During the second quarter, Alphabet’s Cloud revenue rose 28.8% to $10.35 billion, crushing past analysts’ forecasts of $10.16 billion. Alphabet Inc Class C (NASDAQ:GOOG) is on the path to reach a $100 billion revenue run-rate from YouTube Ads and Google Cloud by the end of 2024.

Vulcan Value Partners stated the following regarding Alphabet Inc. (NASDAQ:GOOG) in its Q2 2024 investor letter:

“There was one material contributor to performance: Alphabet Inc. (NASDAQ:GOOG). During the first quarter, Alphabet’s revenue growth accelerated and margins expanded. The company continues to introduce new search pathways with advanced models and algorithms that are 100 times more efficient than they were 18 months ago. Disruption risks to core search from generative AI have not completely abated, but Alphabet’s technical prowess and historical investments in leading technologies are becoming more apparent.”

3. NVIDIA Corp (NASDAQ:NVDA)

Number of Hedge Fund Investors: 186

Raymond James analyst Javed Mirza recently said in a report that NVDA has “triggered a mechanical sell signal” based on a moving average convergence/divergence indicator. In a technical analysis report, he stated that the stock is trading below its 50-day moving average and exhibiting early signs of selling pressure. This, according to Mirza, shows there is a looming corrective phase lasting 1-3 months. He added that a sustained break below the 50-day moving average could lead to a decline towards 94.94, representing a further 16.9% drop from current levels.

NVIDIA Corp (NASDAQ:NVDA) rapid run and soaring valuation have started to make some circles on Wall Street uneasy. New Street Research recently downgraded the stock to Neutral from Buy and set the stock’s price target at $135.

“We downgrade the stock to Neutral today, as upside will only materialize in a bull case, in which the outlook beyond 2025 increases materially, and we do not have the conviction on this scenario playing out yet.” New Street analyst Pierre Ferragu said.

NYU professor and valuation guru Aswath Damodoran has also been skeptical about NVDA over the past several months, saying repeatedly that the stock looks overvalued. In March, when he was asked about his previous predictions (that proved wrong) about NVDA valuation, the professor said that either he has “no idea what I’m talking about” or it’s the market that just does not understand.

Aswath Damodoran at the time said that while Nvidia was in the “driving seat” of the AI bandwagon, its path to profits won’t be as easy as the market assumes.

Recently, Oppenheimer’s Rick Schafer joined the NVIDIA Corp (NASDAQ:NVDA) chorus, raising the chipmaker’s price target to $150 from $110 following the 10-1 stock split.

NVIDIA Corp (NASDAQ:NVDA) is one of the stocks accounting for a huge chunk of the total market returns, thanks to its AI-fueled rally that seems to have no end in sight. NVIDIA Corp (NASDAQ:NVDA) shares have gained about 174% over the past year.

Patient Capital Opportunity Equity Strategy stated the following regarding NVIDIA Corporation (NASDAQ:NVDA) in its Q2 2024 investor letter:

“NVIDIA Corporation (NASDAQ:NVDA) continued to lead both the market and the portfolio, remaining a top performer in the period gaining 36.7%. Nvidia is the market leader in designing and selling Graphics Processing Units (GPU), which has recently benefited from the insatiable demand of artificial intelligence (AI) models. The company currently captures 92% market share of data center GPUs and grew revenue, earnings and free cash flow (“FCF”) an astounding 126%, 392%, and 610%, respectively, over the last year. While we expect competition to increase, we think NVDA can continue to maintain top market share. While many are concerned with backlog times shortening, we think the rollout of the B100, which promises 2.5x better performance for only 25% more cost, later this year will create more shortages. With leading edge technology, an increasing innovation cycle and strong cash generation, the company is well positioned for the increased adoption of artificial intelligence (AI).”

2. Microsoft Corp (NASDAQ:MSFT)

Number of Hedge Fund Investors: 293

Brent Thill, Jefferies tech research analyst, while talking on CNBC about AI companies, said that of all AI companies, Microsoft Corporation (NASDAQ:MSFT) is best positioned to begin monetizing AI. The analyst thinks companies are still “years” away from making money from AI.

“The ramp really begins in 2025, 2026. Microsoft is leading that pack. We think they are in a phenomenal position. It could be a low single-digit percent of their total revenue stream this year and grow going forward,” Thill said.

Thill also said in a separate interview that Microsoft is in “great shape” with its “Copilot strategy” for the back half of 2024.

Dan Ives of Wedbush also believes MSFT is one of the leaders in the AI enterprise segment.

New Street Research started covering the stock with a Buy rating. The firm said that Microsoft Corp (NASDAQ:MSFT) is well positioned to grow profit in the “low teens for years to come” even if the AI revolution fails to pan out. New Street Research has a $570 price target on Microsoft Corp (NASDAQ:MSFT).

Analysts believe Microsoft Corp’s (NASDAQ:MSFT) AI ecosystem around its products would strengthen its Cloud division thanks to Microsoft Corp’s (NASDAQ:MSFT) integration of AI into its Cloud products. Microsoft Corp’s (NASDAQ:MSFT) Intelligent Cloud segment’s profit in the latest quarter totaled $12.51 billion, a whopping 32% growth on a YoY basis.

Microsoft Corp’s (NASDAQ:MSFT) huge investments to revive its Search business are also working. Bing’s market share has jumped to 3.64% as of April 2024, a 0.88 points gain on a YoY basis.

Wall Street expects Microsoft Corp’s (NASDAQ:MSFT) earnings to grow 12.50% next year. The stock’s forward P/E of 31 based on 2025 EPS makes it look attractive at the current levels.

Polen Focus Growth Strategy stated the following regarding Microsoft Corporation (NASDAQ:MSFT) in its Q2 2024 investor letter:

“The top absolute contributors were Alphabet, Microsoft Corporation (NASDAQ:MSFT), and Amazon. Microsoft was another top absolute contributor in the quarter, speaking to a growing appreciation for all the ways the company has an opportunity to monetize GenAI, be it in its Office suite or Azure cloud business. In the latter case, it contributed 7% to Azure’s revenue growth in the most recent quarter. We believe Microsoft remains a highly advantaged business with many secular tailwinds driving durable growth for the foreseeable future, even at its immense scale.”

1. Amazon.com Inc (NASDAQ:AMZN)

Number of Hedge Fund Investors: 302

BMO Capital recently upgraded Amazon shares and the company’s Cloud estimates. The firm expects Amazon Web Services to grow revenue 19% to hit $26.3 billion. BMO increased its price target for AMZN to $230 from $220 and reiterated an Outperform rating on the stock.

Amazon.com Inc (NASDAQ:AMZN) continues to gain on the back of its AWS business which is set to benefit from the rise in AI spending. Mizuho recently cited a survey conducted by one of its partners which shows that AWS sales cycle is seeing acceleration. Mizuho analyst James Lee reiterated his Outperform rating on the stock and gave a $240 price target. The survey shows that spending on AWS is expected to rise about 22% year over year in 2024, up from the previous estimate of 20%, as generative AI projects are seen at an “inflection point” with external models about six months away from commercial deployment.

Amazon.com Inc (NASDAQ:AMZN) is one of the stocks Dan Ives of Wedbush thinks have the potential to grow based on the AI revolution.

Investment firm UBS in a latest report named Trainium and Inferentia as Amazon.com Inc’s (NASDAQ:AMZN) strengths in the AI Enabling layer to profit from the $1.16 trillion opportunity. Trainium is a machine learning (ML) chip that AWS purpose-built for deep learning (DL) training of 100B+ parameter models. Inferentia is an AI accelerator for deep learning (DL) and generative AI inference applications.

Amazon Web Services is another major factor that makes Amazon.com Inc (NASDAQ:AMZN) well positioned in the Enabling layer of the AI value chain. However, UBS believes Amazon.com Inc (NASDAQ:AMZN) doesn’t have any offering in the Intelligence layer of the AI value chain. The firm labeled “chatbot recommendations” as Amazon.com Inc’s (NASDAQ:AMZN) strength in the application layer of AI.

Patient Capital Opportunity Equity Strategy stated the following regarding Amazon.com, Inc. (NASDAQ:AMZN) in its Q2 2024 investor letter:

“Amazon.com, Inc. (NASDAQ:AMZN) moved higher throughout the second quarter as AI demand helped to reaccelerate growth in their AWS business. It looks as though the cloud business is finally past the customer cost optimization period with customers restarting their cloud migrations as well as expanding spend on AI projects. Despite the top and bottom-line improvement seen in the first quarter, the company is significantly underearning its long-term potential as it continues to reinvest aggressively in the business. With 80% of global retail sales still being done in physical stores and 85% of global IT spending still on-premises, we see a long-run way for the dominant player in the cloud, retail, and increasingly logistics and advertising space.”

While we acknowledge the potential of Amazon.com Inc. (NASDAQ:AMZN), our conviction lies in the belief that under the radar AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than AMZN but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: Analyst Sees a New $25 Billion “Opportunity” for NVIDIA and Jim Cramer is Recommending These 10 Stocks in June.

Disclosure: None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and insiders. Please subscribe to our free daily e-newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below. You can also look at the 10 Best Penny Stocks To Buy According to the Media and the 14 Best FMCG Stocks To Buy Now.