Former OpenAI chief scientist Ilya Sutskever recently claimed that a major change is on the horizon of artificial intelligence. Accepting a “Test Of Time” award for his 2014 paper with Oriol Vinyals and Quoc Le on Friday, December 13, he claimed that reasoning capabilities will make the technology far less predictable. He discussed how an idea his team had explored a decade ago regarding scaling data to new heights for pre-training AI systems, has begun to reach its limits. As such, more data and computing power had resulted in ChatGPT which OpenAI launched in 2022.

“But pre-training as we know it will unquestionably end. While compute is growing, the data is not growing, because we have but one internet”.

-Sutskever declared before thousands of attendees at the NeurIPS conference in Vancouver.

READ NOW: 10 AI News Investors Shouldn’t Miss and 10 AI Stocks Taking Wall Street by Storm

Speaking of its limits, Sutskever also proposed some ways of breaking new ground, such as technology itself generating new data, or AI models evaluating multiple answers before choosing the best response for a user, to improve accuracy. He further went on to predict a future of super-intelligent, self-aware AI capable of reasoning like humans, forecasting that the long-awaited AI agents will eventually become a reality in this advanced era.

As such, AI leaders are now hinting that the generative AI revolution is entering a new phase, with advanced foundation models poised to bring reasoning and long-term thinking to AI capabilities.

“We’re in the beginnings of this generative AI revolution as we all know. And we’re at the beginning of a new generation of foundation models that are able to do reasoning and able to do long thinking.”

– CEO Jensen Huang.

Long thinking enables AI models to take more time to “think over” the results they generate for us, and are an effort to bring AI into System 2. System 2, a term popularized by Daniel Kahneman in his book “Thinking, Fast and Slow”, represents a mode of thinking that is slow, deliberate, analytical, and demanding conscious effort.

As these capabilities develop further, AI is expected to move beyond its current applications in different sectors to intensely impact fields like medicine, research, and education, as evidenced by OpenAI’s recent advancements and their practical benefits in accelerating scientific discovery.

“We’re going to have AI systems that can talk more fluently with us, that can also visualize the real world. And this combination of reasoning and multimodal capabilities, I think, is going to enable us to build more powerful agentic applications next year.”

-Srinivas Narayanan, vice president of engineering at OpenAI.

For this article, we selected AI stocks by going through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

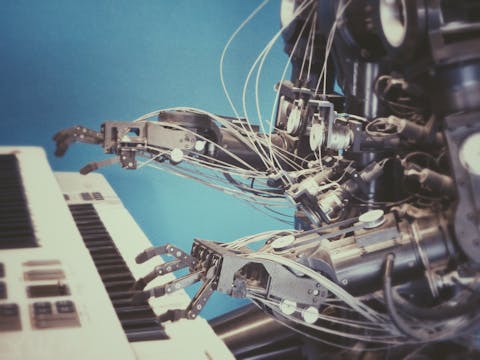

Photo by Possessed Photography on Unsplash

10. Monolithic Power Systems, Inc. (NASDAQ:MPWR)

Number of Hedge Fund Holders: 38

Monolithic Power Systems, Inc. (NASDAQ:MPWR) is a leading international semiconductor company that provides high-performance, semiconductor-based power electronics solutions. On December 11, Citigroup initiated coverage on Monolithic Power Systems, Inc. (NASDAQ:MPWR) with a “Buy” rating and a price target of $700.

The firm sees the recent price drop due to concerns about losing business with Nvidia as a good opportunity to invest in the analog semiconductor company. The concerns about Monolithic losing business with Nvidia were initially reported by Edgewater Research, which claimed that Nvidia may reduce its reliance on Monolithic for power modules in its upcoming Blackwell GPU line to alternative suppliers.

The firm highlighted that Monolithic has consistently achieved over 20% sales and over 30% EPS compound annual growth rate, or CAGR, over the past decade. It also anticipates the company to sustain more than 20% sales growth, driven by the upcoming analog inventory replenishment. Additionally, the fast-growing artificial intelligence and auto markets will likely compensate for the company’s share loss. As such, the $700 price target is in line with the multiple range it was trading before the Al upturn.

9. Synopsys, Inc. (NASDAQ:SNPS)

Number of Hedge Fund Holders: 53

Synopsys, Inc. (NASDAQ:SNPS) provides electronic design automation solutions and services, enabling the design and testing of integrated circuits (chips). On December 11, Reuters reported that the company has offered to sell one of its own units, along with a unit from Ansys, in order to win EU approval for its $35 billion acquisition of Ansys’ chip design software unit.

Ansys specializes in software development for autonomous vehicle sensor simulations. The news further reported that the European Commission is waiting to hear back from rivals and customers on the Synopsys proposal, with a Dec. 16 response for deadlines.

Subject to the Ansys deal, Synopsys said that it would sell its Optical Solutions Group, its optical design tool maker, to Keysight Technologies. Additionally, it has also offered to divest Ansys PowerArtist, a tool for analyzing and reducing power to enable power-efficient design, which includes its research, development, distribution, licensing, selling, and marketing. Synopsys said that the proposed steps are to advance regulatory approvals.

“Customers remain overwhelmingly supportive of this pro-competitive deal, and we continue to expect the transaction to close in the first half of 2025”.

8. Cadence Design Systems, Inc. (NASDAQ:CDNS)

Number of Hedge Fund Holders: 53

Cadence Design Systems, Inc. (NASDAQ:CDNS) is a leading Electronic Design Automation (EDA) and Intelligent System Design provider that supplies software and specialized computer servers to leading AI-chip designers. On December 13, Mizuho raised the firm’s price target on Cadence Design to $350 from $325 and kept an “Outperform” rating on the shares.

The rating, issued as part of a 2025 outlook for the software group, reflects the recent increases in comp multiples. The firm believes that the most important trends impacting software vendors today and in the future are digital transformation, generative artificial intelligence, data and analytics, contact center cloud migrations, DevOps, and next-generation security. The firm believes that the industry’s risk/reward is more balanced entering 2025, but is overall appealing.

7. Marvell Technology, Inc. (NASDAQ:MRVL)

Number of Hedge Fund Holders: 70

Marvell Technology, Inc. (NASDAQ:MRVL) is a leader in data infrastructure semiconductor solutions. On December 10, the company announced the launch of Marvell® Aquila, the industry’s first coherent-lite DSP optimized for 1.6 Tbps coherent optical transceiver modules operating at O-band wavelengths. The Aquila is a new technology that allows connecting campus-based data centers spanning up to 20 km with high bandwidth and low latency. Built on an innovative O-band coherent architecture, it delivers cost efficiency, power savings, and scalability.

“Interconnect bandwidth, data center traffic, and data center capacity needs are all growing at accelerated rates because of AI, and operators are limited by the available power delivery in a single building. Aquila offers data center operators a new, groundbreaking avenue for optimizing their infrastructure for sustainability and developing campus facilities that can scale with their customers’ demands for cloud and AI services.”

-Xi Wang, vice president of product marketing for Optical Connectivity at Marvell.

6. CrowdStrike Holdings, Inc. (NASDAQ:CRWD)

Number of Hedge Fund Holders: 74

CrowdStrike Holdings, Inc. (NASDAQ:CRWD) is a leader in AI-driven endpoint and cloud workload protection. On December 9, Crowdstrike and SonicWall announced the launch of a new Managed Detection and Response (MDR) offering to protect small and medium-sized businesses (SMBs) from cyber threats. The collaboration incorporates SonicWall’s trusted Managed Security Services (MSS) with the Endpoint Detection and Response (EDR) capabilities from the CrowdStrike Falcon® cybersecurity platform, resulting in an AI-native security solution. This powerful and scalable solution is intended for Managed Service Providers (MSPs) serving SMBs.

“SonicWall’s large SMB presence and their long-standing commitment to supporting MSPs make this partnership a natural fit. Together, we are providing MSPs with the solutions to deliver scalable, effective AI-powered cybersecurity that is easy to deploy and tailored to the unique needs of SMBs. This partnership underscores CrowdStrike’s mission to stop breaches and secure organizations of all sizes”.

-Daniel Bernard, CrowdStrike chief business officer.

5. Workday, Inc. (NASDAQ:WDAY)

Number of Hedge Fund Holders: 84

Workday, Inc. (NASDAQ:WDAY) is a provider of enterprise cloud applications. On December 11, The Hartford, a leading provider of employee benefits and absence management services, announced that it has become a strategic Wellness partner of Workday Inc. The company has enhanced its relationship with Workday Inc. by becoming a Workday Wellness Partner. Workday Wellness, an AI-powered solution, will connect employers and employees to top wellness partners. It will be leveraging tools such as Illuminate and Workday Peakon Employee Voice to provide companies with real-time insights into the benefits and wellness offerings their employees want and use to improve programs and add new offerings.

“Our employee benefits customers strategically invest their time and resources into human resources technology solutions to manage their benefits and enhance employee well-being, and we are dedicated to helping them maximize their investments. We look forward to collaborating as a strategic partner with Workday to provide a differentiated end-to-end benefits experience for our shared customers.”

-Mike Fish, head of Group Benefits at The Hartford.

4. Micron Technology, Inc. (NASDAQ:MU)

Number of Hedge Fund Holders: 107

Micron Technology, Inc. (NASDAQ:MU) is an innovative memory and storage solutions provider. On December 10, Reuters reported that the U.S. Commerce Department has finalized a $6.165 billion government subsidy for Micron Technology to produce semiconductors in New York and Idaho. The funding, which is one of the largest government awards to chip companies under the $52.7 billion 2022 CHIPS and Science Act, will bolster Micron’s long-term strategy to invest around $100 billion in manufacturing in New York and $25 billion in Idaho.

Additionally, the department has also reached a preliminary agreement to award Micron up to $275 million in proposed funding for expanding and modernizing its facility in Manassas, Virginia. The agreement will help the company introduce more advanced technology to the US to boost wafer production. Moreover, the investments will help create 20,000 jobs and allow the U.S. to grow its share of advanced memory chip manufacturing to an estimated 10% by 2035.

3. Salesforce, Inc. (NYSE:CRM)

Number of Hedge Fund Holders: 116

Salesforce Inc (NYSE:CRM) is a cloud-based CRM company that has gained significant traction after the launch of its AI-powered platform called Agentforce. On December 12, Macquarie analyst Steve Koenig initiated coverage of Salesforce with a “Neutral” rating and a $370 price target. The analyst told investors in a research note that Salesforce CEO and founder Marc Benioff is aiming to position the company as a “digital labor” pioneer with the new Agentforce product. The move strives to target growth as share gains stall and the company faces slowing momentum. Even though there is excitement and interest around Agentforce, there may be some challenges, the analyst noted. In particular, the consumption-based pricing model of Gen AI functionality could disrupt Salesforce’s current seat-based revenue model. In addition, Salesforce’s sequential revenue additions have been declining for three years, a key concern for the firm. As such, meeting market expectations requires a turnaround.

2. Broadcom Inc. (NASDAQ:AVGO)

Number of Hedge Fund Holders: 128

Broadcom Inc. (NASDAQ:AVGO) is a technology company that provides custom chip offerings and networking assets. On Thursday, December 12, the company forecast quarterly revenue above Wall Street estimates as it expects booming demand for its custom artificial intelligence chips in the next few years. The company forecast revenue of an estimated $14.6 billion for the first quarter, compared with analysts’ average estimate of $14.57 billion, as per data compiled by LSEG. According to CEO Hock Tan, the revenue opportunity from AI is in the range of $60 billion to $90 billion in fiscal 2027. He stated how three hyperscale customers are likely to deploy millions of AI chip clusters at the time. Demand for the company’s networking chips has also increased, with businesses increasing investments in GenAI infrastructure.

“Broadcom’s strong performance doesn’t come as a surprise. It’s one of several companies benefiting from AI invigorating the global semiconductor industry, with its AI revenue growing 220% this year”.

-eMarketer analyst Jacob Bourne.

1. NVIDIA Corporation (NASDAQ:NVDA)

Number of Hedge Fund Holders: 193

NVIDIA Corporation (NASDAQ:NVDA) produces some of the most advanced chips, systems, and software for the AI factories of the future. On Friday, December 13, Mizuho reiterated Nvidia as “Outperform”, stating that it is sticking with its rating on Nvidia. According to the firm, even though several technology companies will adopt and utilize generative AI in their businesses, the real winners are going to be those that are “AI-first”. The analysts also stated that the growing focus on generative AI and its significant power demands could lead to a rise in modular data centers, further creating opportunities for companies like Nvidia.

“While we expect countless tech vendors will leverage core Generative AI technologies to benefit their businesses (to varying degrees), the technology companies that have invested heavily in developing their internal AI research and development teams and consider themselves AI-first companies will be among the big players pushing the boundaries of innovation”.

-Mizuho

While we acknowledge the potential of NVDA as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than NVDA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and insiders. Please subscribe to our free daily e-newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.