Former OpenAI chief scientist Ilya Sutskever recently claimed that a major change is on the horizon of artificial intelligence. Accepting a “Test Of Time” award for his 2014 paper with Oriol Vinyals and Quoc Le on Friday, December 13, he claimed that reasoning capabilities will make the technology far less predictable. He discussed how an idea his team had explored a decade ago regarding scaling data to new heights for pre-training AI systems, has begun to reach its limits. As such, more data and computing power had resulted in ChatGPT which OpenAI launched in 2022.

“But pre-training as we know it will unquestionably end. While compute is growing, the data is not growing, because we have but one internet”.

-Sutskever declared before thousands of attendees at the NeurIPS conference in Vancouver.

READ NOW: 10 AI News Investors Shouldn’t Miss and 10 AI Stocks Taking Wall Street by Storm

Speaking of its limits, Sutskever also proposed some ways of breaking new ground, such as technology itself generating new data, or AI models evaluating multiple answers before choosing the best response for a user, to improve accuracy. He further went on to predict a future of super-intelligent, self-aware AI capable of reasoning like humans, forecasting that the long-awaited AI agents will eventually become a reality in this advanced era.

As such, AI leaders are now hinting that the generative AI revolution is entering a new phase, with advanced foundation models poised to bring reasoning and long-term thinking to AI capabilities.

“We’re in the beginnings of this generative AI revolution as we all know. And we’re at the beginning of a new generation of foundation models that are able to do reasoning and able to do long thinking.”

– CEO Jensen Huang.

Long thinking enables AI models to take more time to “think over” the results they generate for us, and are an effort to bring AI into System 2. System 2, a term popularized by Daniel Kahneman in his book “Thinking, Fast and Slow”, represents a mode of thinking that is slow, deliberate, analytical, and demanding conscious effort.

As these capabilities develop further, AI is expected to move beyond its current applications in different sectors to intensely impact fields like medicine, research, and education, as evidenced by OpenAI’s recent advancements and their practical benefits in accelerating scientific discovery.

“We’re going to have AI systems that can talk more fluently with us, that can also visualize the real world. And this combination of reasoning and multimodal capabilities, I think, is going to enable us to build more powerful agentic applications next year.”

-Srinivas Narayanan, vice president of engineering at OpenAI.

For this article, we selected AI stocks by going through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

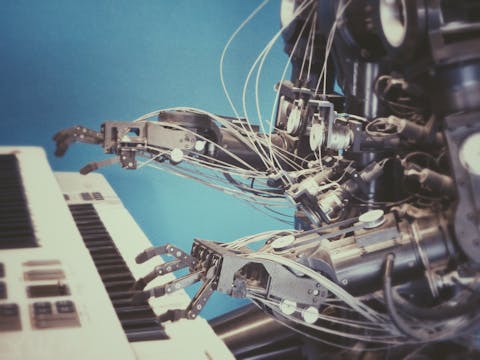

Photo by Possessed Photography on Unsplash

10. Monolithic Power Systems, Inc. (NASDAQ:MPWR)

Number of Hedge Fund Holders: 38

Monolithic Power Systems, Inc. (NASDAQ:MPWR) is a leading international semiconductor company that provides high-performance, semiconductor-based power electronics solutions. On December 11, Citigroup initiated coverage on Monolithic Power Systems, Inc. (NASDAQ:MPWR) with a “Buy” rating and a price target of $700.

The firm sees the recent price drop due to concerns about losing business with Nvidia as a good opportunity to invest in the analog semiconductor company. The concerns about Monolithic losing business with Nvidia were initially reported by Edgewater Research, which claimed that Nvidia may reduce its reliance on Monolithic for power modules in its upcoming Blackwell GPU line to alternative suppliers.

The firm highlighted that Monolithic has consistently achieved over 20% sales and over 30% EPS compound annual growth rate, or CAGR, over the past decade. It also anticipates the company to sustain more than 20% sales growth, driven by the upcoming analog inventory replenishment. Additionally, the fast-growing artificial intelligence and auto markets will likely compensate for the company’s share loss. As such, the $700 price target is in line with the multiple range it was trading before the Al upturn.

9. Synopsys, Inc. (NASDAQ:SNPS)

Number of Hedge Fund Holders: 53

Synopsys, Inc. (NASDAQ:SNPS) provides electronic design automation solutions and services, enabling the design and testing of integrated circuits (chips). On December 11, Reuters reported that the company has offered to sell one of its own units, along with a unit from Ansys, in order to win EU approval for its $35 billion acquisition of Ansys’ chip design software unit.

Ansys specializes in software development for autonomous vehicle sensor simulations. The news further reported that the European Commission is waiting to hear back from rivals and customers on the Synopsys proposal, with a Dec. 16 response for deadlines.

Subject to the Ansys deal, Synopsys said that it would sell its Optical Solutions Group, its optical design tool maker, to Keysight Technologies. Additionally, it has also offered to divest Ansys PowerArtist, a tool for analyzing and reducing power to enable power-efficient design, which includes its research, development, distribution, licensing, selling, and marketing. Synopsys said that the proposed steps are to advance regulatory approvals.

“Customers remain overwhelmingly supportive of this pro-competitive deal, and we continue to expect the transaction to close in the first half of 2025”.