Apple Inc. (NASDAQ:AAPL) lost almost 25% of its market value in one year. Just as analysts and fund managers saw some signs of the stock pulling back to regain its glory, bad things started to happen. Right now, news coming out of China does not sound too good for the company.

Apple’s Recent Up-Move

Last Friday, a day after Samsung (NASDAQOTH: SSNLF.PK) held the launching event for its latest offering, Galaxy S IV, Apple gained 2.58% to close at $443.66.

Bill Mayer of Legg Mason said that he is going overweight on Apple. UBS’s Steve Milunovich reiterated his buy recommendation albeit with a cut on his target – down to $560 from $600 – on fears that news of a fall in iPhone orders may affect Apple’s numbers.

Much of what Bill Miller said was based on hopes that Apple Inc. (NASDAQ:AAPL) may finally do something about the large amount of cash it is holding, something that investors are not too happy about.

Image: source

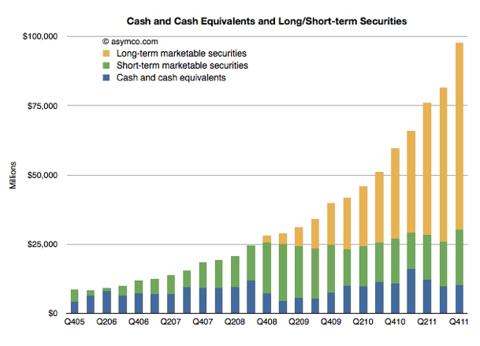

Despite three dividends of $2.65 paid per quarter since August 2012, Apple Inc. (NASDAQ:AAPL)’s cash pile keeps growing. Against $38 billion added in fiscal year 2011, it added $16 billion in the quarter ended December 2012 alone. As of the most recent quarter, Apple has $137.11 billion in cash and cash equivalents and short term and long term investments.

Almost a year ago Apple had announced a $45 billion distribution program through dividends and share buybacks. Even as late as February’s annual shareholder meeting, Tim Cook said that the company was still “seriously considering” returning cash to shareholders. Speculations abound that Apple may increase its dividend payout to anything between $3.75 and $5.00 per share. Brian White of Topeka Capital also believes that Apple Inc. (NASDAQ:AAPL) is in a “good position to deploy more cash”.

The rally could also have been fueled by speculations that Apple’s low-cost iPhone will be launched soon when Ming-Chi Kuo of KGI Securities revealed its specifications. Kuo, who has a proven track record of making correct predictions of Apple’s future plans, also said that an updated premium version of iPhone 5 was on its way.

China, Apple’s second largest market after the U.S. seems to be spoiling Apple’s party

China’s government-controlled television broadcaster China Central Television put a spanner in the works. In a prime-time program aired last Friday night, the powerful television accused Apple of avoiding warranty obligations and of adopting different customer service policies in China from what it offers to its customers in other countries. The program also targeted Volkswagen, alleging that it was selling cars in China with substandard direct-shift gearbox.

Google (NASDAQ:GOOG)’s X-Phone

Another scene is developing on the Google front, where the same story of partners becoming competitors – something that is now commonplace in the smartphone industry – is unfolding.

Google developed Android OS and gave it to the world free (with certain terms) so as to generate ad revenue through Google apps. It, however, did not account for Samsung making such a success of it and growing bigger than the Android brand it was riding on. Unlike other Android licensees, Samsung’s Galaxy brand has as much, if not more, recognition as Android.

Although Google’s revenues from mobile apps are expected to touch $8 billion in 2013, the company seems to be worried about Samsung gaining too much clout. The signs were there for everyone to see at the launch of Galaxy S IV. There was no mention of Samsung’s latest offering being a part of Google’s Android.

Last December there was news that Motorola Mobility, the company that Google acquired in early 2012, was developing a sophisticated handset called X-Phone, with state-of-the-art features.

Although motivated by Samsung’s growing clout, X-Phone will obviously also challenge Apple.

How much of a worry is it for Apple?

Apple Inc. (NASDAQ:AAPL) needs to address the issue arising from China, where it has 17,000 company owned outlets. As of now Apple doesn’t appear to be concerned and seems to be sidetracking the issue by saying, “Our team is always striving to exceed our customers’ expectations, and we take any customer concerns very seriously.” It may be too early to tell but regardless of whether the allegation is proved right or wrong, it needs to be taken seriously. When the same channel had taken on Yum Brands over the quality of chicken served at its KFC outlets, it eventually led to a 6% fall in sales for the quarter.

The issue of Google’s X-Phone is, however, not an immediate threat. Motorola had a backlog of 18 months when it was taken over. Even if the X-Phone is launched this year, it will not be until September, by which time Motorola is expected to clear its pipeline products.

Apple Inc. (NASDAQ:AAPL)’s fundamentals haven’t changed much. All is quiet on that front. Eventually Apple’s bosses will have to address investor concerns regarding the cash pile – make a good investment and/or hike the dividend payout. Or even better, they might pull up a rabbit from the hat and surprise us all – a never seen before feature in the new version of iPhone perhaps.

The article Time to Buy Apple Again? originally appeared on Fool.com and is written by Sujata Dutta.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.