The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of September 30th. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Thomson Reuters Corporation (NYSE:TRI).

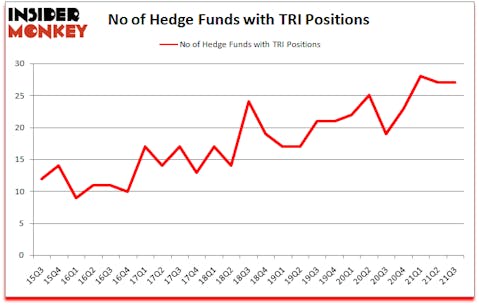

Thomson Reuters Corporation (NYSE:TRI) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 27 hedge funds’ portfolios at the end of September. Our calculations also showed that TRI isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Baidu, Inc. (NASDAQ:BIDU), Honda Motor Co Ltd (NYSE:HMC), and DexCom, Inc. (NASDAQ:DXCM) to gather more data points.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind let’s analyze the recent hedge fund action surrounding Thomson Reuters Corporation (NYSE:TRI).

Steven Cohen of Point72 Asset Management

Do Hedge Funds Think TRI Is A Good Stock To Buy Now?

At the end of the third quarter, a total of 27 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the second quarter of 2021. On the other hand, there were a total of 19 hedge funds with a bullish position in TRI a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Woodline Partners was the largest shareholder of Thomson Reuters Corporation (NYSE:TRI), with a stake worth $53.7 million reported as of the end of September. Trailing Woodline Partners was Citadel Investment Group, which amassed a stake valued at $46.2 million. Millennium Management, Adage Capital Management, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Strycker View Capital allocated the biggest weight to Thomson Reuters Corporation (NYSE:TRI), around 5.84% of its 13F portfolio. Bishop Rock Capital is also relatively very bullish on the stock, setting aside 0.95 percent of its 13F equity portfolio to TRI.

Seeing as Thomson Reuters Corporation (NYSE:TRI) has faced falling interest from the smart money, it’s easy to see that there exists a select few funds that decided to sell off their entire stakes last quarter. Intriguingly, James Parsons’s Junto Capital Management cut the largest investment of all the hedgies monitored by Insider Monkey, worth close to $56 million in call options, and Brad Stephens’s Six Columns Capital was right behind this move, as the fund dumped about $15.9 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Thomson Reuters Corporation (NYSE:TRI) but similarly valued. These stocks are Baidu, Inc. (NASDAQ:BIDU), Honda Motor Co Ltd (NYSE:HMC), DexCom, Inc. (NASDAQ:DXCM), The Progressive Corporation (NYSE:PGR), Metlife Inc (NYSE:MET), IDEXX Laboratories, Inc. (NASDAQ:IDXX), and Align Technology, Inc. (NASDAQ:ALGN). This group of stocks’ market values are similar to TRI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BIDU | 44 | 2004620 | -15 |

| HMC | 12 | 338639 | 2 |

| DXCM | 53 | 1781583 | 4 |

| PGR | 47 | 1574950 | 3 |

| MET | 39 | 1145473 | -2 |

| IDXX | 43 | 3698749 | 4 |

| ALGN | 49 | 2262912 | -8 |

| Average | 41 | 1829561 | -1.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41 hedge funds with bullish positions and the average amount invested in these stocks was $1830 million. That figure was $246 million in TRI’s case. DexCom, Inc. (NASDAQ:DXCM) is the most popular stock in this table. On the other hand Honda Motor Co Ltd (NYSE:HMC) is the least popular one with only 12 bullish hedge fund positions. Thomson Reuters Corporation (NYSE:TRI) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for TRI is 52.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 31.1% in 2021 through December 9th and still beat the market by 5.1 percentage points. A small number of hedge funds were also right about betting on TRI as the stock returned 9.4% since the end of the third quarter (through 12/9) and outperformed the market by an even larger margin.

Follow Thomson Reuters Corp (NASDAQ:TRI)

Follow Thomson Reuters Corp (NASDAQ:TRI)

Receive real-time insider trading and news alerts

Suggested Articles:

- 30 Best Jobs for 18 Year Old College Students

- 10 Hedge Funds that Profited from Reddit’s Meme Stock Craze

- 10 Best American Dividend Stocks to Invest In

Disclosure: None. This article was originally published at Insider Monkey.