Personally, I’ve been focused on losing weight and getting healthier this year. This means a daily regimen of working out and making healthy food choices. One of the major decisions I made was to eat healthier, so my diet now consists mainly of all natural and organic foods. And the effort has paid off — since May, I’ve lost nearly 35 pounds.

Many health- and environmentally-conscious consumers are aware of the benefits of natural and organic products, and although their prices are higher, these consumers have been buying these products more and more.

The organic food sector grew 9.5% in 2011 compared with 2010, making more than $31.5 billion in sales, according to the Organic Trade Association (OTA). This was double the total sales of comparable non-organic food and beverage, which grew 4.7% in the same period. This type of growth offers substantial proof that consumers are willing to pay more for organic products. In fact, 78% of U.S. families say they purchase organic food at one time or another, according to OTA.

The fastest-growing segment has been the organic meat, fish and poultry category, posting an astonishing 13% year-over-year growth in 2011. Overall, organic food sales now represent 4.2% of all U.S. food purchases. Additionally, organic non-food sales, which reached $2.2 billion in 2011, experienced a strong 11% year-over-year growth, while total comparable non-organic items grew by only half of that — about 5% in the same period.

Prospects for 2013 indicate that organic food will continue to sustain growth levels of 9% or higher. With a trend like this, it’s clear the organic sector should continue to fuel jobs, rural economies and consumer choice. Obviously, this presents a great opportunity for investors.

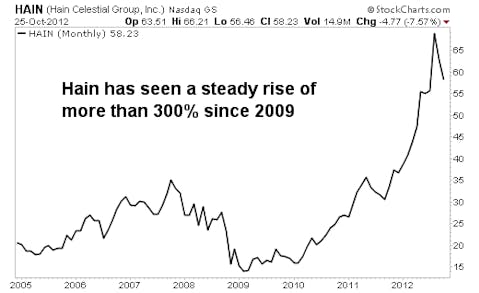

There is a company that stands far above the competition in the organic food space. The stock has risen more than 300% since 2009, and investors who buy into the stock now still have a chance of making a good 30% on their investment.

The Hain Celestial Group, Inc. (NASDAQ:HAIN) operates as a manufacturer, marketer and seller of natural and organic foods, as well as personal care items. Its brand portfolio includes Celestial Seasonings teas, Garden of Eatin’ snacks, Arrowhead Mills whole grains and Spectrum Essentials oils. The firm sells primarily to specialty and natural food distributors, as well as to supermarkets, natural food stores and other retail outlets. Hain also sells products in more than 50 other countries, which made up 20% of the company’s total revenue in fiscal 2011.

Here are four reasons I like Hain Celestrial…

1. The organic food category had been growing in the low-double digits for several years, as consumers have sought more healthful diets, and may resume this type of growth coming out of the economic downturn.

2. Celestial Seasonings is the leading brand of natural and specialty tea in North America and is a top-selling brand for Hain, with operating margins that exceed the rest of its product portfolio.

3. Hain maintains the leading market share in North America and Europe with its JASON brand of natural and organic oral, body and hair care offerings.

4. Founder and CEO Irwin Simon has kept Hain on a steady acquisition regimen, with close to 30 buys since its start in 1993. His strategy? Acquire smaller entrepreneurial companies that are a strategic fit with Hain’s business. Simon takes these companies to the next level, puts them together under one umbrella company, and uses Hain’s wherewithal and expertise to manage and build their brands.

The stock currently trades right under $60 a share, after hitting a recent high of a little more than $66. It has seen a nearly 70% gain in 2012 and I think it could hit $80 during the next 12 months. I see this upside because of its strong sales growth, improved profit margins and dominating position in the U.K., which was once unprofitable but is now a strong bottom-line performer.

Additionally, Hain’s top line has grown more than 24% annually since 2010 and I expect this trend to continue. The company will likely maintain solid growth rates through additional acquisitions and organic growth. Plus, Hain is financially sound. Its debt-to-equity ratio stood at around 40% at the end of June.

Risks to Consider: Competition in the organic segment has been increasing, as large packaged-food firms and established grocers try to take advantage of consumers’ growing preference for natural and organic food products.

Additionally, if inflation heats up and input costs rise for Hain’s products, then this could lead consumers to switch back to cheaper alternatives. This would lower Hain’s volumes and profitability. More than 50% of Hain’s fiscal 2012 revenue is currently generated from its role as a third-party distributor for other manufacturers. In its distribution role, Hain is unable to control the quality of the product deriving the lion’s share of its revenue. Still, given these risks, there are a lot more positives working in Hain’s favor.

Action to Take –> Buy Hain Celestrial up to $65 a share. I see this stock hitting $80 within the next 12 months as consumers continue to seek out all-natural and organic foods, and Hain builds its lead in the U.S. and U.K. markets.

This article was originally written by Jay Peroni, and posted on StreetAuthority.