We at Insider Monkey have gone over 821 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, near the height of the coronavirus market crash. In this article, we look at what those funds think of Molina Healthcare, Inc. (NYSE:MOH) based on that data.

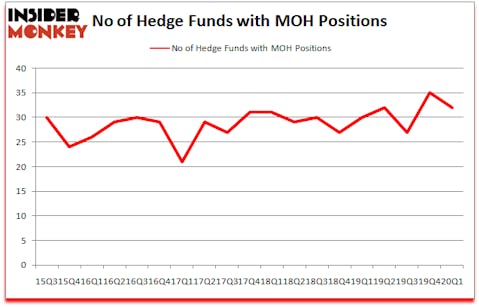

Molina Healthcare, Inc. (NYSE:MOH) shareholders have witnessed a decrease in activity from the world’s largest hedge funds of late. MOH was in 32 hedge funds’ portfolios at the end of the first quarter of 2020. There were 35 hedge funds in our database with MOH holdings at the end of the previous quarter. Our calculations also showed that MOH isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

At the moment there are dozens of tools stock market investors use to assess publicly traded companies. A couple of the best tools are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the best investment managers can outclass the market by a superb amount (see the details here).

Andreas Halvorsen of Viking Global

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, 2020’s unprecedented market conditions provide us with the highest number of trading opportunities in a decade. So we are checking out trades like this one. We interview hedge fund managers and ask them about their best ideas. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s take a peek at the latest hedge fund action encompassing Molina Healthcare, Inc. (NYSE:MOH).

How are hedge funds trading Molina Healthcare, Inc. (NYSE:MOH)?

At Q1’s end, a total of 32 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -9% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards MOH over the last 18 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, holds the most valuable position in Molina Healthcare, Inc. (NYSE:MOH). Renaissance Technologies has a $579.5 million position in the stock, comprising 0.6% of its 13F portfolio. Sitting at the No. 2 spot is Andreas Halvorsen of Viking Global, with a $190.7 million position; the fund has 1% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism encompass David Cohen and Harold Levy’s Iridian Asset Management, Ken Griffin’s Citadel Investment Group and D. E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position Tavio Capital allocated the biggest weight to Molina Healthcare, Inc. (NYSE:MOH), around 29.61% of its 13F portfolio. Iron Triangle Partners is also relatively very bullish on the stock, setting aside 5.03 percent of its 13F equity portfolio to MOH.

At the end of April we talked to Sio Capital’s Michael Castor about hedge funds and he had a lot of good things to say about Molina Healthcare (watch the video here). Clearly some hedge fund managers don’t agree with him and cut their positions entirely in the first quarter. At the top of the heap, Steve Cohen’s Point72 Asset Management said goodbye to the largest stake of the 750 funds monitored by Insider Monkey, worth an estimated $13.9 million in stock, and Frank Brosens’s Taconic Capital was right behind this move, as the fund dropped about $4.1 million worth. These transactions are important to note, as total hedge fund interest fell by 3 funds in the first quarter.

Let’s now review hedge fund activity in other stocks similar to Molina Healthcare, Inc. (NYSE:MOH). These stocks are Avery Dennison Corporation (NYSE:AVY), Huazhu Group Limited (NASDAQ:HTHT), Molson Coors Beverage Company (NYSE:TAP), and Concho Resources Inc. (NYSE:CXO). This group of stocks’ market values are similar to MOH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVY | 18 | 82899 | -4 |

| HTHT | 17 | 255677 | -1 |

| TAP | 34 | 258923 | 3 |

| CXO | 31 | 492191 | -8 |

| Average | 25 | 272423 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $272 million. That figure was $1223 million in MOH’s case. Molson Coors Beverage Company (NYSE:TAP) is the most popular stock in this table. On the other hand Huazhu Group Limited (NASDAQ:HTHT) is the least popular one with only 17 bullish hedge fund positions. Molina Healthcare, Inc. (NYSE:MOH) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 8.3% in 2020 through the end of May but still beat the market by 13.2 percentage points. Hedge funds were also right about betting on MOH as the stock returned 33% in Q2 (through the end of May) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Molina Healthcare Inc. (NYSE:MOH)

Follow Molina Healthcare Inc. (NYSE:MOH)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.