While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, increasing oil prices and deteriorating expectations towards the resolution of the trade war with China, many smart money investors kept their cautious approach regarding the current bull run in the second quarter and hedging or reducing many of their long positions. Some fund managers like this one are betting on Dow hitting 40,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Brookfield Asset Management Inc. (NYSE:BAM).

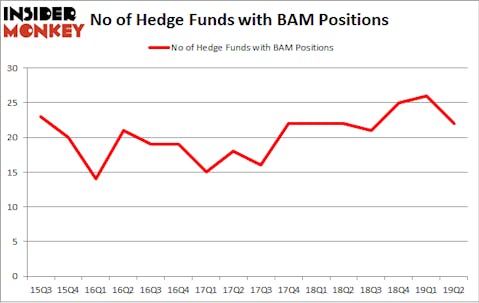

Brookfield Asset Management Inc. (NYSE:BAM) was in 22 hedge funds’ portfolios at the end of the second quarter of 2019. BAM shareholders have witnessed a decrease in enthusiasm from smart money in recent months. There were 26 hedge funds in our database with BAM positions at the end of the previous quarter. Our calculations also showed that BAM isn’t among the 30 most popular stocks among hedge funds (see the video at the end of this article).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the key hedge fund action encompassing Brookfield Asset Management Inc. (NYSE:BAM).

How have hedgies been trading Brookfield Asset Management Inc. (NYSE:BAM)?

Heading into the third quarter of 2019, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of -15% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in BAM over the last 16 quarters. With hedge funds’ capital changing hands, there exists a few noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Markel Gayner Asset Management, managed by Tom Gayner, holds the biggest position in Brookfield Asset Management Inc. (NYSE:BAM). Markel Gayner Asset Management has a $275.4 million position in the stock, comprising 4.2% of its 13F portfolio. Coming in second is Select Equity Group, led by Robert Joseph Caruso, holding a $90.7 million position; 0.6% of its 13F portfolio is allocated to the company. Some other peers that are bullish comprise Martin Whitman’s Third Avenue Management, Ken Griffin’s Citadel Investment Group and Murray Stahl’s Horizon Asset Management.

Seeing as Brookfield Asset Management Inc. (NYSE:BAM) has faced declining sentiment from the entirety of the hedge funds we track, it’s safe to say that there exists a select few hedgies that elected to cut their entire stakes heading into Q3. Intriguingly, Lou Simpson’s SQ Advisors said goodbye to the biggest stake of the “upper crust” of funds tracked by Insider Monkey, valued at an estimated $178.6 million in stock. Josh Donfeld and David Rogers’s fund, Castle Hook Partners, also sold off its stock, about $6.2 million worth. These bearish behaviors are important to note, as total hedge fund interest dropped by 4 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks similar to Brookfield Asset Management Inc. (NYSE:BAM). We will take a look at Raytheon Company (NYSE:RTN), Las Vegas Sands Corp. (NYSE:LVS), Metlife Inc (NYSE:MET), and Kinder Morgan Inc (NYSE:KMI). This group of stocks’ market valuations are closest to BAM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RTN | 39 | 1609376 | -1 |

| LVS | 39 | 1882579 | 2 |

| MET | 26 | 1498576 | -5 |

| KMI | 37 | 1685778 | 1 |

| Average | 35.25 | 1669077 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.25 hedge funds with bullish positions and the average amount invested in these stocks was $1669 million. That figure was $807 million in BAM’s case. Raytheon Company (NYSE:RTN) is the most popular stock in this table. On the other hand Metlife Inc (NYSE:MET) is the least popular one with only 26 bullish hedge fund positions. Compared to these stocks Brookfield Asset Management Inc. (NYSE:BAM) is even less popular than MET. Hedge funds clearly dropped the ball on BAM as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on BAM as the stock returned 11.5% during the third quarter and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.