We are still in an overall bull market and many stocks that smart money investors were piling into surged through October 17th. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 45% and 39% respectively. Hedge funds’ top 3 stock picks returned 34.4% this year and beat the S&P 500 ETFs by 13 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Telenav Inc (NASDAQ:TNAV).

Telenav Inc (NASDAQ:TNAV) investors should be aware of an increase in hedge fund interest recently. Our calculations also showed that TNAV isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are several methods stock traders employ to grade publicly traded companies. A duo of the less utilized methods are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the best hedge fund managers can outperform the S&P 500 by a very impressive amount (see the details here).

Unlike other investors who track every movement of the 25 largest hedge funds, our long-short investment strategy relies on hedge fund buy/sell signals given by the 100 best performing hedge funds. We’re going to take a glance at the new hedge fund action encompassing Telenav Inc (NASDAQ:TNAV).

How have hedgies been trading Telenav Inc (NASDAQ:TNAV)?

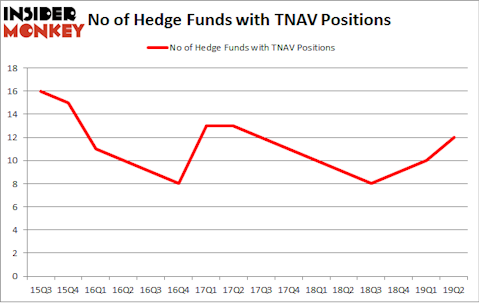

Heading into the third quarter of 2019, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 20% from the previous quarter. The graph below displays the number of hedge funds with bullish position in TNAV over the last 16 quarters. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

Among these funds, Nokomis Capital held the most valuable stake in Telenav Inc (NASDAQ:TNAV), which was worth $38.4 million at the end of the second quarter. On the second spot was Divisar Capital which amassed $27.2 million worth of shares. Moreover, Ariel Investments, Renaissance Technologies, and Arrowstreet Capital were also bullish on Telenav Inc (NASDAQ:TNAV), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key money managers were breaking ground themselves. Algert Coldiron Investors, managed by Peter Algert and Kevin Coldiron, established the most outsized position in Telenav Inc (NASDAQ:TNAV). Algert Coldiron Investors had $0.8 million invested in the company at the end of the quarter. Mike Vranos’s Ellington also initiated a $0.2 million position during the quarter. The only other fund with a new position in the stock is Matthew Hulsizer’s PEAK6 Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Telenav Inc (NASDAQ:TNAV) but similarly valued. We will take a look at MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT), Motorcar Parts of America, Inc. (NASDAQ:MPAA), Albireo Pharma, Inc. (NASDAQ:ALBO), and MMTec, Inc. (NASDAQ:MTC). This group of stocks’ market values are closest to TNAV’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MCFT | 17 | 91965 | 1 |

| MPAA | 13 | 93803 | 4 |

| ALBO | 12 | 95008 | -1 |

| MTC | 1 | 10 | 1 |

| Average | 10.75 | 70197 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.75 hedge funds with bullish positions and the average amount invested in these stocks was $70 million. That figure was $91 million in TNAV’s case. MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT) is the most popular stock in this table. On the other hand MMTec, Inc. (NASDAQ:MTC) is the least popular one with only 1 bullish hedge fund positions. Telenav Inc (NASDAQ:TNAV) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately TNAV wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on TNAV were disappointed as the stock returned -40.3% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.