Excerpted from Stanphyl Capital’s October 2020 letter to investors, discussing that there is no China growth story for Tesla.

We remain short the biggest bubble in modern stock market history, Tesla Inc. (TSLA), which currently has a fully diluted market cap of approximately $429 billion, which is nearly 90% of those of Toyota, VW, GM, Daimler, BMW and Ford combined despite unprofitably selling fewer than 500,000 cars a year to their nearly 40 million. The core points of our Tesla short thesis are:

- Tesla has no “moat” of any kind; i.e., nothing meaningfully proprietary in terms of electric car technology, while existing automakers—unlike Tesla—have a decades-long “experience moat” of knowing how to mass-produce, distribute and service high-quality cars consistently and profitably, as well as the ability to subsidize losses on electric cars with profits from their conventional cars.

- Excluding sunsetting emission credit sales, in 2020 Tesla will again lose money, as it has every year in its 17-year existence.

- Unit demand for Tesla’s cars is only maintained via continual price cutting.

- Elon Musk is a pathological liar who under the terms of his SEC settlement cannot deny having committed securities fraud.

Q3 2020 hedge fund letters, conferences and more

Tesla’s Q3 Results

Tesla reported Q3 results in October, and excluding $397 million of pure-profit emission credit sales (an income stream that begins shrinking imminently, then likely disappears after next year when other automakers have enough EVs of their own) and a $43 million one-time D&O insurance payment received to compensate the company for its directors’ complicity in the self-dealing SolarCity buyout, Tesla would have reported just $77 million in pre-tax income attributable to common stockholders for Q3 2020.

However, Tesla’s Q3 warranty provision was only $175 million for 129,579 non-leased cars, which is just $1350/car despite a long history of replacing motors, battery packs and suspensions under warranty (often fraudulently reclassified as “customer goodwill repairs”) as its cars age, plus repaintings, etc. due to their poor build quality. If Tesla’s warranty provision were a more honest $3000/car it would have meant an additional $214 million hit to Q3 gross margin, lowering pre-tax income to negative $137 million. Indeed, warranty provisioning is perhaps Tesla’s most fraudulent accounting maneuver.

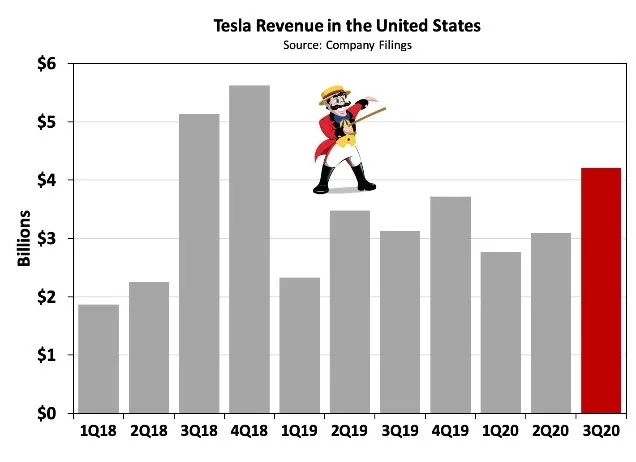

In fairness to Tesla though, Q3 had a non-repeating compensation expense of $338 million for Elon Musk’s egregious pay package, so let’s add that back to pre-tax income and call Tesla’s Q3 “honest & normalized pre-tax GAAP income” -$137 million + $338 million = $201 million. If we then adjust that for a typical 28% tax rate we get an estimated $145 million in after-tax GAAP income, which is an annualized rate of $0.53/share. Thus, at October’s closing price of $388/share Tesla has a normalized GAAP run-rate PE ratio of 732 vs. a PE of around 10x for the rest of the auto industry, despite year-over-year declining Tesla deliveries in Europe (in an electric car market that grew approximately 100% during that same period!) and U.S. revenue that’s lower now than it was two years ago:

Tesla’s China Growth Story

What about Tesla’s “China growth story”? Tesla’s monthly China deliveries haven’t grown since May despite massive price cutting, plenty of excess production capacity and an overall fast-growing EV market. Here are Tesla’s sales in China for the last 5 months:

May: 11,565

June: 14,976

July: 11,456

August: 11,811

September: 11,329

Where is the growth???

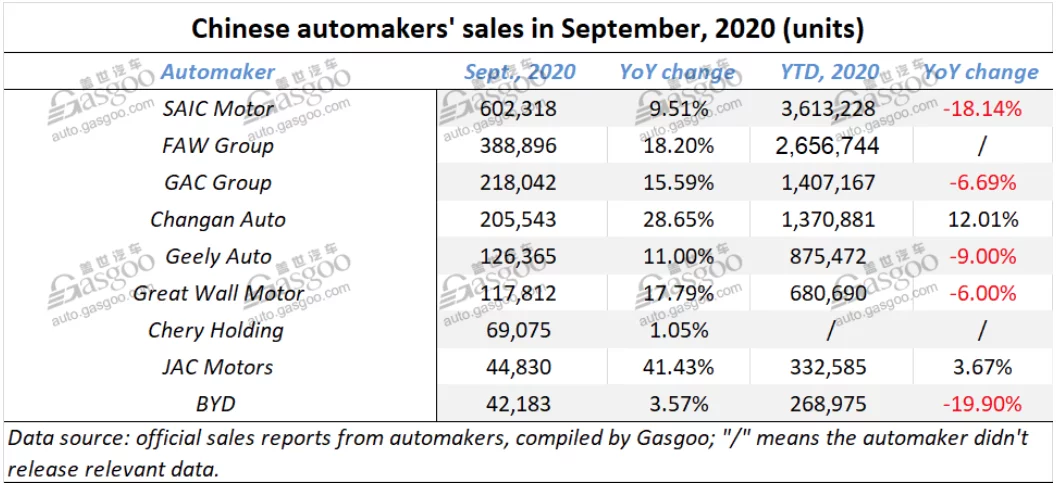

In Q3 Tesla sold only around 34,000 cars in China vs. its claimed manufacturing capacity of over 60,000 (for perspective, GM sold 771,000 and Ford sold 164,000!) and has so much excess capacity that it’s now exporting to Europe (another negative-growth Tesla market)! In September Tesla sold just 11,329 cars in China; lets see how everyone else did:

And China’s EV competitive landscape is about to get vicious thanks to rapidly increasing sales from local brands and massive commitments from foreign OEMs.

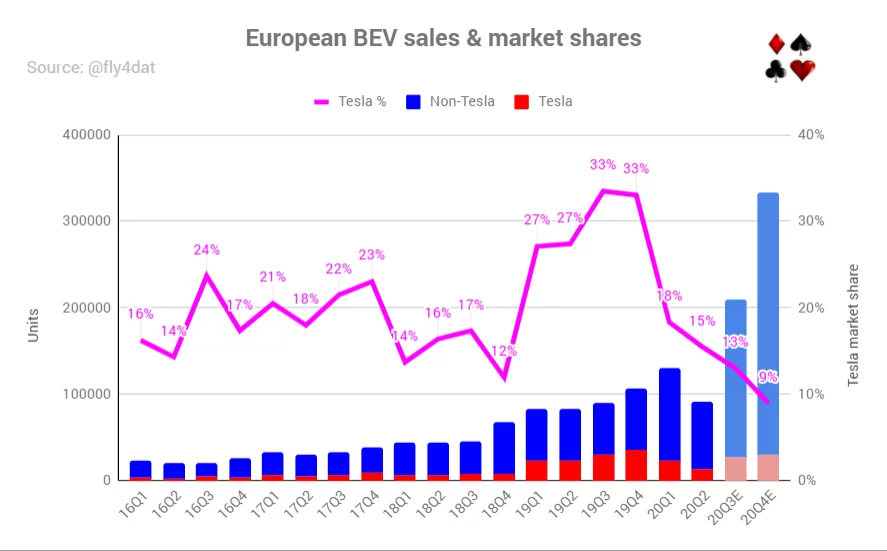

And for those of you who still think Tesla “is years ahead of the competition,” the most competitive EV region in the world is Europe, and in addition to Tesla’s outright year-over-year Q3 sales decline there, its European EV market share has dropped from over 30% to an estimated 9% (and in 2021 will be much lower). Courtesy of Twitter user @fly4dat, here’s a great chart showing that:

The Slim Profits Will Disappear

Thanks to continual price cutting Tesla delivered 139,000 cars in Q3, well short of the company’s self-proclaimed new current quarterly production capacity of 210,000. In fact if we consider Q2 to be the “COVID quarter” and Q3 to be the “make-up quarter,” averaging the two to 115,000 each means that despite massive price-cutting Tesla has barely grown from the 112,000 cars it delivered in Q4 2019, and as it’s forced to continue cutting prices its slim profits will disappear with its emission credit revenue.

Nothing is more amusing than seeing this giant stock promotion of a company try to perpetuate the illusion of being “supply constrained” by continuing to add capacity (expanding its Chinese factory while breaking ground on new factories in Texas and Germany) in order to desperately try to maintain an image of “limitless demand” while it continually slashes prices just to utilize far less than its existing capacity. Tesla’s “plan” is now obvious: keep slashing prices to move as much volume as possible while maintaining razor-thin profitability. But what’s the end game? If Tesla stops cutting prices volume will collapse. Tesla is no longer “a growth story”—it’s a nearly-profitless stock promotion for idiots!

As for Tesla’s newest “hope,” the Model Y, its quality is awful and it faces current (or imminent) competition from the much better built electric Audi Q4 e-tron and Q4 e-tron Sportback, BMW iX3, Mercedes EQB, Volvo XC40 Recharge, Volkswagen ID.4, Ford Mustang Mach E and Nissan Ariya, as well as the less expensive yet excellent all-electric Hyundai Kona and Kia Niro. Meanwhile, Tesla’s Model 3 now has terrific direct “sedan competition” from Volvo’s beautiful new Polestar 2 and the premium version of Volkswagen’s ID.3 (in Europe), and in 2021 from the BMW i4.

Cyberktruck Won’t Be Much Of “Growth Engine”

And oh, the joke of a “pickup truck” Tesla previewed last year won’t be much of “growth engine” either, as it will enter a dogfight of a market.

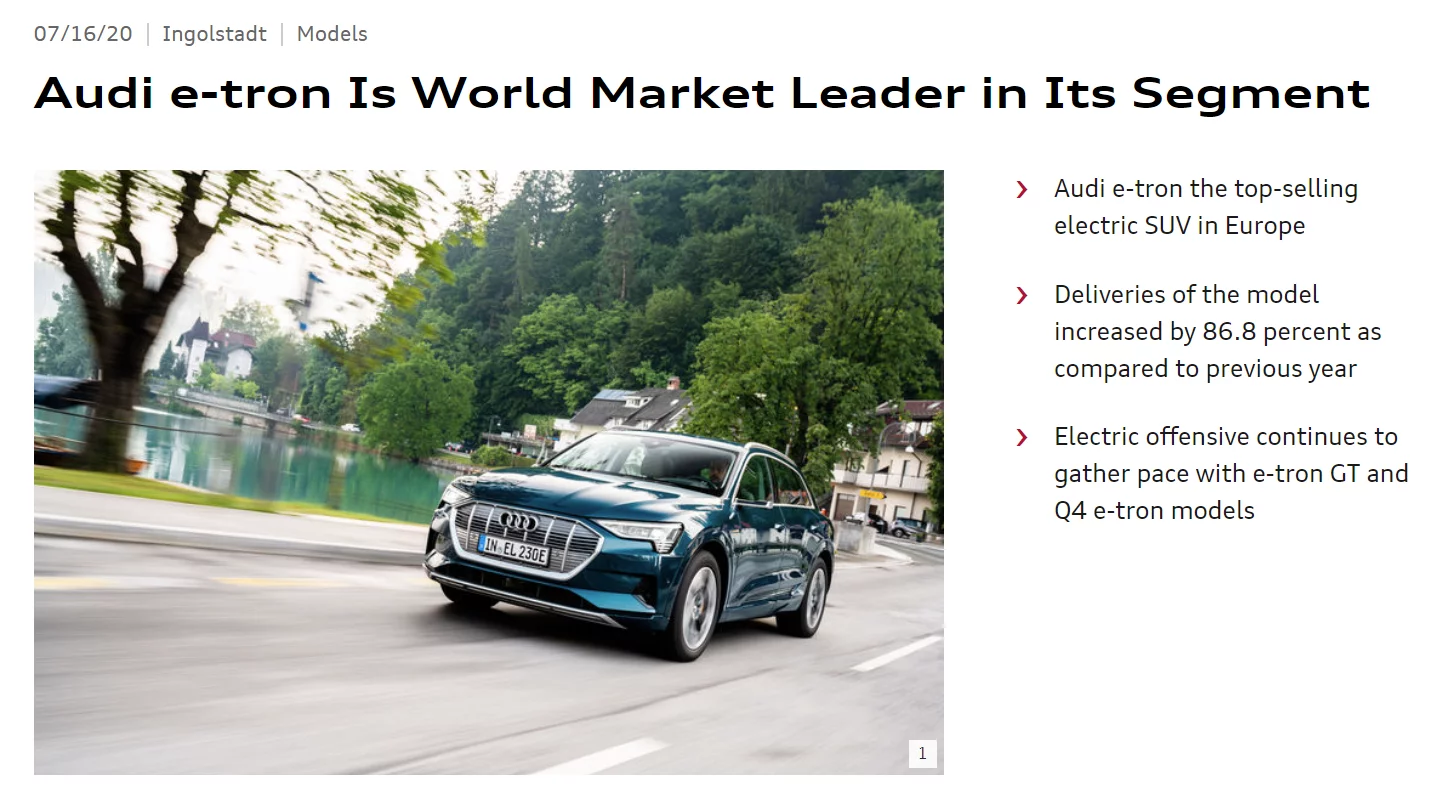

And in the high-end segment worldwide, the Audi eTron now outsells either of Tesla’s offerings (the Model S and the Model X)…

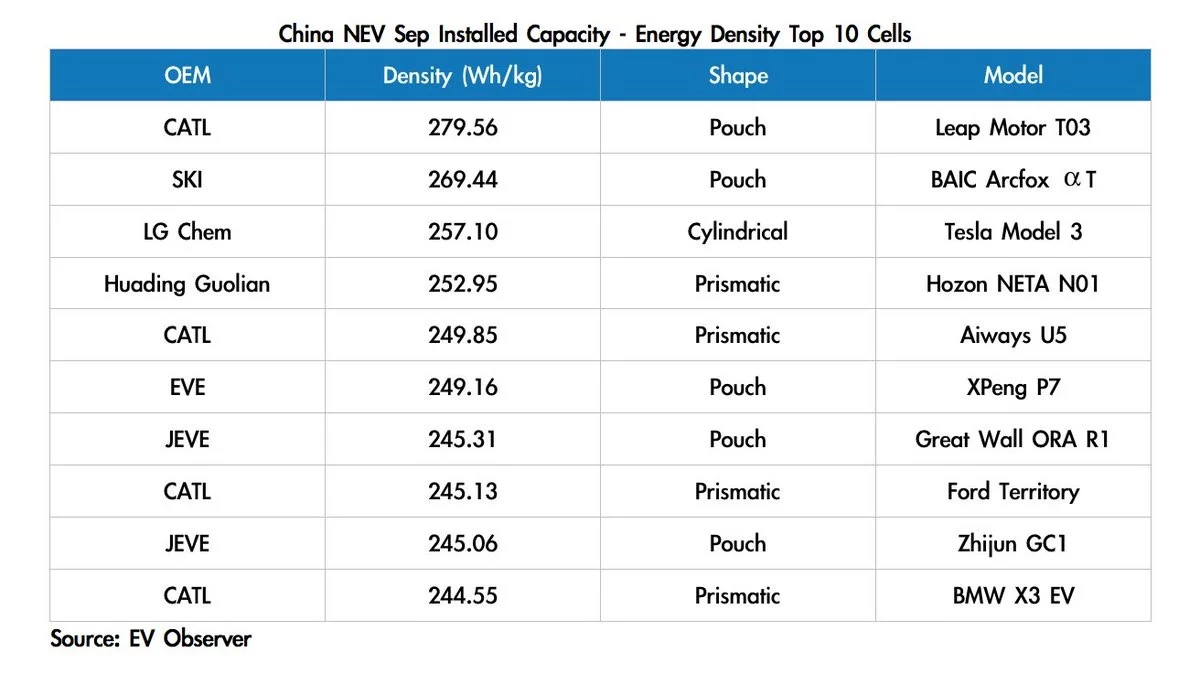

As for batteries, Tesla has nothing proprietary—it doesn’t make them, it buys them, and although the performance of all batteries is now so close as to be indistinguishable by the consumer, in China it isn’t even buying the best ones available:

Regarding safety, Tesla has been hit with at least one well-documented sudden acceleration class action lawsuit and for years knowingly sold cars that it knew were a fire hazard. And of course it continues to sell and promote its hugely dangerous so-called “Autopilot” system, which Consumer Reports has completely eviscerated; God only knows how many more people this monstrosity unleashed on public roads will kill, despite the NTSB condemning it as dangerous. In fact, Teslas have far more pro rata (i.e., relative to the number sold) deadly incidents than other comparable new luxury cars; here’s a link to those that have been made public. In other words, when it comes to the safety of customers and innocent bystanders, Tesla is truly one of the most vile companies on Earth. Meanwhile the number of lawsuits of all types against the company continues to escalate, including one proving blatant fraud by Musk in the SolarCity buyout. (If you want to be really entertained, read his deposition!)

Finally, Tesla has the most executive departures I’ve ever seen from any company; here’s the astounding full list of escapees. These people aren’t leaving because things are going great (or even passably) at Tesla; rather, they’re likely leaving because Musk is either an outright crook or the world’s biggest jerk to work for (or both).

Thanks and stay healthy,

Mark Spiegel