Although they own rival sports networks, neither News Corporation nor Comcast can match the strength of Disney’s brand name and other business segments. While Disney makes movies, toys, cruise ships and theme parks, News Corporation has an extremely fragmented business model spread across dozens of media assets, many of them unprofitable. Meanwhile, Comcast generates the majority of its revenue from its original business – being a cable provider.

Let’s compare the basic fundamentals of these three companies.

From this comparison, we can see that Disney wins out in the most important growth categories, and more importantly, it has far less debt than its rivals. News Corporation’s future growth can’t even be accurately measured by P/E and PEG since it is not currently profitable. Comcast is in better shape than News Corporation, but its debt levels are nearly the same.

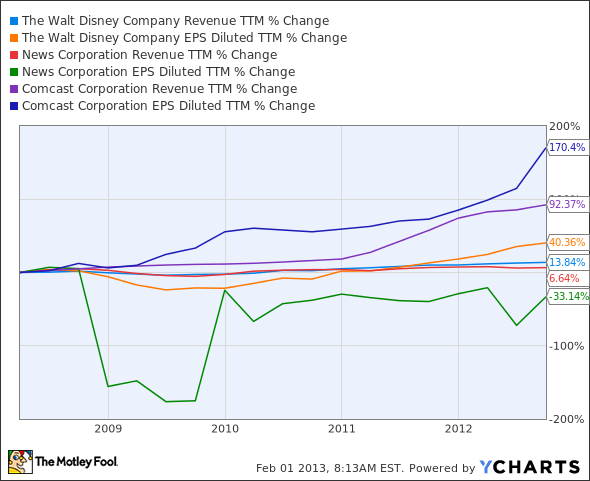

Now let’s check on their revenue and earnings growth over the past five years.

DIS Revenue TTM data by YCharts

Here’s where Comcast has really grown, easily outpacing Disney and News Corp. Both Comcast and Disney are growing profits faster than revenue, an encouraging sign that margins will grow in the future.

In addition to Disney’s booming media business, it’s two other key businesses – theme parks and movies – have been extremely promising.

Disney’s flagship theme parks account for nearly a third of total revenues. This percentage has also slowly risen, despite the global recession. Disney’s upcoming Shanghai Disneyland Park, which opens in 2015, will be the largest in Asia and will capitalize on a rising Chinese middle class. At its existing resorts, Disney has been able to raise ticket and room rates without adversely impacting sales volume.

Disney’s investments and overall revenue from movie franchises at its Studio Entertainment division has steadily declined over the past four years, as the company shifts production over to its subsidiary Marvel (and later on, Lucasfilm).

This is a great strategy, since Disney’s own movie studios have had a notoriously inconsistent track record of blockbusters and bombs.

Mars Needs Moms

and

John Carter

, two of its worst faring films in the past two years, lost a combined $300 million at the box office.

It’s definitely time to let Marvel’s multi-year franchises do the heavy lifting from now on.

The Foolish Bottom Line

In closing, Disney is a stock that has all of these things:

- Globally recognized and loved brands

- Owns the largest sports network in the world

- Stable revenue and earnings growth

- Diverse all-weather portfolio of products

- Low debt compared to its industry

- Proven pricing power at its flagship parks and resorts

While Disney has risen nearly 40% over the past twelve months, its low forward P/E suggests that it still has room to grow. Therefore, the “Happiest Place on Earth” might just be the “Happiest Place” for all your uninvested cash.

The article Still the Most Magical Investment On Earth originally appeared on Fool.com and is written by Leo Sun.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.