The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their September 30 holdings, data that is available nowhere else. Should you consider The TJX Companies, Inc. (NYSE:TJX) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

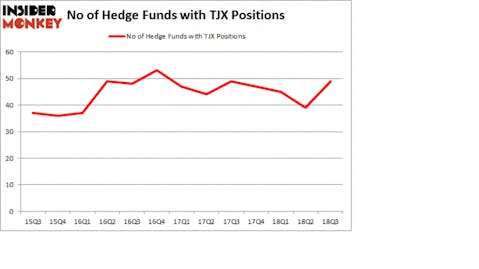

Is The TJX Companies, Inc. (NYSE:TJX) a buy here? The best stock pickers are in an optimistic mood. The number of bullish hedge fund bets inched up by 10 in recent months. Our calculations also showed that TJX isn’t among the 30 most popular stocks among hedge funds. TJX was in 49 hedge funds’ portfolios at the end of the third quarter of 2018. There were 39 hedge funds in our database with TJX holdings at the end of the previous quarter.

If you’d ask most stock holders, hedge funds are assumed to be underperforming, old financial tools of yesteryear. While there are over 8,000 funds in operation at present, Our researchers hone in on the moguls of this group, about 700 funds. These investment experts orchestrate the lion’s share of the hedge fund industry’s total capital, and by following their top investments, Insider Monkey has deciphered many investment strategies that have historically exceeded the market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s review the key hedge fund action encompassing The TJX Companies, Inc. (NYSE:TJX).

How have hedgies been trading The TJX Companies, Inc. (NYSE:TJX)?

At the end of the third quarter, a total of 49 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 26% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards TJX over the last 13 quarters. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

Among these funds, Arrowstreet Capital held the most valuable stake in The TJX Companies, Inc. (NYSE:TJX), which was worth $786.7 million at the end of the third quarter. On the second spot was Diamond Hill Capital which amassed $387.9 million worth of shares. Moreover, D E Shaw, Two Sigma Advisors, and Citadel Investment Group were also bullish on The TJX Companies, Inc. (NYSE:TJX), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers have jumped into The TJX Companies, Inc. (NYSE:TJX) headfirst. Samlyn Capital, managed by Robert Pohly, created the largest call position in The TJX Companies, Inc. (NYSE:TJX). Samlyn Capital had $30.5 million invested in the company at the end of the quarter. Gregg Moskowitz’s Interval Partners also made a $22.4 million investment in the stock during the quarter. The other funds with new positions in the stock are Doug Gordon, Jon Hilsabeck and Don Jabro’s Shellback Capital, Gregory Thomas’s Carbonado Capital, and Matthew Tewksbury’s Stevens Capital Management.

Let’s check out hedge fund activity in other stocks similar to The TJX Companies, Inc. (NYSE:TJX). These stocks are Eni SpA (NYSE:E), Westpac Banking Corporation (NYSE:WBK), The Kraft Heinz Company (NASDAQ:KHC), and Stryker Corporation (NYSE:SYK). This group of stocks’ market valuations resemble TJX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| E | 7 | 72126 | 0 |

| WBK | 6 | 41825 | -1 |

| KHC | 37 | 19059495 | 10 |

| SYK | 44 | 855103 | 6 |

| Average | 23.5 | 5007 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $5.01 billion. That figure was $3.25 billion in TJX’s case. Stryker Corporation (NYSE:SYK) is the most popular stock in this table. On the other hand Westpac Banking Corporation (NYSE:WBK) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks The TJX Companies, Inc. (NYSE:TJX) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.