Introduction

The threat of rising interest rates is all the rage in financial circles today. However, the seminal question is: How real is the threat, and how much impact will rising rates have on stock prices and investor performance? This article will present my personal perspectives on interest rates and their potential impact on stock prices longer term.

Wall Street Climbs a Wall of Worry

There are many clichés in the world of Wall Street and many of them are trite. However, the best clichés often convey important and profound messages. A case in point is the old adage “Wall Street climbs a wall of worry.” The important message contained in this saying is that for the most part the market climbs.

Rawpixel.com/Shutterstock.com

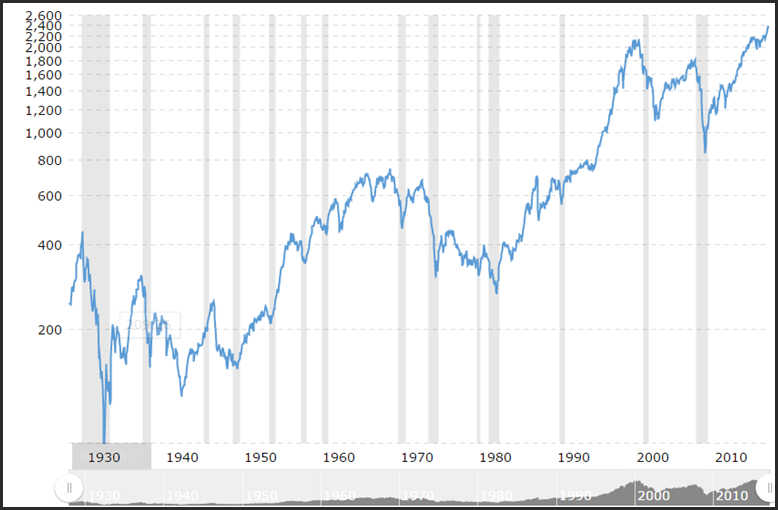

Of course, there are always exceptions. Since the mid-1920s, we have had three periods of extended price drops spanning years rather than months. The timeframe spanning the mid-1920s up to the late 1940s was a real humdinger. However, within this timeframe there were also years of strong price performance interspersed. Another bear market spans the market peak in the mid-1960s which ended after the recession in the mid-1980s. And finally, the so-called “lost decade” that followed the peak of prices in calendar year 2000. Otherwise, the general direction of the stock market has been up. The following graph courtesy of Macrotrends illustrates the above:

S&P 500 Index – 90 Year Historical Chart

But with that said, the primary focus of this article is to address what the market worries about. In truth, there is always something that engenders worry in the minds of investors. If the market is behaving well as it has in recent years, investors worry that the end is near. When the market is behaving badly, investors worry that Armageddon is upon us. In truth, things are rarely as good or bad as people fear or expect.

Interest rates: Economic and Stock Value Impact

I would like to start my discussion about the impact of interest rates on our economy and stock values by pointing out an important reality. The economy does not work like a light switch. In other words, economic activity does not respond instantly to interest rate changes or political policy. It takes time for any widespread economic impact to occur or be felt. On the other hand, investor psychology can be instantaneous or at least more immediate. Consequently, I believe it’s important to make a distinction between long-term impacts versus short-term reactions.

Perhaps of equal importance is the understanding that interest rates are but one factor among many that can have an impact on stock prices in general, and even more importantly, on the prospects and fortunes of any individual company or stock. Therefore, I believe it is erroneous to think that stock prices and values are directly correlated to the level of interest rates. In truth, they can be a factor, and under certain circumstances – a major factor. However, there are many other factors that are also at play. As I will elaborate on later, the relative valuation at the time when interest rates change can either negate or accentuate the effect of a rate change.

Interest Rates and Stock Valuations: An Inverse Relationship?

When I was young, I bought into the notion that there was an inverse relationship between interest rates and stock valuations. The logic was straightforward, and it seemed to make sense. When interest rates are high, bonds and other fixed income instruments are more competitive against stocks. Conversely, when interest rates are low, stocks, especially dividend paying stocks, are more competitive versus fixed income.

I have always found that the best lessons can be learned from evaluating extreme situations. For example, and to illustrate this more clearly, all we have to do is think back to September of 1981 (at peak interest rates) when the yield on the 10-year Treasury was 15.84%. From 1968 to the peak in 1981, interest on the 10-year Treasury increased from 6.16% to 15.84%. This coincided almost perfectly with the S&P 500 falling from 712.69 in December, 1968 to 351.04 by December, 1982.

This was approximately a protracted 50% decline in stock prices over this 14-year time period. Therefore, the inverse relationship between stock values and interest rates was perfectly in sync. Steadily rising interest rates drove stock prices steadily lower for almost a decade and a half. As an aside, I entered the business in 1970 and consequently experienced the stock value versus interest rate relationship firsthand.

As an additional aside, during this time I was also in the early stages of developing the F.A.S.T. Graphs™ fundamentals analyzer software tool for my own personal research and due diligence. Since the inverse relationship between interest rates and stock values was functioning as theory suggested, I thought it would be wise to create a graph that measured stock valuations (P/E ratios) versus interest rates on the 10-Year Treasury. Therefore, I could examine and measure the impact of interest rates on stock valuations into my analysis and due diligence process.