Google (GOOGL) just made a statement. On August 3, Google announced that it’s investing $450 million in home security company ADT Corp (ADT). The investment will give Google a 6.6% stake in the company.

You might be wondering why the tech giant wants anything to do with ADT. Simple. Google’s asserting its dominance in one of today’s biggest megatrends.

Investors who see where this is headed stand to make a fortune. But only if they know how to play it. And it’s not Google. The two stocks I’ll share with you today offer much more explosive upside. But let’s first look at why Google is investing hundreds of millions into ADT.

Google, as you know, operates the world’s most popular search engine, and the #1 most trafficked website. But it’s far from a one-trick pony.

Google also owns YouTube—the world’s #1 video platform and the second most-visited website. It owns Android—the #1 smartphone operating system. And it owns Waymo, the #1 self-driving car tech company.

Q2 2020 hedge fund letters, conferences and more

Google Is also a Major Player in the Booming Internet of Things (IoT) Market

IoT refers to a world where connected devices “talk” to each other. Not long ago, IoT was just a buzzword. It was a trend that was always on the horizon but never quite arrived.

Not anymore. These days, roughly one in four US adults have an Amazon (AMZN) Alexa, Google Home, or other voice-enabled digital assistant inside their home. The market for smart lightbulbs, thermostats, and home appliance is also exploding. And today, about 21% of Americans own a smartwatch or fitness tracker.

Google is at the forefront of the smart home revolution. That’s why last November, Google bought Fitbit, which makes one of the world’s most popular smartwatches, for $2.1 billion. Google also owns Nest—one of the world’s most popular smart thermostats and one of the first IoT products to truly go mainstream.

Google’s new partnership with ADT will only further cement its dominance in this space. The partnership will make Google Nest devices “the cornerstone” of ADT’s smart home offering. ADT will utilize its professional sales and installation network to get Google’s smart devices into more people’s hands.

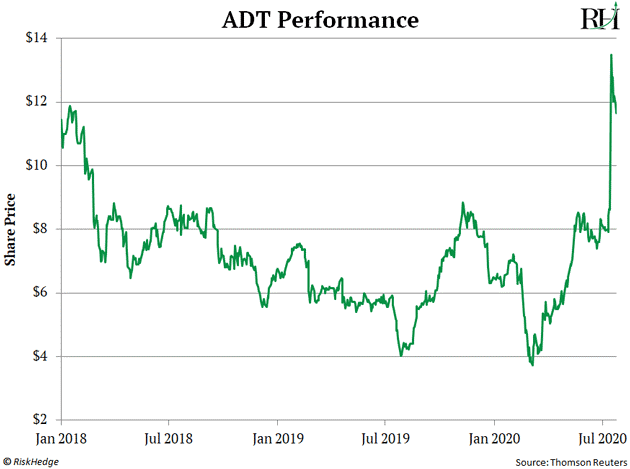

ADT will also use Google’s artificial intelligence (AI) capabilities to provide enhanced security. ADT customers will be able to track who’s coming in and out of their homes. ADT surged 57% on the news. It’s now trading at its highest price since its 2018 IPO.

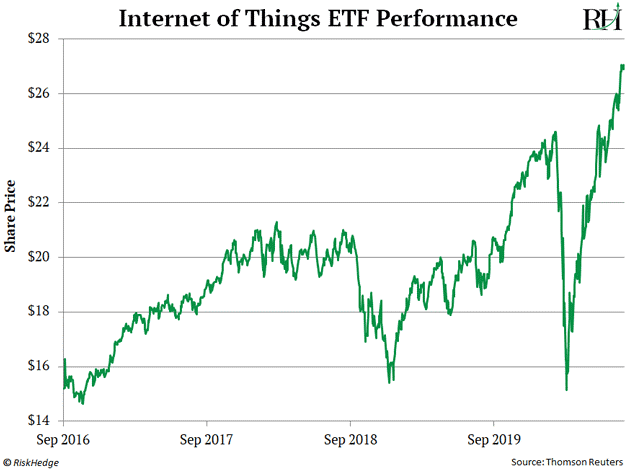

The deal also lifted the entire IoT market. The Global X Internet of Things ETF (SNSR), a fund that invests in companies benefiting from the IoT craze, is now trading at record highs.

But don’t worry if you missed out on these big moves. IoT stocks should be top performers for many years to come.

The Number of Connected Devices Is Set to Explode

According to Statista, there were 23 billion connected devices in 2018. By 2025, there will be more than 75 billion. That’s a three-fold spike in just seven years! But IoT isn’t just revolutionizing how we interact with devices in our homes or helping us catch potential burglars.

It’s also radically changing how goods are produced. According to PricewaterhouseCoopers, 35% of US manufacturers have already adopted IoT technology. Use of IoT technologies will only accelerate as connectivity improves (think 5G and edge computing).

Investors can profit off this megatrend by buying SNSR. It’s a “one-click” way to get exposure to IoT.

But if you want to make bigger profits, I suggest focusing on the best stocks. And there’s one corner of this market that should offer the most explosive gains: “connected” medical devices.

A connected medical device generates, collects, analyzes, and transmits health data. Many provide real-time insights to healthcare providers.

Take the pacemaker, for example. These heart tracking devices have been around for decades. Before, if there were any issues, you’d have to go see your doctor.

Now that they’re connected to the internet, doctors can adjust settings without requiring an invasive procedure or even a visit to the office! That’s just one example. Connected insulin pumps, glucose monitoring devices, and nerve stimulators are also transforming healthcare.

All told, about 48% of medical devices were connected in 2018. By 2023, 68% of medical devices will be. Eventually, practically every medical device will be connected! That spells huge opportunity.

Healthcare is an enormous market. The US industry alone is worth $3.5 trillion. The sheer size of healthcare, an aging US population, and huge cost savings are driving rapid adoption of connected devices.

In fact, mHealthIntelligence estimates that 88% of healthcare providers are already investing in remote patient monitoring solutions. According to investment bank Goldman Sachs (GS), these devices will save the healthcare industry $300 billion annually in the coming years.

Connected devices are becoming so big that the space is known as the “internet of medical things (IoMT).” In 2018, the global IoMT market was valued at just under $45 billion. By 2026, it’s projected to be a $254 billion market. That’s nearly a six-fold increase in under a decade.

Buying the Right IoMT Stocks Can Make You a Fortune

For example, subscribers to our premium advisory IPO Insider are already up 328% on Livongo Health (LVGO) in just six months. And it’s likely headed much higher as it merges with telemedicine giant Teladoc (TDOC).

But there will be many more “Livongos” in the months and years to come.

Thanks to COVID-19, demand for “contactless care” is soaring through the roof. Plus, a bill was introduced in June by two US senators to expand essential access to remote monitoring across rural America and on tribal lands. So, this megatrend has support from Washington.

Two of my favorite IoMT stocks are DexCom (DXCM) and Tandem Diabetes Care (TNDM).

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money”

Get our latest report where we reveal our three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

Article by By Justin Spittler, Mauldin Economics

The top 10 stocks among hedge funds returned 185% since the end of 2014 and outperformed the S&P 500 Index ETFs by more than 109 percentage points. We know it sounds unbelievable. You have been dismissing our articles about top hedge fund stocks mostly because you were fed biased information by other media outlets about hedge funds’ poor performance. You could have doubled the size of your nest egg by investing in the top hedge fund stocks instead of dumb S&P 500 ETFs. Below you can watch our video about the top 5 hedge fund stocks right now. All of these stocks had positive returns in 2020.

Video: Top 5 Stocks Among Hedge Funds

At Insider Monkey we scour multiple sources to uncover the next great investment idea. We go through lists like the 10 most profitable companies in America to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. You can subscribe to our free enewsletter below to receive our stories in your inbox:

Disclosure: None. This article is originally published at Insider Monkey.