The key to successful investing is to quickly get to the salient points of why a stock’s value will appreciate. In the case of Whirlpool Corporation (NYSE:WHR) it is not as easily apparent as it may seem. Yes the stock is exposed to the housing market, but it would be a mistake just to determine that it is a play on a recovery in North American housing. In reality it has quite a few profit drivers which I thought investors might like to look into in more depth.

Whirlpool’s Earnings Drivers

I’m going to summarize some key issues with bullet points and then flesh them out a bit later.

New Home Build does drive demand but housing starts are still relatively low numbers and demand wont kick in until 6-9 months after starts pick up

The replacement cycle will drive demand as the 10 year anniversary of the housing boom takes place

US discretionary demand remains weak

Brazil remains the key to emerging market prospects for Whirlpool

Europe remains a challenge

The policy of trying to expand its higher margin sales

Margin expansion thanks to productivity improvements is being offset by higher input costs

The last five years have been emblematic of the economic recovery for Whirlpool Corporation (NYSE:WHR) and its chief rival in the home goods appliance market General Electric Company (NYSE:GE). A struggling North American consumer coupled with housing being at the epicenter of the crisis hit the industry hard. Government attempts to stimulate spending had an affect in 2010 but this proved all too temporary and the industry fell back into a more normalized demand path. Throw in the obvious difficulties in Europe and it has been a tough period of which last discussed in an article linked here.

The good news is that there does appear to be a sustainable recovery in US housing and efforts to diversify by expanding sales in emerging markets like Brazil. The story going forward will be over the strength of demand spurred by the replacement cycle in the US and the potential for ongoing growth in emerging markets. Meanwhile Europe is in a holding pattern and the attempt to shift sales to higher margin products will carry the concomitant risk of losing market share in a competitive market. New home sales will add some growth kicker, but ultimately discretionary demand in the US for large ticket white goods remains weak.

What This Means in Charts

A breakdown of the last four years revenues and margins gives a pretty accurate picture of what has been going on. There was a nice pick up in 2010 but since then revenue growth has slowed. Incidentally, top line growth was negative in 2012 but this is largely due to foreign currency effects and lower tax credits. Stripping these effects out, sales rose 3%. On the plus side, productivity improvements helped margins rise in 2012.

As for the optimism over the replacement cycle this is largely due to the timing of the post 2000 housing boom. In order to demonstrate this I’ve taken some data from the Association of Home Appliance Manufacturers. In this case I’m looking at automatic washers but the trends are the same across most categories.

While the evidence is compelling, it is one thing to draw up a balance sheet and assume a depreciation rate of 10% and assume that goods should and will get replaced over 10 years and it is another thing for it to actually happen. For example many commentators have been amazed by how the average life of a car in the US has gone up and up, far exceeding historical norms. Will this be the case for household appliances? It’s possible, but one thing that is sure is that in this environment consumers will be reluctant to make discretionary spending decisions over large ticket appliances.

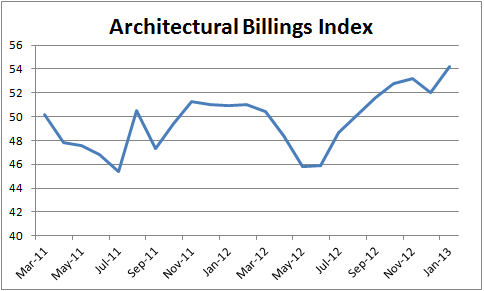

As for the kicker from new housing starts the indicators are that this will indeed kick in for Whirlpool Corporation (NYSE:WHR) in late 2013. Here is the latest Architectural Billings Index and within this index the residential indicator is the highest.

Broadly speaking the industry has been reporting positive news lately. The Home Depot, Inc. (NYSE:HD) has recently reported broad based strength across its categories and importantly, its more discretionary based items are seeing sequential strength. It’s worth noting that Whirlpool distributes products at both The Home Depot, Inc. (NYSE:HD) and Lowe’s and if they are seeing strength then so will Whirlpool. Furthermore much of the background data in this article equally applies to their end demand too.

As for its chief rival in the US, General Electric Company (NYSE:GE) recently reported a solid set of results and expressed positive commentary on North America. Although its home and business based profits don’t make up more than 13% of GE’s total so it less exposed to the sector than Whirlpool Corporation (NYSE:WHR) or Electrolux. Of course this means it can cross subsidize its home goods sales and engage in the kinds of pricing promotions and discounts that hit the industry in 2010-11. On the other hand with conditions improving in the US there may be some opportunity to for price gains across the industry.

And finally the segmental breakdown of profits reveals the importance of Latin America (mainly Brazil) to the company’ profitability.

Indeed for 2013, the company is forecasting 3-5% growth in Latin America and Asia with 2-3% in North America and EMEA as being flat.

Where Next For Whirlpool?

A quick review of the guidance for 2013 shows Whirpool predicting $600-650 million in free cash flow with $950-1bn in ‘ongoing business cash flow’. The latter is adjusted for tax credits, pension contributions and restructurings. Even taking the lower number’s midpoint of $625m, it is still forecast to generate around 6% if its enterprise value in free cash flow this year. Moreover its earnings guidance of $9.25-9.75 of ongoing diluted EPS implies a forward PE of 12.1 at the midpoint.

In conclusion, the stock doesn’t look expensive and provided the US housing market is doing okay I think it is worth picking up. As for Brazil, a large part of its prospects depend on servicing China with raw materials so this makes Whirlpool the kind of stock to avoid should China disappoint with growth. For now things look okay.

The article The Real Earnings Potential of This Stock originally appeared on Fool.com and is written by Lee Samaha.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.