Billionaire Bill Ackman of Pershing Square Capital has been calling for the turnaround of the mega-cap consumer products company The Procter & Gamble Company (NYSE:PG) for some time now. At the Sohn Investment Conference last week he reiterated his position on P&G, calling out the CEO Bob McDonald.

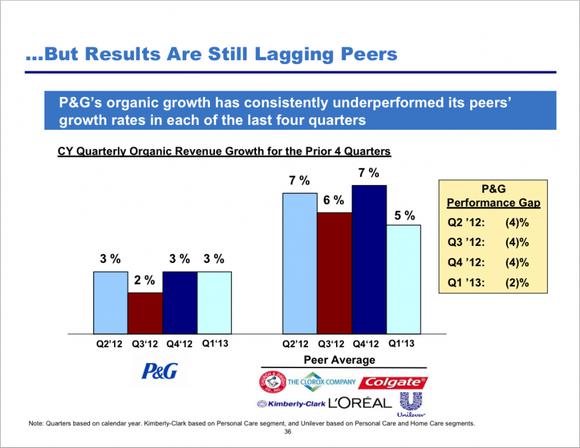

Ackman’s comments at the Sohn conference said he was willing to give CEO McDonald two to three quarters to get the company in “better shape.” Of course, that’s a relative term, but by better shape, Ackman wants to see at least 5% annualized revenue growth and major cost cutting. Part of Ackman’s displeasure includes the fact that The Procter & Gamble Company (NYSE:PG) has underperformed its major peers over the past four quarters.

One of Ackman’s big gripes about McDonald is that he has served on 21 different organization boards, which includes Xerox Corporation (NYSE:XRX) as of early 2012. Ackman thinks this number is excessive. At Sohn, Ackman noted that “we make the conservative assumption that just attending board meetings and not including travel time, this accounts for 25% of his time.”

Ackman believes that If McDonald and the board can strategically refocus the company and cut costs effectively, the company has tremendous upside.

The positives

One of the positives of The Procter & Gamble Company (NYSE:PG), as Ackman has noted, is the company’s exposure to emerging markets.

P&G hopes to further increase its presence in these fast-growing markets, helping diversify away from the weakening North America and Western Europe markets. P&G’s developing-market sales have grown at a compounded average growth rate of 12% over the last 12 years and its current exposure is one of the industry’s best.

The after-tax profits in its top-10 developing markets are also expected to increase by 35% in fiscal 2013 versus 2012 behind increased marketing investments and innovation.

The comps

Two of The Procter & Gamble Company (NYSE:PG)’s top competitors include Johnson & Johnson (NYSE:JNJ) and Colgate-Palmolive Company (NYSE:CL). Johnson & Johnson has unique exposure to a variety of industries, not just consumer products, but also the pharmaceutical and medical-device industry. Its medical-device segment accounts for more than 40% of revenues. This segment offers wound care and minimally invasive surgical products, as well as orthopedics and diagnostics.

One possible setback for Johnson & Johnson (NYSE:JNJ) is its exposure to the pharma industry, which accounts for over 37% of revenues. The company has seen a number of setbacks in its drug pipeline, which includes failure to gain approval for ceftobiprole, a second complete response letter (CRL) for the supplemental new drug application (sNDA) for Xarelto for acute coronary syndrome (ACS), and the withdrawal of the EU application for an additional indication for Velcade for the treatment of patients with relapsed follicular non-Hodgkin lymphoma.

Even after posting better-than-expected 2012 earnings and first-quarter 2013 earnings that beat expectations, Johnson & Johnson (NYSE:JNJ) maintained, versus upping, its 2013 earnings guidance at $5.35 to $5.45 per share.

Colgate-Palmolive Company (NYSE:CL) gets the majority of its revenues, over 25%, from Latin America, which is a long-term positive as the country continues to develop. As well, the consumer-products company has one of the leading positions in oral and personal care.