Briefly, the New York Times Company publishes three major newspapers: The New York Times, International Herald Tribune, and Boston Globe. It also recently sold its stake in the About Group to IAC Corp for US$300 million in cash. With its flagship newspaper, The New York Times, the Company has one of the few internationally recognized newspapers and one of the strongest brands in the industry. As the industry continues to wind down in size, the Company has taken advantage of cost cutting at other newspapers to expand its coverage of various cities – thus cementing its reputation as one of the best newspapers in the country.

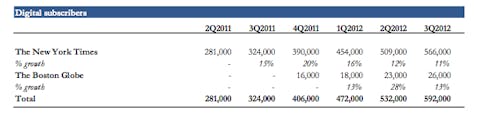

In Kapitall Wire’s last article about the newspaper industry, The New York Times featured prominently as one of the few news publishing companies that have managed to build a modestly successful digital subscription model. Today, digital-only paid subscribers have reached 566,000 for The New York Times and International Herald Tribune, while its sister newspaper Boston Globe have around 26,000 paid subscribers for its web offering. Total daily print subscription remains fairly constant at 717,513 for the six months ending September 30th according to the Audit Bureau of Circulations.

Encouragingly, circulation revenues have also continued to increase because of the continued ability of the Company to conduct price hikes in its major newspapers. In January, The New York Times increased its single copy price by 25 percent and home delivery subscription by four percent. Similarly, the Boston Globe has increased its single copy prices by 25 cents and another six percent for home delivery subscription. The increasingly price insensitivity of its customer base bodes well for the Company going forward.

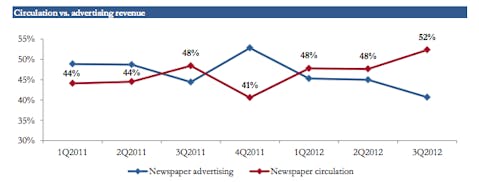

However, despite the encouraging growth in circulation, there is much room for concern amidst the current downturn in newspaper advertising. In 2011, print advertising was down four percent, and it is expected to slow down further in 2012. Industry-wide, print media has seen its advertising income streams cannibalized rapidly by the rise of both online word and display advertisements. The challenge for the Company is to make sure that the decline in advertising revenues can be made up faster by its circulation revenues.

In a sense, the Company has been making decent strides in meeting this challenge. Comparing first half results of 2011 and 2012, advertising revenue declined US$29.6 million while circulation revenue increased US$38.0 million – resulting in a positive net change of US$8.4 million. If the Company can continue this trend, it is going to be in a healthy position going forward.

Lastly, another disadvantage for the Company is its cost structure. Because its editorial staff is largely based in the highly costly locations such as New York City and Boston, editorial expenses at the Company can be expected to be much higher than other industry players. This puts the New York Times at a disadvantage to its competitors as its margins remain below its peers.

Given that it is currently trading at a higher valuation range than its competitors (5-5.5x 2013E EBITDA to peer group of 4-5x 2013E EBITDA), an investment case can only be made either if cost-cutting measures at the Company are successfully implemented or if revenue growth outpaces its rising cost.

Business Section: Investing Ideas

Looking to trade the trends? Here’s a list of publicly-listed U.S. newspaper publishing companies:

1. The New York Times Company (NYT, Earnings, Analysts, Financials): A global, multimedia news and information company that includes newspapers, digital businesses, investments in paper mills and other investments. Market cap at $1.3B

2. Gannett Co., Inc. (GCI, Earnings, Analysts, Financials): Operates as a media and marketing solutions company in the United States and internationally. Market cap at $3.88B

3. The McClatchy Company (MNI, Earnings, Analysts, Financials): Operates as a newspaper publisher in the United States. Market cap at $224.64M

4. Media General, Inc. (MEG, Earnings, Analysts, Financials): A provider of local news and information over multiple media platforms principally in small and mid-size communities throughout the Southeastern United States. Market cap at $95.45M

5. The E. W. Scripps Company (SSP, Earnings, Analysts, Financials): Operates as a diverse media company with interests in television stations, newspapers, and local news and information Web sites. Market cap at $586.63M

6. Lee Enterprises Inc. (LEE, Earnings, Analysts, Financials): Incorporated provides local news, information and advertising in midsize markets, with 49 daily newspapers and a joint interest in four others, nearly 300 weekly newspapers and specialty publications in 23 states. Market cap at $77.91M

7. A. H. Belo Corporation (AHC, Earnings, Analysts, Financials): Operates as a news and information company primarily in the United States. Market cap at $108.7M

Compare analyst ratings for these publicly traded newspaper companies:

This article was originally written by SiHien Goh, and posted on Kapitall.